Trading position (short-term; our opinion): Short positions with a stop-loss order at $54.12 and initial (!) target price at $35.72 are justified from the risk/reward perspective.

On Tuesday, crude oil moved higher after Turkey shot down a Russian fighter jet near the Syrian border, increasing worries over disruptions to supplies from the Middle East. As a result, light crude climbed above $42 and reached resistance zone. Will it withstand the buying pressure in the coming days?

Yesterday, a Turkish F-16 jet plane shot down a Russian jet near the Syrian border after it violated Turkey's airspace. In response, Russia president Vladimir Putin warned that the attacks could place a serious dent in Russian-Turkish relations, which fuelled fears that the conflict could spread across the region and send oil prices higher. As a result, light crude climbed above $42 and reached resistance zone. Will it withstand the buying pressure in the coming days? Let’s examine charts and find out (charts courtesy of http://stockcharts.com).

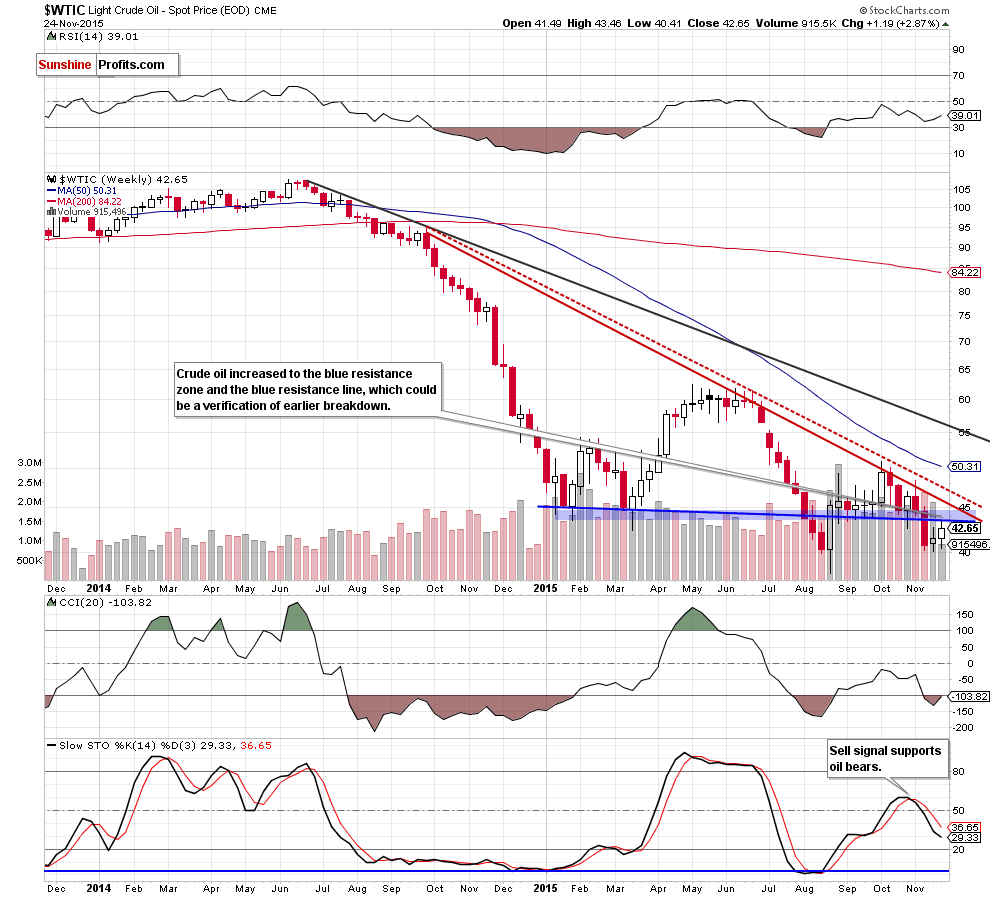

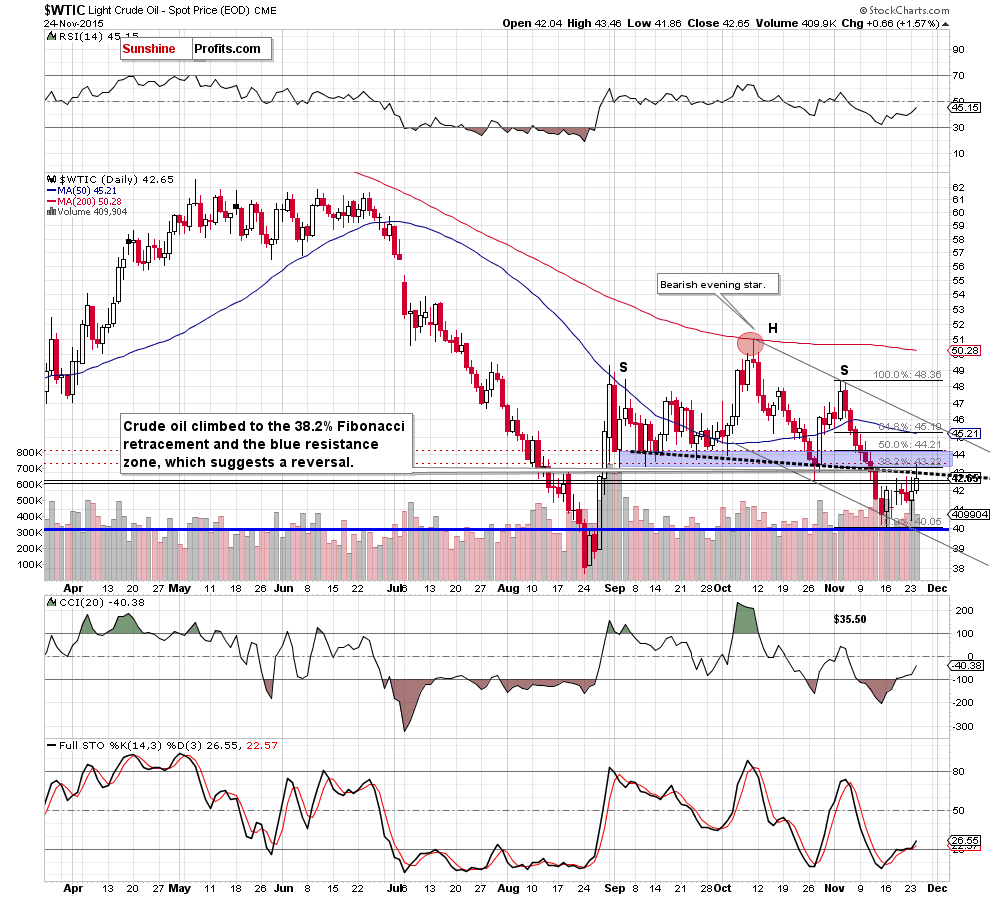

Looking at the charts we see that crude oil extended gains and climbed to the blue resistance zone created by the Jan and Feb lows and reinforced by the blue resistance line (marked o the weekly chart). With this upswing, the commodity also reached the blue resistance zone created by the Sept and Oct lows and reinforced by the 38.2% Fibonacci retracement (based on the Nov declines).

What does it mean for light crude? In our opinion, this solid resistance zone will be strong enough to stop further improvement and trigger a pullback. The reason? Firstly, despite yesterday’s increase, the commodity gave up some of earlier gains and closed the day under the black dashed resistance line. Secondly, the size of volume that accompanied yesterday’s upswing was smaller than day before, which doesn’t confirm oil bulls’ strength. Thirdly, although daily indicators generated buy signals, the sell signal generated by the weekly Stochastic Oscillator remains in place supporting oil bears.

Taking all the above into account, we think that reversal and lower values of the commodity are more likely than not. If this is the case, and light crude declines from here, we’ll see another test of the barrier of $40 in the coming days.

Summing up, although crude oil moved higher on Tuesday, the commodity remains under solid resistance zone, which suggests that yesterdays upswing could be just a verification of earlier breakdown. If this is the case, light crude will decline from here and we’ll see further deterioration in the coming weeks. Therefore, we believe that short positions (which are already profitable as we opened them when crude oil was trading around $46.69) continue to be justified from the risk/reward point of view.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: bearish

LT outlook: mixed with bearish bias

Trading position (short-term; our opinion): Short positions with a stop-loss order at $54.12 and initial (!) target price at $35.72 are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

On an administrative note, there will be no regular Oil Trading Alert tomorrow and on Friday, but if the situation changes dramatically, we will send you a quick note with our latest analysis and thoughts on that matter.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts