Trading position (short-term; our opinion): Short positions with a stop-loss order at $54.12 and initial (!) target price at $35.72 are justified from the risk/reward perspective.

Yesterday, crude oil moved sharply higher after better-than-expected EIA report. As a result, light crude reversed and increased above $46. Did this rally change anything in the medium-term picture of the commodity?

Yesterday, the U.S. Energy Information Administration reported that U.S. crude oil inventories increased by 3.37 million barrels for the week ending on Oct. 23, slightly below expectations of a 3.41 million barrel gain. Additionally, yesterday’s increase was smaller than Tuesday’s gain of 4.1 million barrels showed by the American Petroleum Institute. On top of that, yesterday’s report also showed that gasoline inventories decreased by 1.1 million barrels (beating expectations for a decline of 0.9 million barrels). Thanks to these numbers, light crude rebounded sharply and increased above $46. Did this rally change anything in the medium-term picture of the commodity? Let’s examine charts and find out (charts courtesy of http://stockcharts.com).

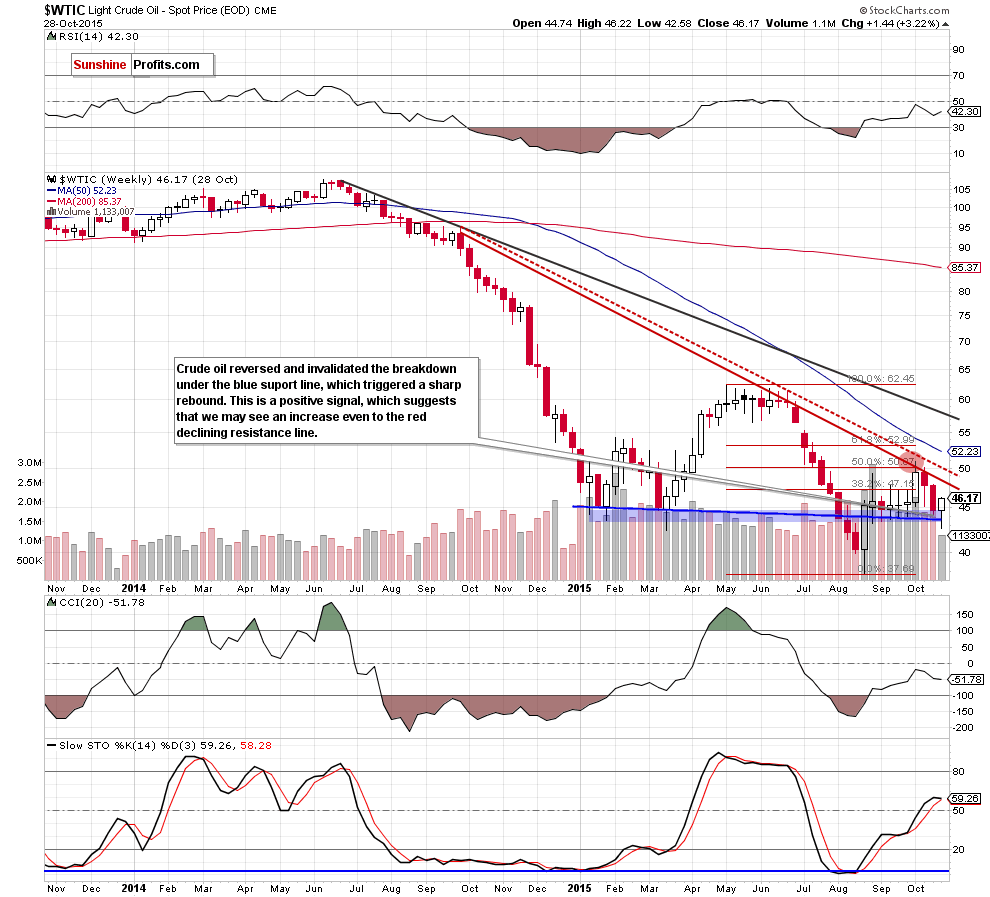

Looking at the weekly chart we see that the commodity reversed and invalidated the breakdown under the blue suppot line, which triggered a shap rebound. This is a positive signal, which suggests that we may see further improvemet and an increase even to the red declining resistance line (currently around $48.60) in the coming days.

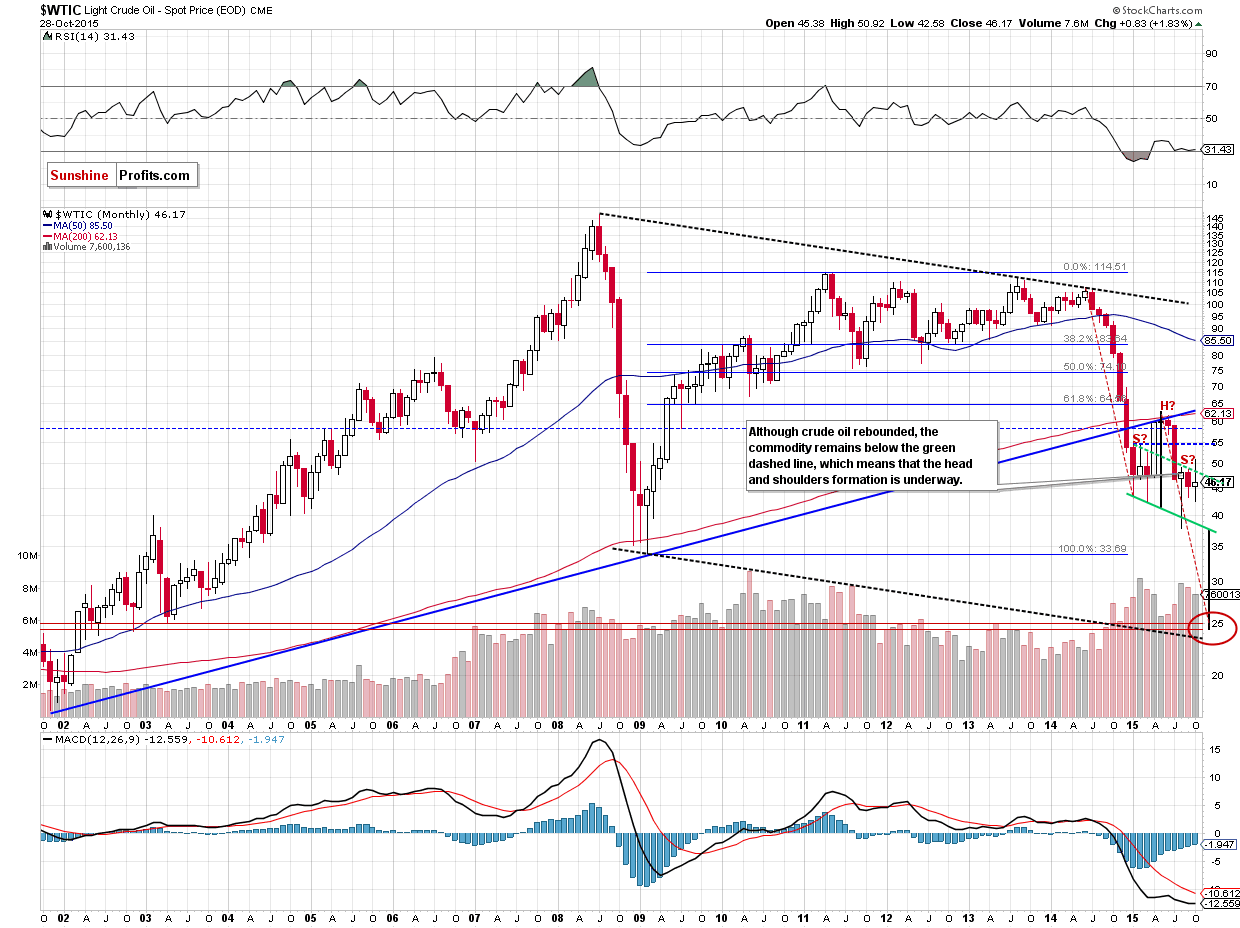

Did yesterday’s rally change anything in the long-term picture of the commodity? Let’s examine the monthy chart and find out.

From this perspective we see that although crude oil rebounded, the commodity remains under the green dashed line, which means that the head and shoulders pattern is underway (even if light crude increases from here and tests this line – currently around $48.70). Therefore, we believe that if crude oil declines in the coming weeks and breaks under the green support line (the neck line of the formation), we’ll see not only fresh 2015, but also further deterioration, which could took the commodity even to $25.

Summing up, crude oil invalidated earlier breakdown under the blue support line and rebounded sharply. Despite this increase, the commodity remains under important long- and medium-term resistance lines, which means that further deterioration is more likely than not and short positions continue to be justified from the risk/reward point of view.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: bearish

LT outlook: mixed with bearish bias

Trading position (short-term; our opinion): Short positions with a stop-loss order at $54.12 and initial (!) target price at $35.72 are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts