Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Monday, crude oil gained 2% as a weaker U.S. dollar and fading Brexit fears continued to weigh on investors’ sentiment. In this environment, light crude extended gains above the previously-broken short-term support line and climbed to the barrier of $50. Will it manage to stop further improvement in the coming days?

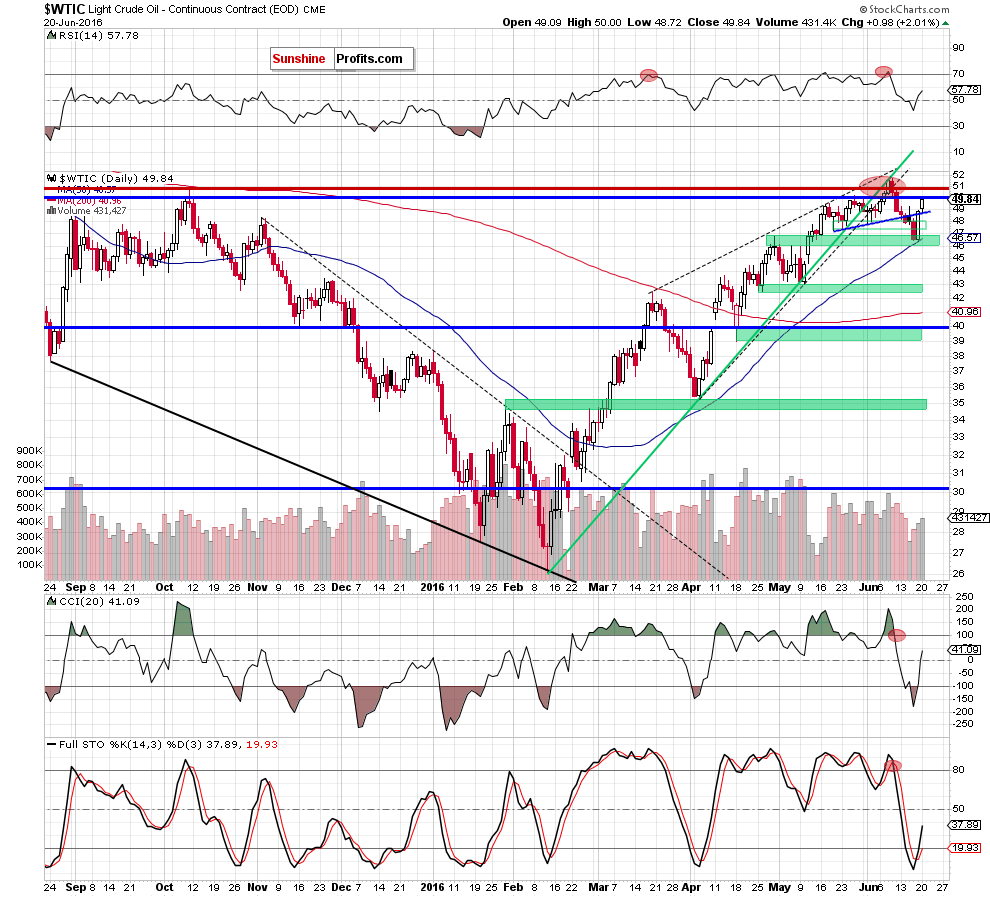

Let’s check the charts below and find out what can w infer from the about future moves (charts courtesy of http://stockcharts.com).

Quoting our yesterday’s alert:

(…) oil bulls managed to push black gold above the previously-broken blue resistance line. As a result, light crude invalidated earlier breakdown under the Jun lows and the above-mentioned line, which is a positive signal that suggests further improvement in the coming day(s).

How high could the commodity go in near future? In our opinion, if crude oil moves higher from here, the initial upside target would be the barrier of $50. (…) Additionally, it’s worth noting that the CCI and Stochastic Oscillator generated buy signals, which supports this pro-growth scenario.

Looking at the daily chart, we see that oil bulls pushed the commodity higher as we had expected, which resulted in a climb to our upside target. What’s next? Taking into account the importance of the barrier of $50, we think that oil bears may feel encouraged to push light crude lower. Therefore, if we see such price action, crude oil will likely test the previously-broken blue support line (currently around $48.88) later in the day.

Summing up, crude oil reached the barrier of $50, which may encourage oil bears to act and trigger a pullback to the previously-broken blue support line (currently around $48.88) in the coming day (s).

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts