Trading position (short-term; our opinion): Short positions (with a stop-loss order at $39.12) are justified from the risk/reward perspective.

On Monday, crude oil lost 5.32% as another sizable decline in Chinese stock markets weighed on the price of the commodity. In this environment, light crude hit a fresh multi-year low of $30.88 and closed the day slightly above $31. Where will the commodity head next?

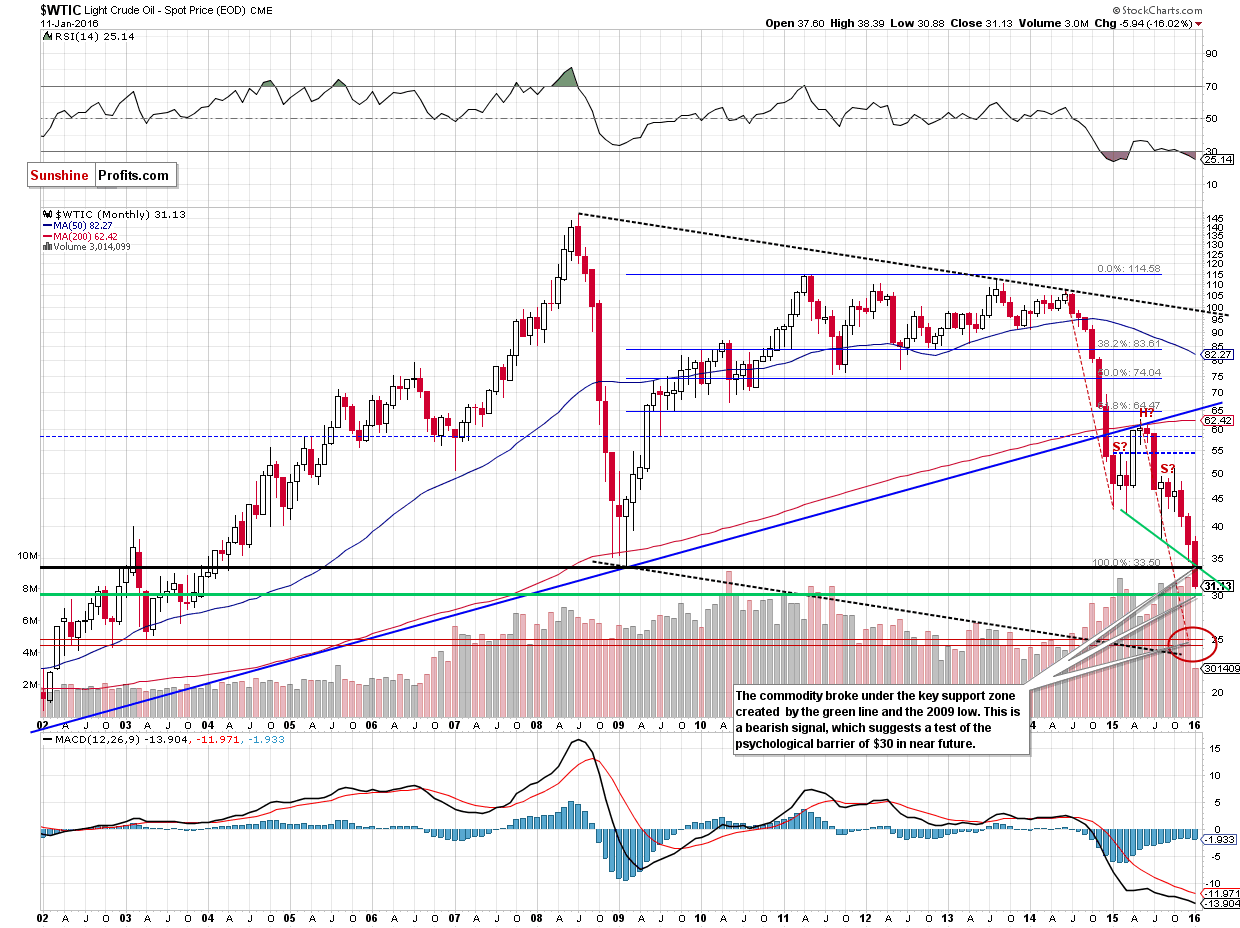

Although Beijing tried to stabilize the market, Chinese stocks markets plunged once again yesterday (the Shanghai Composite Index lost more than 5%), rising even more concerns over country’s oil demand. As a result, light crude hit a fresh multi-year low of $30.88 and closed the day below important support line. What’s next? Let’s examine charts and find out (charts courtesy of http://stockcharts.com).

Yesterday, we wrote the following:

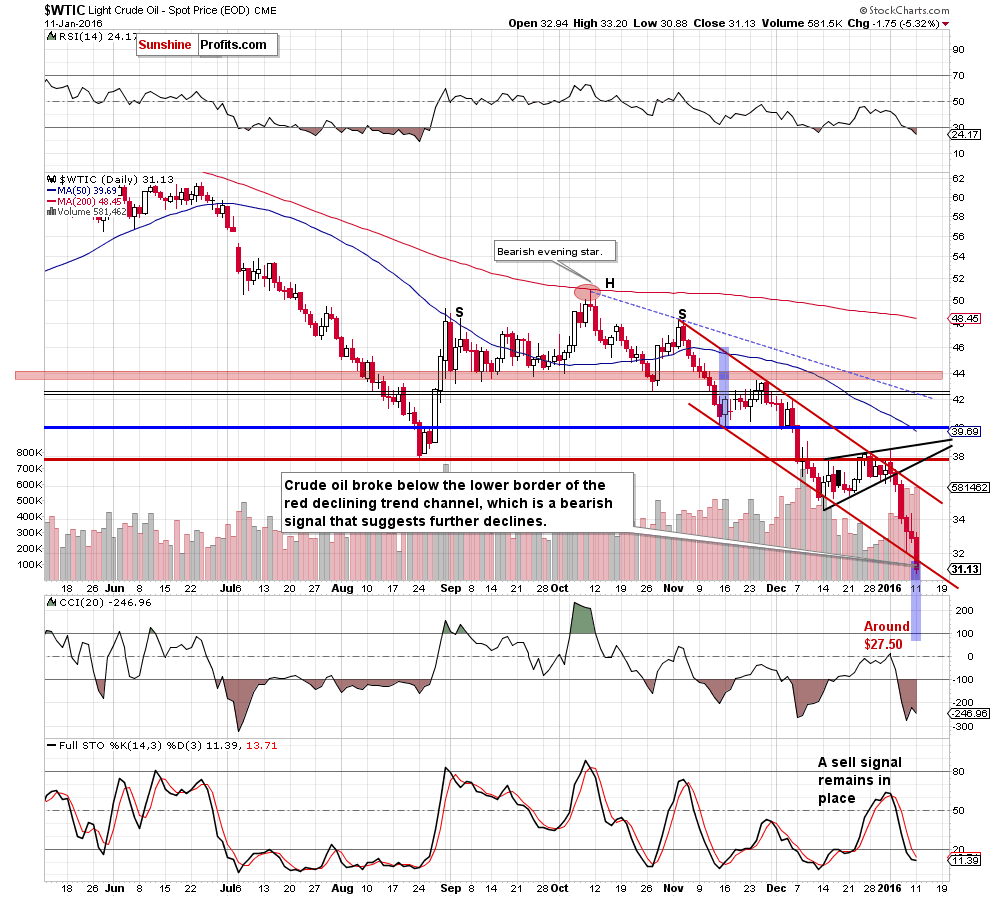

(…) the commodity reversed and declined below $33, which looks like a verification of the breakdown under the Dec low. If this is the case, such price action is a bearish signal, which suggests further deterioration in the coming week.

If crude oil declines from here, the initial downside target will be around $31.30 where the lower border of the red declining trend channel currently is. At this point, it is also worth noting that the sell signal generated by the Stochastic Oscillator continues to support oil bears and further declines.

Looking at the daily chart we see that the situation developed in line with the above scenario and crude oil dropped not only to our next downside target, but also slipped under the lower border of the red declining trend channel. This is a strong bearish signal, which suggests a test of the psychological barrier of $30 in the coming days – especially when we factor in the sell signal generated by the Stochastic Oscillator and the long-term picture. Additionally, please keep in mind that yesterday’s downswing materialized on huge volume, which confirms oil bears’ strength.

Nevertheless, taking into account the size of the recent downward move (so far, there were six consecutive sessions in which crude oil lost more than 16%, making our short positions more profitable), we think that corrective upswing in near future should not surprise us. If we see such price action, the initial upside target would be around $32.65, where the 23.6% Fibonacci retracement (based on the Jan decline) is. However, such improvement would be more likely only if crude oil invalidated yesterday’s breakdown under the lower border of the trend channel.

Summing up, crude oil moved lower once again and closed the day below the lower border of the red declining trend channel marked on the daily chart, which suggests further deterioration in the coming weeks (even if we see a short-lived rebound in near future). Therefore, short positions (which are already profitable as we opened them when crude oil was trading around $38) are justified from the risk/reward perspective.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: bearish

LT outlook: mixed with bearish bias

Trading position (short-term; our opinion): Short positions (with a stop-loss order at $39.12) are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts