Trading position (short-term; our opinion): Short positions (with a stop-loss order at $54.21 and next downside target at $40) are justified from the risk/reward perspective.

On Wednesday, crude oil lost 2.33% after a bearish EIA weekly report, which showed unexpected increase in U.S. crude oil inventories. As a result, light crude dropped under Apr lows and closed the day under $42. Will oil bears manage to push the commodity lower in the coming days?

Although the U.S. Energy Information Administration reported that distillate fuel inventories fell by 780,000 barrels, U.S. crude oil stockpiles increased by 1.671 million barrels and gasoline inventories rose by 452,000 barrels. Additionally, U.S. crude production rose by 21,000 barrels per day last week to 8.515 million bpd, increasing for the third consecutive week. Thanks to these bearish circumstances, light crude dropped under Apr lows and closed the day under $42. What’s next? Let’s examine charts below and find out (charts courtesy of http://stockcharts.com).

On Tuesday, we wrote the following:

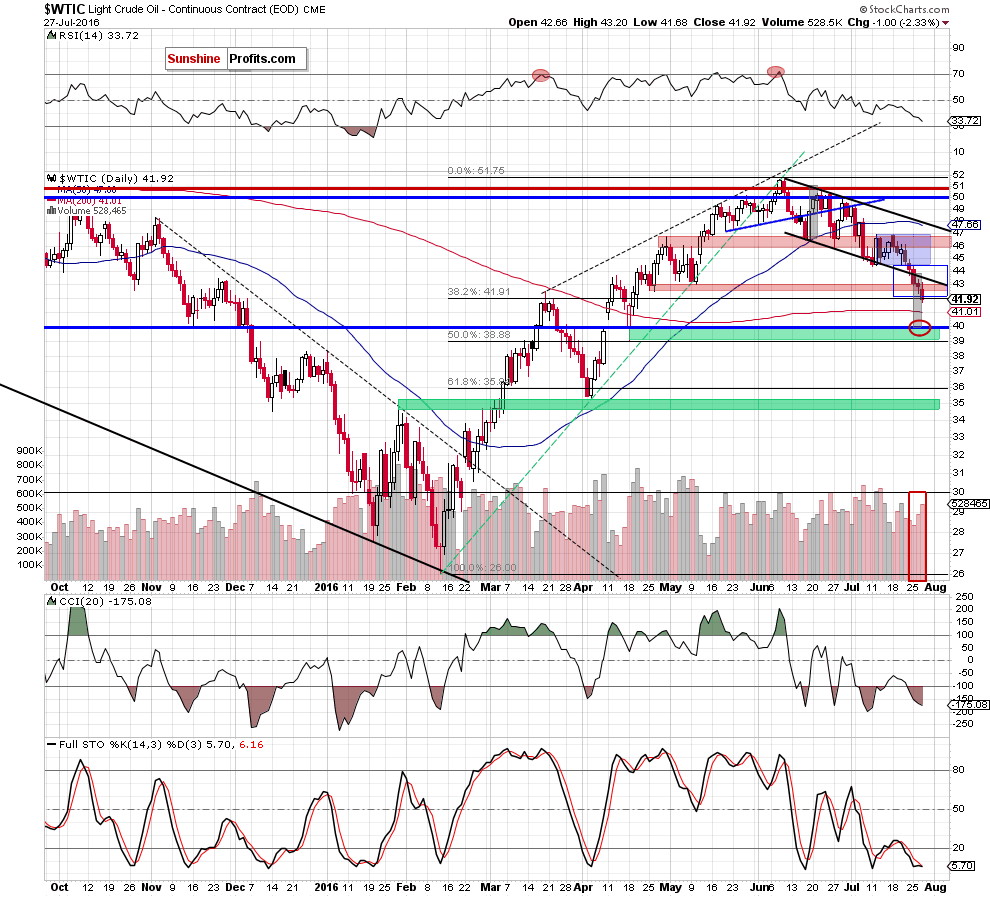

(…) Although light crude rebounded slightly (…), this move is barely visible from the very short-term perspective (not to mention the medium-term view), which suggests further deterioration in the coming day(s). This scenario is not only reinforced by the sell signal generated by the Stochastic Oscillator, but also by the fact that crude oil closed yesterday’s session apparently below the lower border of the black declining trend channel.

How low could the commodity go in the coming days? (…) the first downside target remains the green support zone (the lower line around $42.50). However, taking into account the breakdown under the lower border of the blue consolidation, we think that crude oil may decline even to around $42, where the size of the move will correspond to the height of the formation.

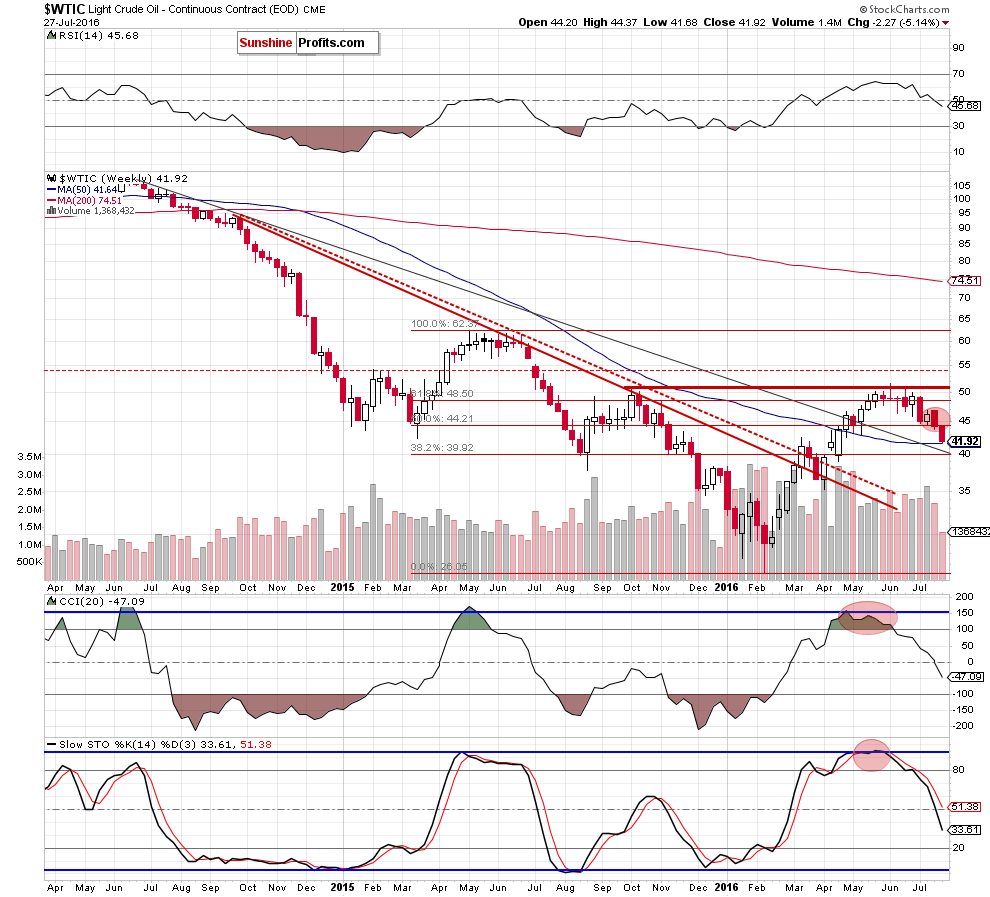

From today’s point of view, we see that oil bears pushed the commodity lower (as we had expected), which resulted in a drop to our next downside target. Taking this fact into account and combining it with a decline to the 38.2% Fibonacci retracement (based on the entire Feb-Jun rally) and the 50-week moving average (marked on the medium-term chart), it seems that crude oil may rebound and verified earlier breakdown under the lower border of the black declining trend channel (currently around $43.44).

However, on the other hand, when we consider fundamental factors, increasing volume during recent declines, confirmed breakdown (by three consecutive daily closures) under the lower line of the black trend channel and sell signals generated by the weekly indicators we see that oil bears still have many important factors on their side. Therefore, in our opinion, as long as there won’t be invalidation of the breakdown under the lower black line, another downswing is likely (even if crude oil moves temporary higher). If this s the case, and light crude extends declines, the next downside target would be the psychologically important barrier of $40 (additionally, in this area, the size of the downward move will correspond to the height of the black declining trend channel).

Summing up, short positions (which are already even more profitable) continue to be justified from the risk/reward perspective as crude oil dropped under the next support zone. Although the commodity could rebound from current levels and verified earlier breakdown under the lower border of the black declining trend channel, we think that further deterioration and a test of the psychologically important barrier of $40 is just around the corner.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: bearish

LT outlook: mixed with bearish bias

Trading position (short-term; our opinion): Short positions (with a stop-loss order at $54.21 and next downside target at $40) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts