Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Although crude oil moved lower after the market’s open on Tuesday, the commodity reversed and rebounded in the following hours. As a result, light crude gained 0.72% and came back above the barrier of $50. Will we see further improvement in the coming days?

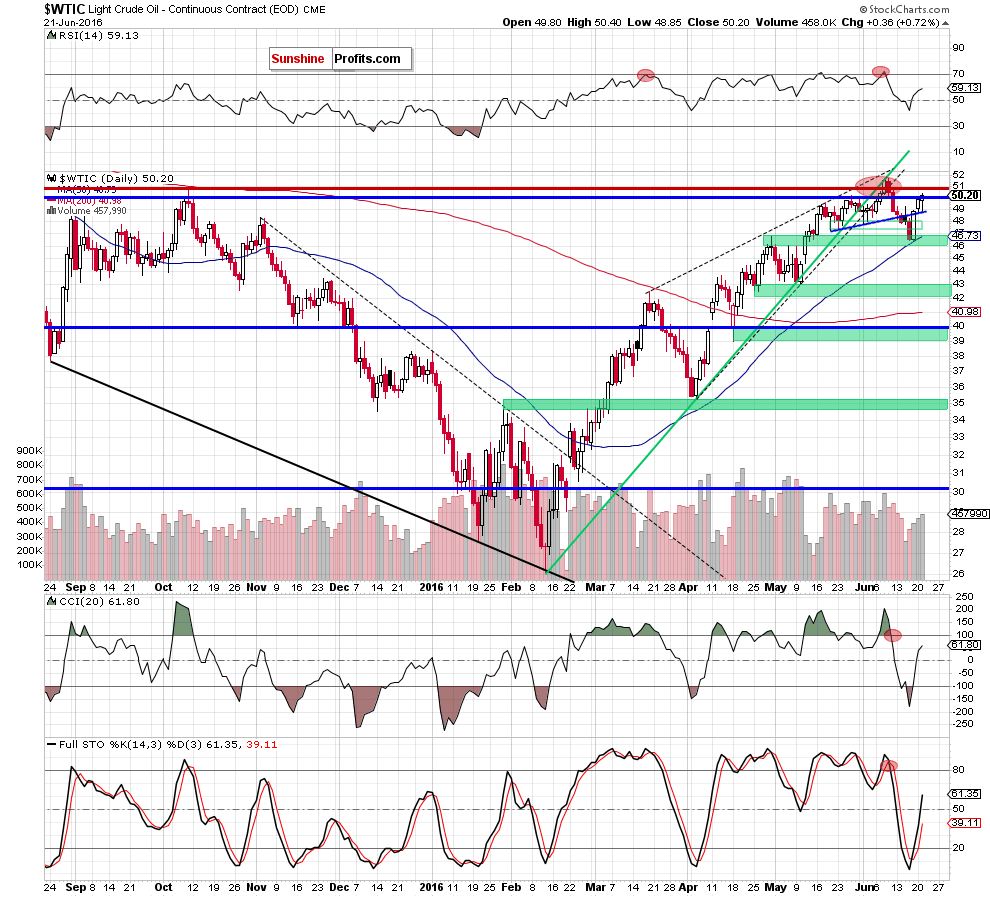

Let’s examine the daily chart and find out what can w infer from it about future moves (charts courtesy of http://stockcharts.com).

On Tuesday, we wrote the following:

(…) Taking into account the importance of the barrier of $50, we think that oil bears may feel encouraged to push light crude lower. Therefore, if we see such price action, crude oil will likely test the previously-broken blue support line (currently around $48.88) later in the day.

From today’s point of view, we see that the situation developed in line with the above scenario and crude oil declined to our initial downside target. As you see the blue support line stopped further deterioration and encouraged oil bulls to act. As a result, the commodity reversed and rebounded sharply, invalidating earlier breakdown under the barrier of $50. This is a positive signal, which suggests further improvement – especially when we factor in buy signals generated by the indicators.

If this is the case and light crude moves higher from here, we may see an increase to around $50.42$50.54, where the nearest resistance zone (created by the 76.4% and 78.6% Fibonacci retracement levels based on the recent downward move) is. Nevertheless, taking into account today’s crude oil futures price action (they reversed and slipped temporary under the barrier of $50), we think that another re-test of the barrier of $50 (or even the blue support line) is likely.

Summing up, crude oil pulled back to the previously-broken blue support line and rebounded, increasing above the barrier of $50. Although this is a positive signal that suggests further improvement another test of the level of $50 or even the blue support line is likely.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts