Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Wednesday, light crude lost 1.30% after the EIA weekly report showed a bigger-than-expected increase in crude oil inventories. As a result, the commodity declined below $40 and closed the day under this psychologically important barrier. Will we see further deterioration in the coming week?

Although yesterday’s data showed that crude oil inventories at the Cushing Oil Hub in Oklahoma dropped by 1.258 million barrels and U.S. production fell by 30,000 barrels per day to 9.038 million bpd, these positive numbers were overshadowed by a bigger-than-expected increase in crude oil inventories. As a reminder, the U.S. Energy Information Administration reported that crude oil inventories increased by 9.4 million barrels, which pushed light crude below $40. Will we see further deterioration in the coming week? Let’s examine charts (charts courtesy of http://stockcharts.com).

Quoting our Monday’s alert:

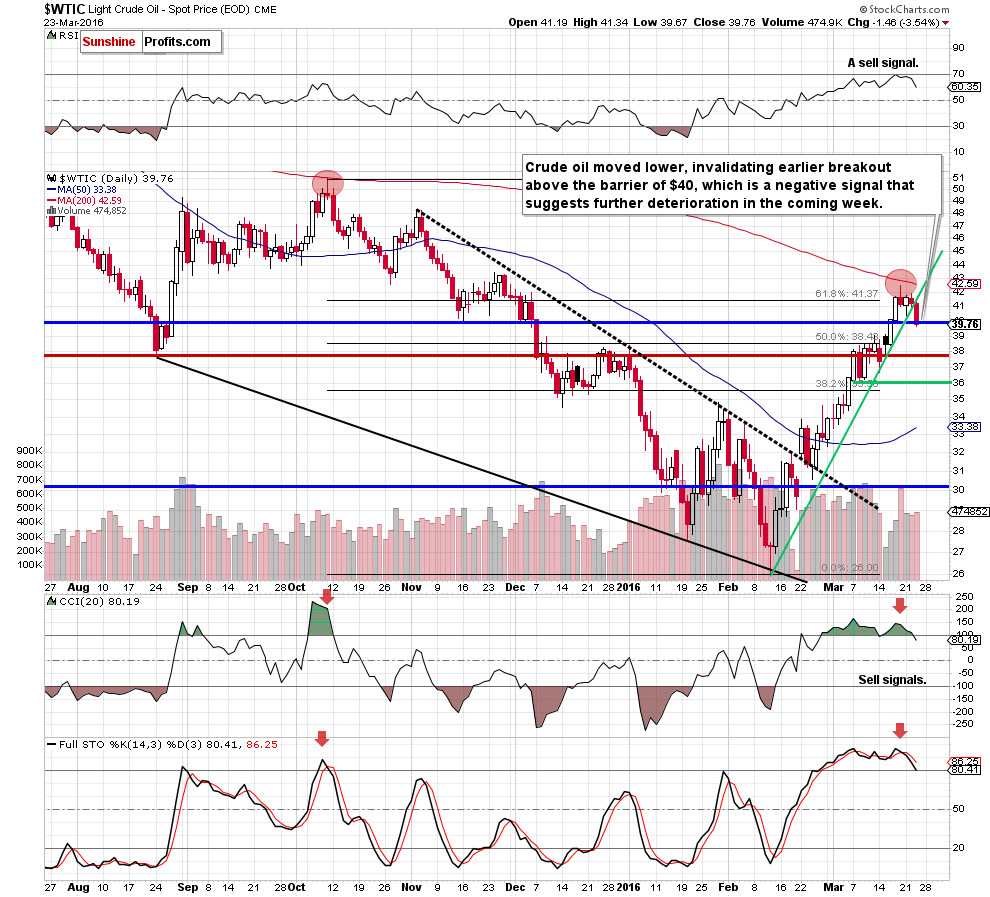

(…) Friday’s increase approached the commodity to the 200-day moving average – similarly to what we saw in Oct. Back then, this important resistance stopped further improvement and triggered a sizable downward move that took light crude under $30. On top of that, Friday’s pullback invalidated earlier breakout above the 61.8% Fibonacci retracement, which is an additional negative signal.

Are there any other bearish factors? As you see on the daily chart, the RSI generated a sell signal (for the first time in more than seven months), while the CCI and Stochastic Oscillator remain overbought. There are also negative divergences between them and the price of light crude, which suggests that the probability of a reversal increases with each passing trading day. The last, but not less important factor is the size of Friday’s volume. As you see, it was huge compared to the volume that we saw during recent increases, which suggests that oil bulls may not be as strong as it seems at the first sight.

Looking at the daily chart, we see that the situation developed in line with the above scenario and crude oil moved lower in recent days. Additionally, yesterday’s decline took the commodity under the green support line (based on the Feb and March 14 lows) and the psychologically important barrier of $40, invalidating earlier breakout above this level. Taking these negative factors into account and combining them with sell signals generated by all indicators, we think that further deterioration in the coming week is very likely. Nevertheless, the size of volume that accompanied yesterday’s decline wasn’t significant, which doesn’t confirm oil bears’ strength (not enough to go short at the moment).

On top of that, we should also keep in mind the medium-term picture.

On Monday, we wrote:

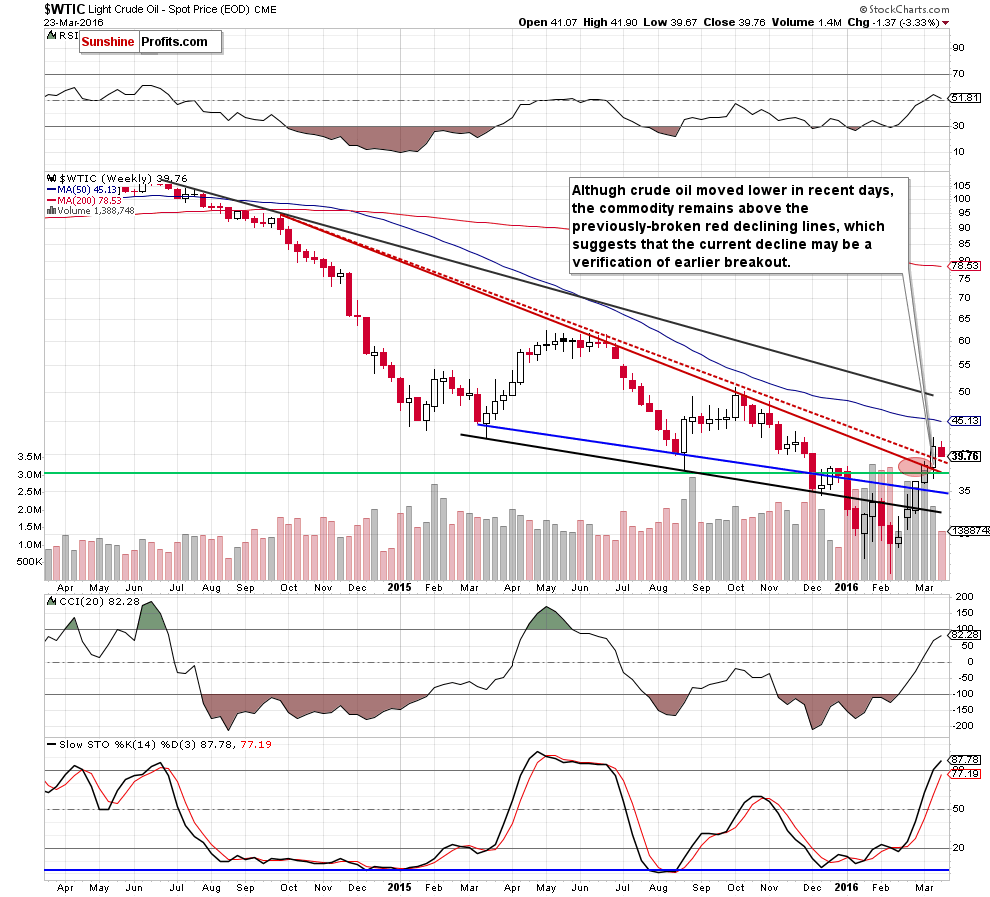

(…) the overall situation is a bit unclear. On one hand, crude oil broke above both medium-term declining resistance lines and hit a fresh 2016 high, which is a bullish signal. On the other hand, when we take a closer look at the weekly chart, we notice that the size of volume that accompanied last week’s increase wasn’t significant and much smaller than week earlier, which suggests that oil bulls' strength may begin to wane.

From today’s point of view, we see that oil bulls gave up some gains and crude oil slipped under $40. Despite this deterioration, light crude is still trading above both medium-term declining red lines, which suggests that we may see a rebound after drop to the red dashed one (currently around $39). Therefore, in our opinion, further declines will be more likely and reliable if we see an invalidation of the breakout above it.

Summing up, the most important event of yesterday’s session was a drop below $40 and invalidation of earlier breakout above this psychologically important level. Despite this deterioration, light crude remains above two medium-term support lines, which could encourage oil bulls to act in the coming day. Therefore, in our opinion, further declines would be more likely and reliable if we see an invalidation of the breakout above the red dashed line marked on the weekly chart.

Very short-term outlook: mixed with berish bias

Short-term outlook: mixed with berishbias

MT outlook: bearish

LT outlook: mixed with bearish bias

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

On an administrative note, due to the Easter weekend, there will be no regular Oil Trading Alerts on Friday and on Monday. If there are important changes, we will send you a short intra-day alert. Thank you for understanding.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts