Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Although the EIA report showed another increase in crude oil inventories, yesterday’s build was smaller than numbers released by the API, which in combination with news that Russia considers cooperation with OPEC countries about crude oil’s output cuts supported the price of the commodity. Thanks to these circumstances, light crude gained 5.41% and approached resistance levels. What’s next?

Yesterday, the U.S. Energy Information Administration reported that U.S. commercial crude oil inventories for the week ending on January 22, increased by 8.4 million barrels from the previous week. Although this build was bigger than analysts’ expected, yesterday’s increase was much smaller than the figure reported by the API on Tuesday evening. On top of that, Russian officials have decided to talk to Saudi Arabia and other OPEC countries about crude oil’s output cuts to support the price of the commodity. Thanks to these circumstances, light crude extended gains and hit an intraday high of $32.84. What’s next? Let’s examine charts and find out (charts courtesy of http://stockcharts.com).

On Monday, we wrote the following:

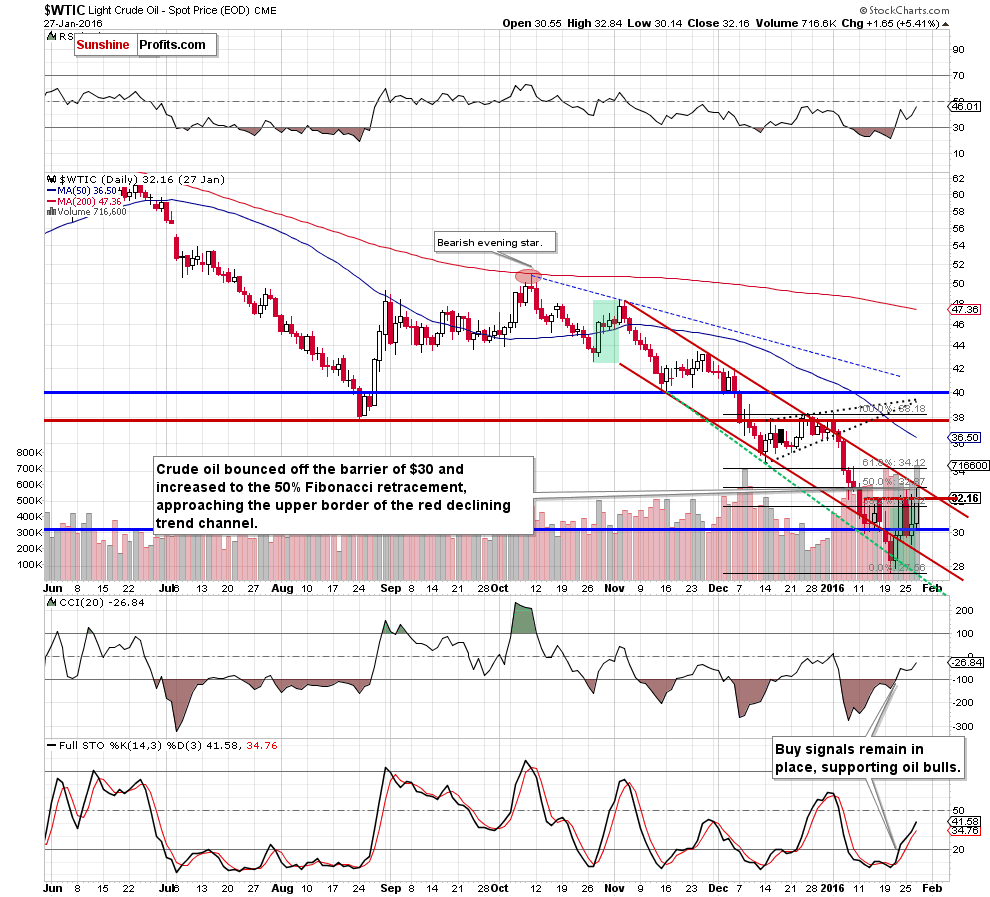

(…) How high could the commodity go? In our opinion, the initial upside target would be around $32.87-$33.35, where the 50% Fibonacci retracement and the upper border of the red declining trend channel are.

Looking at the daily chart, we see that the situation developed in line with the above scenario and crude oil almost touched our upside target. As you see, yesterday’s move materialized on sizable volume which in combination with buy signals generated by the indicators suggests further improvement. If this is the case, and light crude breaks above the upper border of the red declining trend channel, the next target for oil bulls would be the 61.8% Fibonacci retracement or even the mid-Dec low of $34.53.

Summing up, crude oil reversed and climbed to our initial upside target, which in combination with a sizable volume and buy signals generated by the indicators suggests further improvement and a test of the next Fibonacci retracement.

Very short-term outlook: mixed with bullish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed with bearish bias

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts