Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Tuesday, crude oil extended gains and hit a fresh 2016 high as combination of expectations that domestic stockpiles drops once again and prolonged conflict in Nigeria continued to weigh on investors’ sentiment. In this environment, light crude invalidated breakdown under the previously-broken support/resistance line and closed the day above $50. How high could the commodity go in near future?

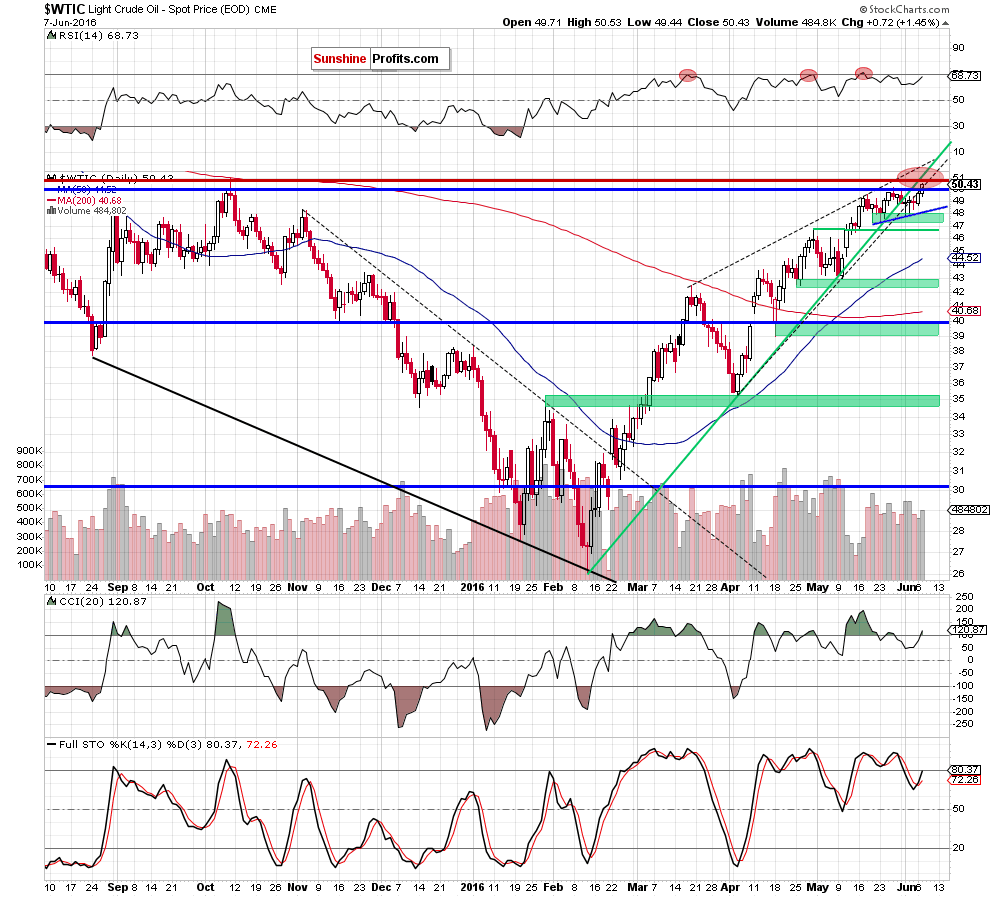

Let’s examine the daily chart and find out what can we infer from it (charts courtesy of http://stockcharts.com).

On the daily chart, we see that crude oil extended Monday’s gains and invalidated earlier breakdown under the lower border of the black rising wedge, which triggered further improvement and resulted in a fresh 2016 high of $50.53. Although the commodity gave up some gains in the following hours, light crude closed the day above the barrier of $50 inside the rising wedge.

Taking these facts into account and combining them with buy signal generated by the Stochastic Oscillator, it seems that the commodity will move higher once again and test the Oct 9 high of $50.92 or even climb to the previously-broken medium-term green line (currently around $51.35) in the coming day(s).

Finishing today’s alert, it’s worth keep in mind that the American Petroleum Institute reported that although distillates stockpiles increased by 270,000 barrels and gasoline stock rose by 760,000 barrels, crude oil inventories declined by 3.56 million barrels. Therefore, if today’s government report confirms these numbers, oil bulls will receive another reason to push the price higher. On the other hand, if the numbers disappoint expectations, oil bears will come back to play and try to take the commodity under $50.

Summing up, crude oil moved higher once again and hit a fresh 2016 high, which suggests a test of the Oct 9 high of $50.92 or even a climb to the previously-broken medium-term green line (currently around $51.35) in the coming day(s).

Very short-term outlook: mixed with bullish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts