Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Friday, crude oil lost 1.70% as worries over Iran's return to global energy markets weighed on the price. Thanks to these circumstances, light crude slipped under support/resistance line and approached the barrier of $30. Will oil bears manage to push the commodity below it in the coming week?

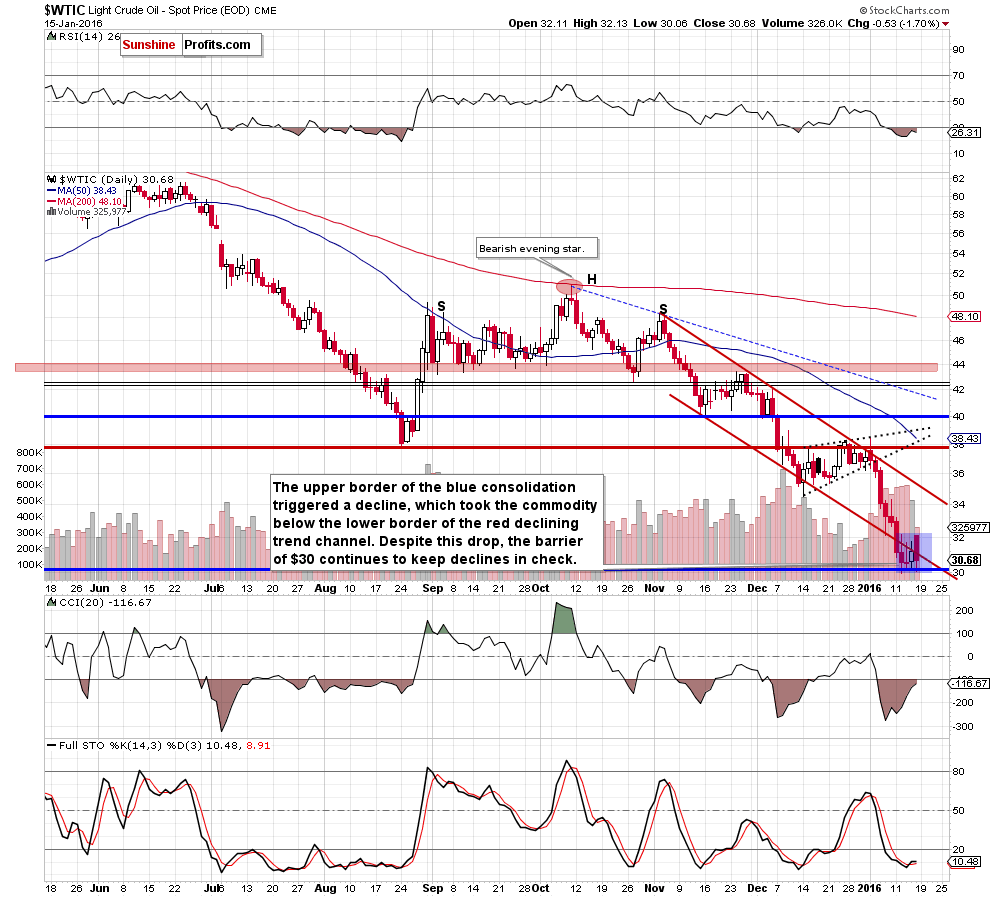

Let’s examine charts and find out what can we infer about future moves (charts courtesy of http://stockcharts.com).

On Friday, crude oil increased after the market’s open and hit an intraday high of $32.13. Despite this improvement, the upper border of the blue consolidation encouraged oil bears to act, which resulted in a sharp pullback. With this downward move, the commodity slipped under the previously-broken lower border of the red declining trend channel, but closed another day above the barrier of $30.

Therefore, in our opinion, as long as there is no breakout above the upper border of the formation (or a breakdown under $30) another bigger move is not likely to be seen and short-lived moves in both directions should not surprise us.

Nevertheless, we should keep in mind that there are positive divergences between the RSI, CCI and the price of the commodity, while the Stochastic Oscillator generated a buy signal (so far, quite week because the indicator remains below 20, but still). On top of that, the size of volume that accompanied Friday’s decline wasn’t huge (compared to what we saw in previous days) which suggests that oil bears may weaken. All the above increases the probability of another rebound in the coming days (especially when we factor in four consecutive daily closures above the barrier of $30).

Summing up, although crude oil moved higher after the markets open once again, the upper border of the consolidation triggered a pullback to the barrier of $30. Therefore, in our opinion, as long as there is no breakout above the upper border of the formation (or a breakdown under $30) another bigger move is not likely to be seen and short-lived moves in both directions should not surprise us.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed with bearish bias

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts