Trading position (short-term; our opinion): Short positions with a stop-loss order at $54.12 and initial (!) target price at $35.72 are justified from the risk/reward perspective.

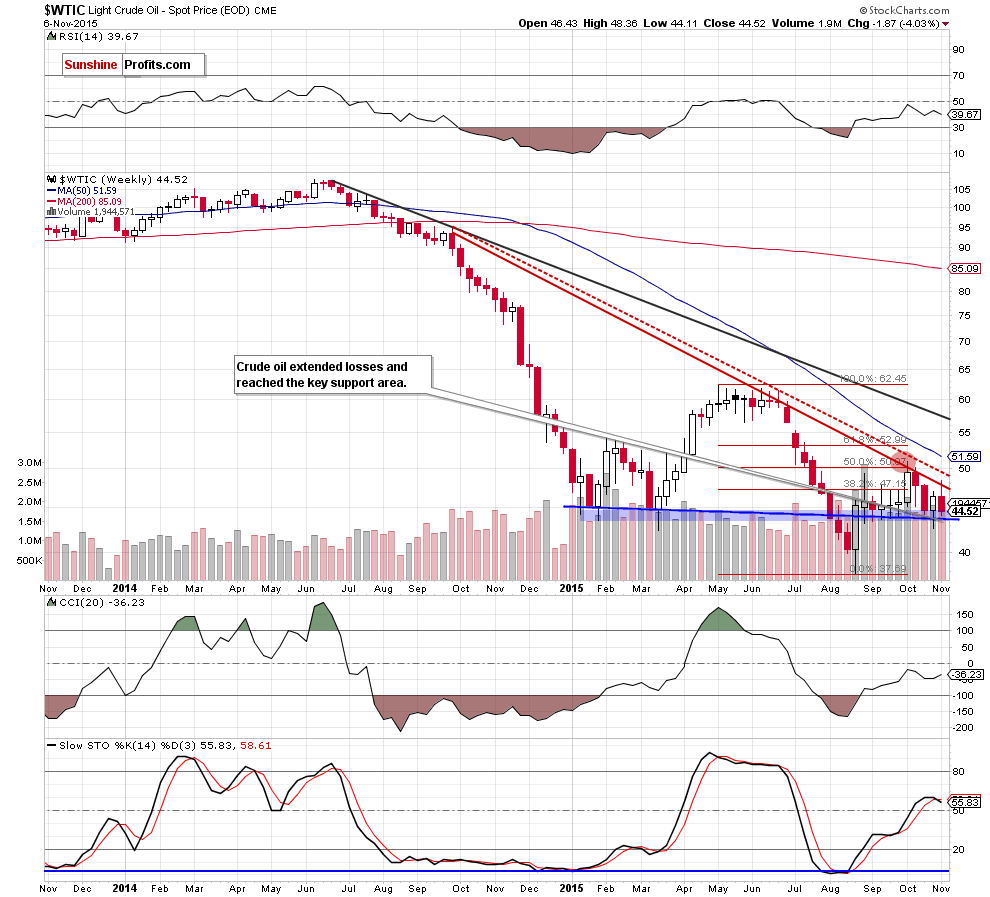

On Friday, crude oil lost 1.92% as the combination of a stronger greenback and concerns over a supply glut continued to weigh on the commodity. As a result, light crude dropped under the support line and reached the key support area. What’s next?

On Friday, the U.S. Labor Department showed the economy added 271.000 jobs in the previous month, beating expectations for a 180.000 rise. Additionally, the U.S. unemployment rate dropped to 5.0% in October from 5.1% the previous month. On top of that, the report also showed that average hourly earnings rose 0.4% last month, also beating forecasts for a 0.2% gain. Thanks to these bullish numbers, the USD Index rallied to a six-month high and climbed above 99, making crude oil less attractive for buyers holding other currencies. Thanks to these circumstances, light crude dropped under the support line and reached the key support area. What’s next? (charts courtesy of http://stockcharts.com).

Quoting our Friday’s commentary:

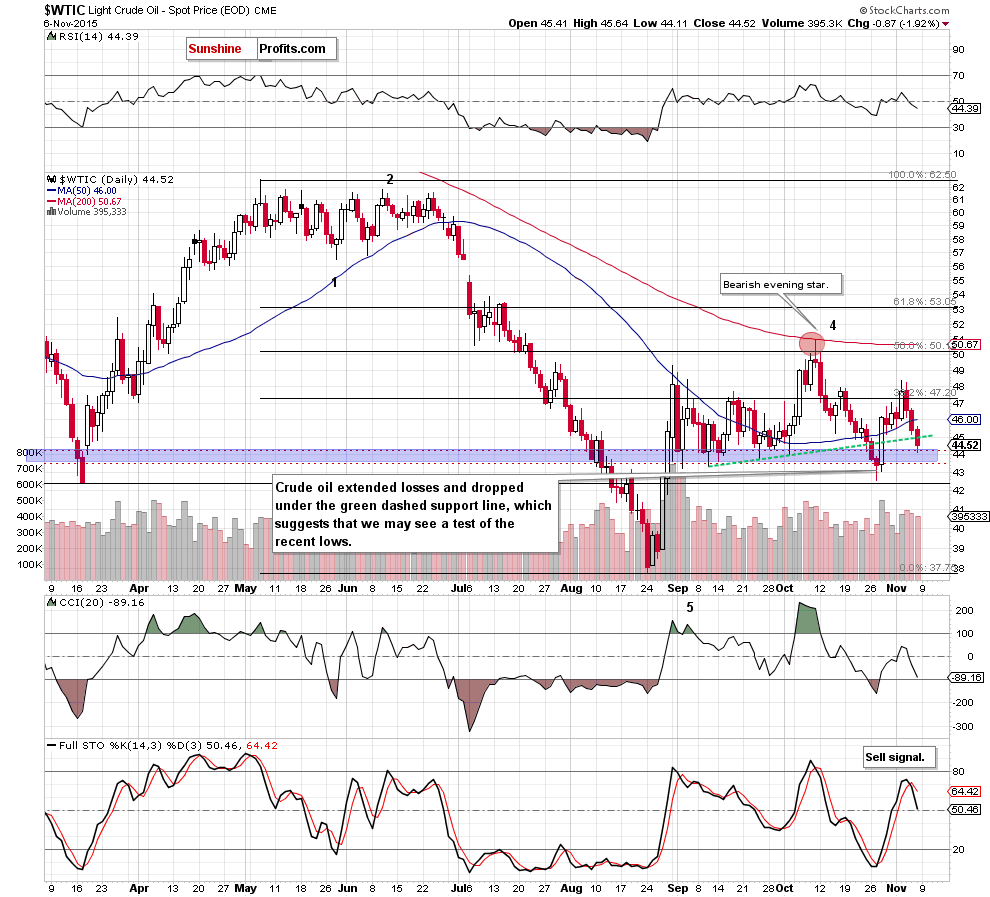

(…) recent downward move invalidated earlier breakout above the 38.2% Fibonacci retracement, which triggered further decline and resulted in a drop below the 50-day moving average (a negative signal). Additionally, the Stochastic Oscillator generated a sell signal, which gives oil bears another reason to act.

Taking all the above into account, we believe that the commodity will test the green support line in the coming day(s). If it is broken, the next downside target would be the blue support line (currently around $43.81).

As you see on the charts, the situation developed in line with the above scenario and the commodity reached our next downside target. Although light crude could rebound from here – similarly to what we saw in previous weeks, the current position of the indicators (weekly and daily Stochastic Oscillator generated a sell signal) suggests further deterioration and a test of the recent lows.

Nevertheless, we believe that a successful breakdown under the key support area will accelerate declines and we’ll see a drop to (at least) $40.57-$40.86, where the next support area (created by the 76.4% and 78.6% Fibonacci retracement levels) is.

Summing up, crude oil extended losses and dropped under the green dashed support line. This is a bearish signal, which suggests that further deterioration in the coming day(s) is more likely than not and short positions continue to be justified from the risk/reward point of view.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: bearish

LT outlook: mixed with bearish bias

Trading position (short-term; our opinion): Short positions with a stop-loss order at $54.12 and initial (!) target price at $35.72 are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts