Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Friday, crude oil gained 8.04% as cold U.S. weather fuelled hopes for higher demand for heating oil. Thanks to these circumstances, light crude came back above the barrier of $30, invalidating earlier breakdown. Does it mean that the worst is behind oil bulls?

Although U.S. crude oil production surged above 9.2 million barrels per day in the previous week, the Friday’s Baker Hughes report showed that U.S. oil rigs dropped by five to 510 for the week ending on January 15, which was the fifth consecutive week of declines. This news in combination with a winter storm (which headed up the East Coast) increased demand for heating oil and pushed the price of light crude higher. As a result, the commodity came back above the barrier of $30, invalidating earlier breakdown. Will we see further rally in the coming days? Let’s examine charts and find out (charts courtesy of http://stockcharts.com).

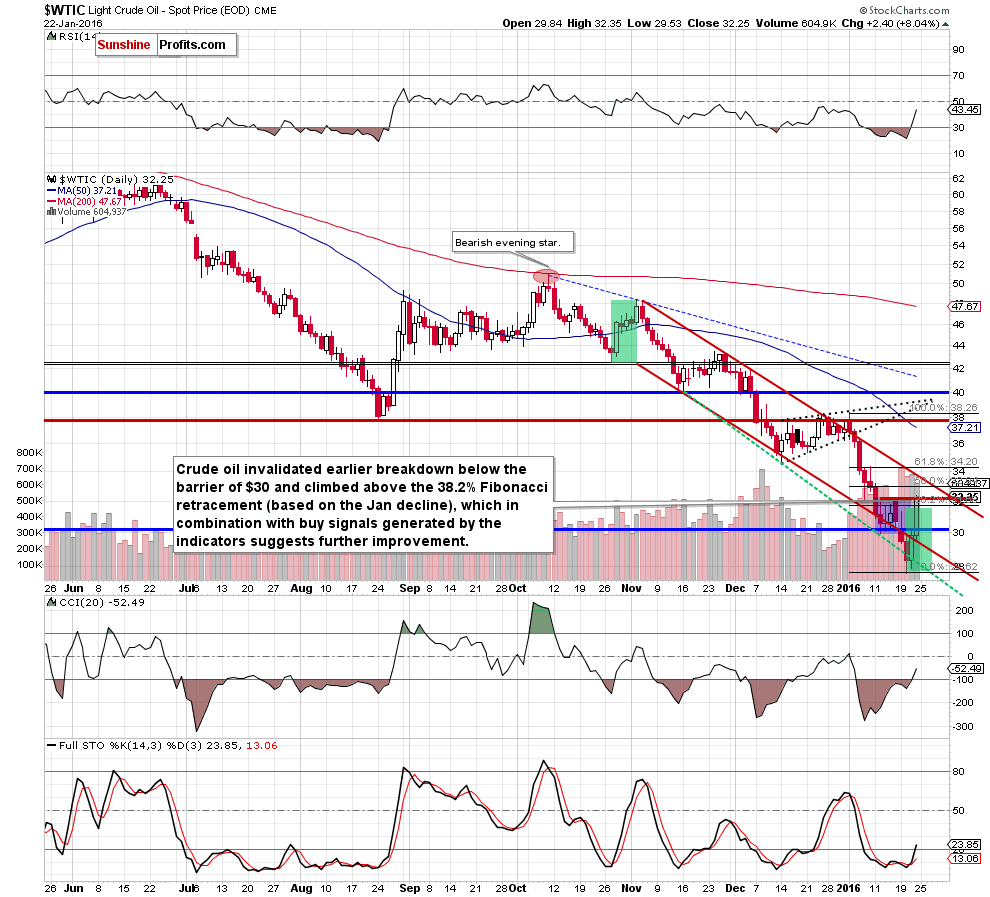

Looking at the daily chart, we see that crude oil extended gains and invalidated earlier breakdown under the barrier of $30, which triggered further improvement. With Friday’s rally, light crude broke above the 38.2% Fibonacci retracement (based on the Jan declines) and reached the upper border of the blue consolidation. Although we can see a pullback from here later in the day, the current position of the indicators (all indicators generated buy signals) in combination with the breakout above the first Fibonacci retracement suggests further improvement.

How high could the commodity go? In our opinion, the initial upside target would be around $32.87-$33.35, where the 50% Fibonacci retracement and the upper border of the red declining trend channel are.

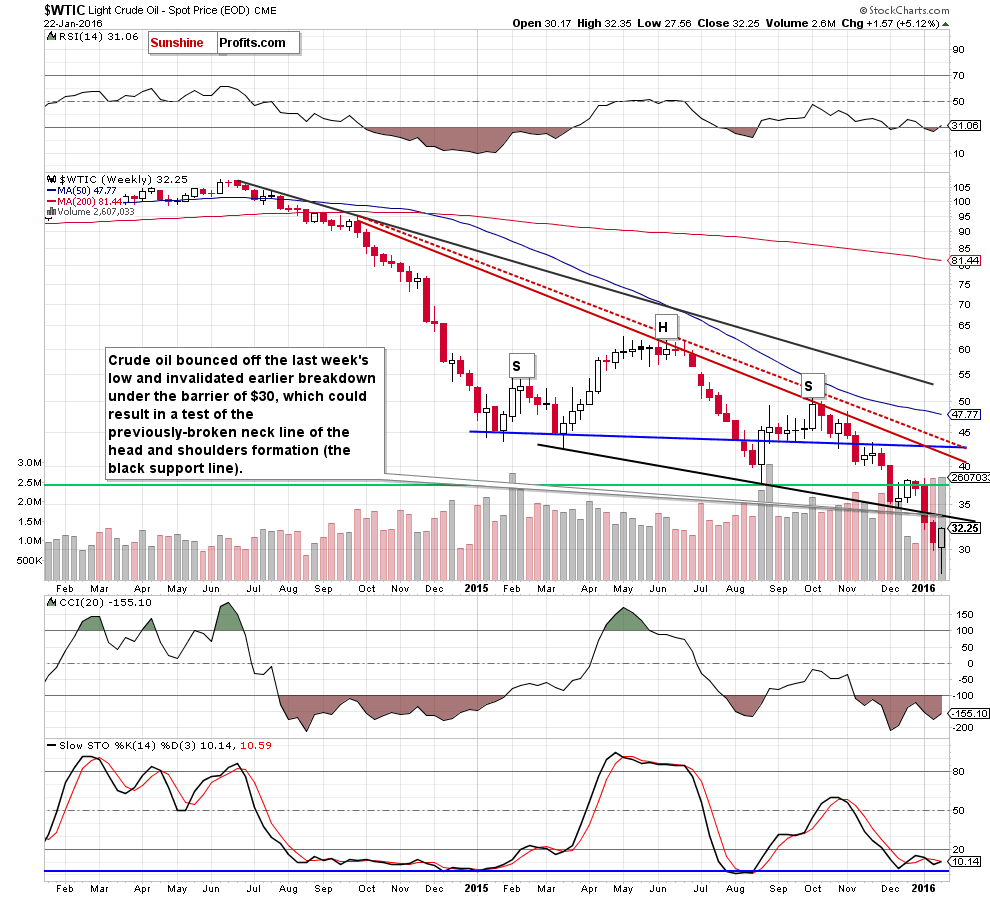

Will we see a breakout above this resistance area? Let’s examine the weekly chart and look for more clues about future moves.

From this perspective, we see that the first upside target for oil bulls would be around $33.68, where the previously-broken neck line of the head and shoulders formation is.

Summing up, crude oil extended gains and invalidated the breakdown under the barrier of $30, which in combination with buy signals generated by the daily indicators suggests further improvement in the coming day(s).

Very short-term outlook: mixed with bullish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed with bearish bias

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts