Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Monday, crude oil extended Friday’s losses as a broadly stronger dollar made crude oil more expensive for buyers holding other currencies. In this environment, light crude lost 2% and declined to the key short-term support once again. Will it manage to stop oil bears in the coming days?

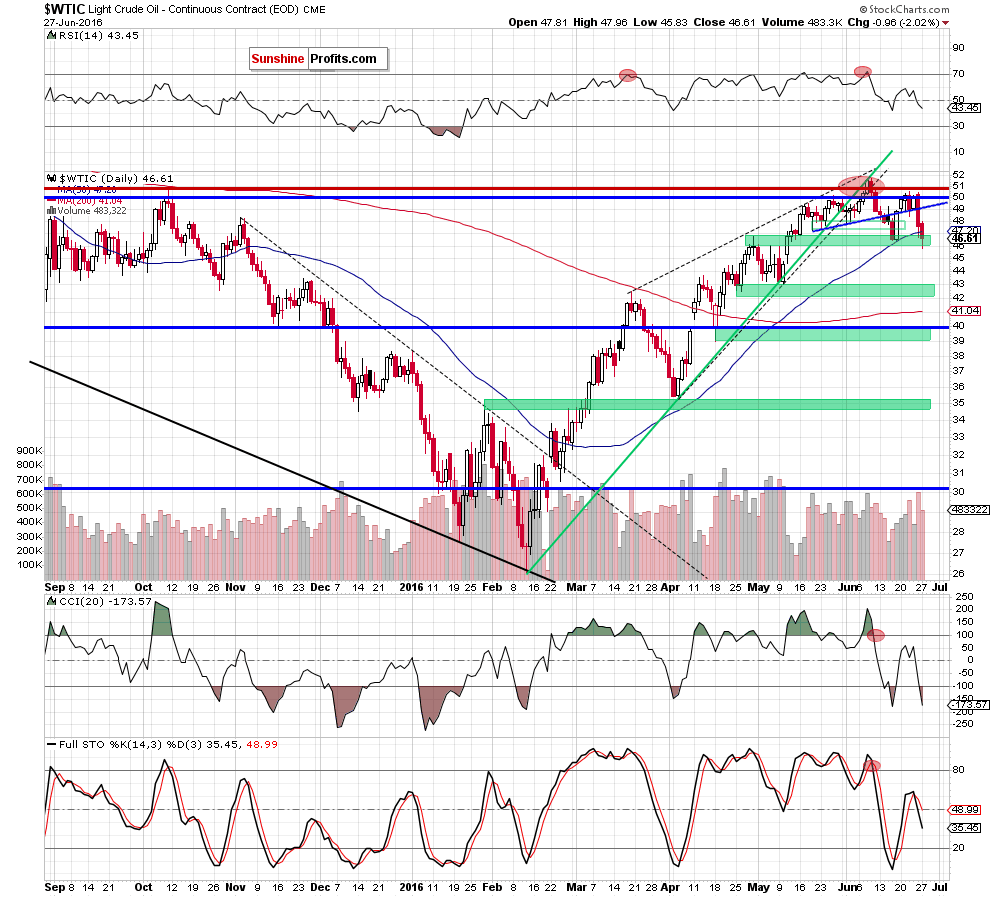

Let’s examine the daily chart (charts courtesy of http://stockcharts.com).

Yesterday, we wrote the following:

(…) the commodity dropped to the green support zone (created by the Apr and early May highs, the 50-day moving average and reinforced by the mid-Jun lows), which triggered a small rebound in the following hours.

(…) Nevertheless, when we take a closer look at the size of volume that accompanied Friday’s decline we clearly see that it was significant, which suggests that oil bears are getting stronger and may want to push the commodity lower later this week. This scenario is also reinforced by the current position of daily indictors (…). Taking the above into account, we think that another attempt to move lower and a re-test of the green support zone is more likely than increases at the moment.

Looking at the daily chart, we see that oil bears pushed the commodity lower as we had expected. With this downswing, crude oil not only reached our initial downside target, but also closed the day under the 50-day moving average. Although this is a negative signal that suggests further deterioration, we should keep in mind that the green support zone was strong enough to stop further declines in mid-Jun. Additionally, yesterday’s decline materialized on smaller volume (compared to what we saw on Friday), which increases the probability of another rebound from this area in the coming day(s).

If this is the case and light crude increases once again, the initial upside target, which will open the way to higher levels would be around $47.20, where the previously-broken 50-day moving average is. If this resistance is broken, we’ll likely see a test of the previous Jun lows around $47.75-$48.33.

Nevertheless, in our opinion, if crude oil declines once again and closes one of the following days under the green support zone, we’ll likely open short positions.

Summing up, crude oil extended declines and dropped to the green support zone, closing the day under the 50-day moving average. Although this is a negative signal that suggests further deterioration, we think that as long as there won’t be daily closure under the green support area, a bigger move to the downside is not likely to be seen and another rebound should not surprise us.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts