Trading position (short-term; our opinion): Short positions (with a stop-loss order at $35.63 and a price target at $25.63) are justified from the risk/reward perspective.

On Thursday, crude oil lost 3.24% as Saudi Arabia didn’t confirm an OPEC meeting. Thanks to these circumstances, light crude came back to the declining trend channel and closed the day under $32. What’s next?

Let’s examine charts and find out (charts courtesy of http://stockcharts.com).

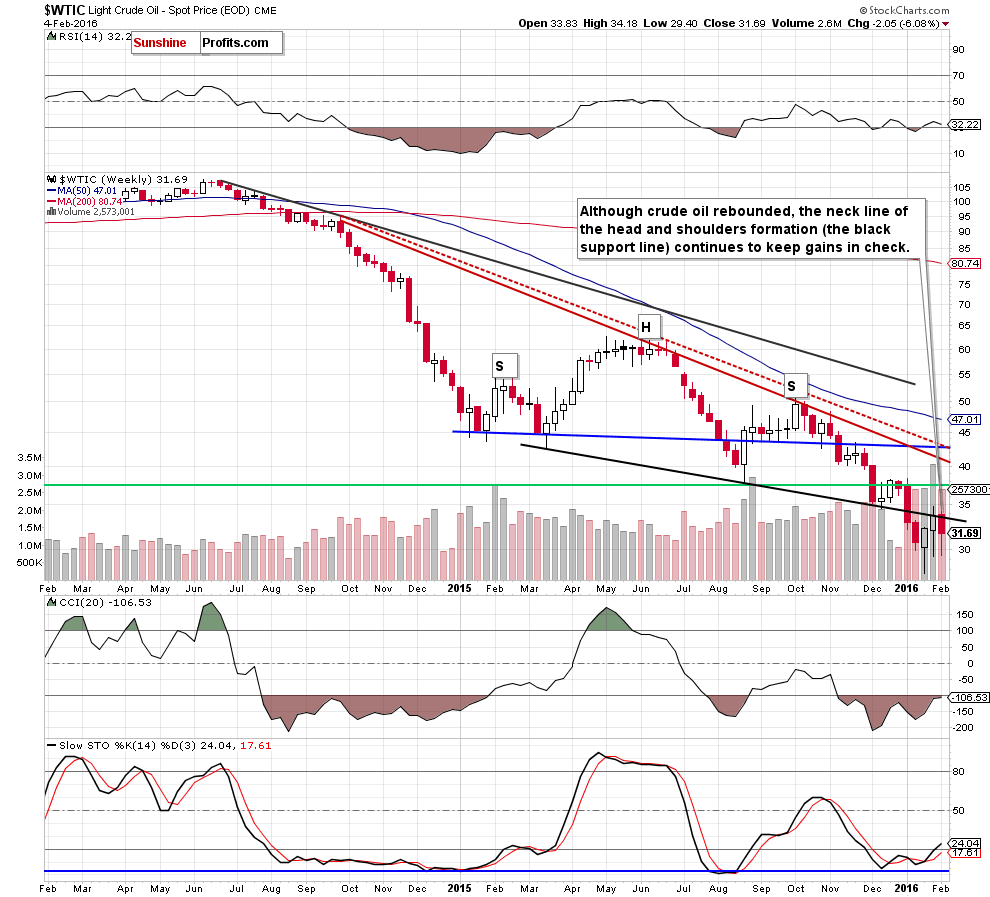

Looking at the above charts we see that the proximity to the black resistance line and neck line of the head and shoulders formation encouraged oil bears to act, which resulted in a pullback. Taking this fact into account, we believe that what e wrote yesterday remains up-to-date also today:

(…) the commodity came back above the previously-broken upper border of the red declining trend channel and re-approached the 50% Fibonacci retracement based on the Jan decline. Although this rally looks very positive, sell signals generated by the indicators remain in place, supporting oil bears. Additionally, light crude is still trading under the key black resistance line and previous highs.

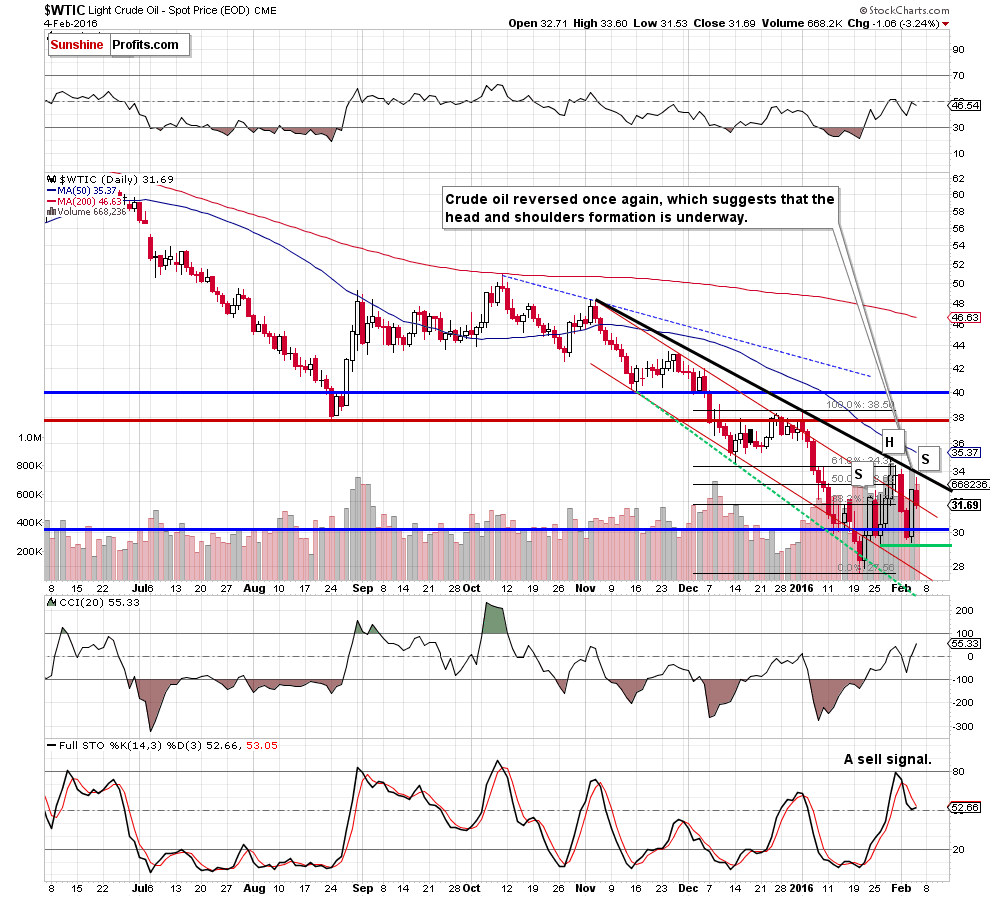

On top of that, when we take a closer look at the chart, we can notice a potential head and shoulders formation (the right shoulder of the pattern is underway). If this is the case, light crude will reverse from here and come back to (at least) the green support line in the coming days.

(…) the overall situation in the medium term hasn’t changed much as the commodity remains under the previously-broken neck line of the head and shoulders formation. Therefore, if light crude declines from here, we’ll receive another verification of earlier breakdown under this important line.

Summing up, crude oil reversed and declined under the upper border of the short-term declining trend channel, which suggests further deterioration - especially when we factor in a potential head and shoulders formation marked on the daily chart. Therefore, we believe that short positions (with a stop-loss order at $35.63 and a price target at $25.63) are justified from the risk/reward perspective.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: bearish

LT outlook: mixed with bearish bias

Trading position (short-term; our opinion): Short positions (with a stop-loss order at $35.63 and the price target at $25.63) are justified from the risk/reward perspective. The analogous levels for USO ETF and DWTI ETN are:

- USO initial target price: $6.67; USO stop-loss: $10.25

- DWTI initial target price: $513.31; DWTI stop-loss: $165.84

We will keep you – our subscribers – informed should anything change.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main market that we provide this level for (crude oil), the stop-loss level and target price for popular ETN and ETF (among other: USO, DWTI, UWTI) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DWTI for instance), but not for the “main instrument” (crude oil in this case), we will view positions in both crude oil and DWTI as still open and the stop-loss for DWTI would have to be moved lower. On the other hand, if crude oil moves to a stop-loss level but DWTI doesn’t, then we will view both positions (in crude oil and DWTI) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the sings pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts