Trading position (short-term; our opinion): Short positions with a stop-loss order at $45.32 and profit-take order at $35.72 are justified from the risk/reward perspective.

On Wednesday, crude oil lost 1.92% as EIA report disappointed market participants. As a result, light crude erased over 75% of Tuesday’s rally and slipped to its short-term support line. What’s next?

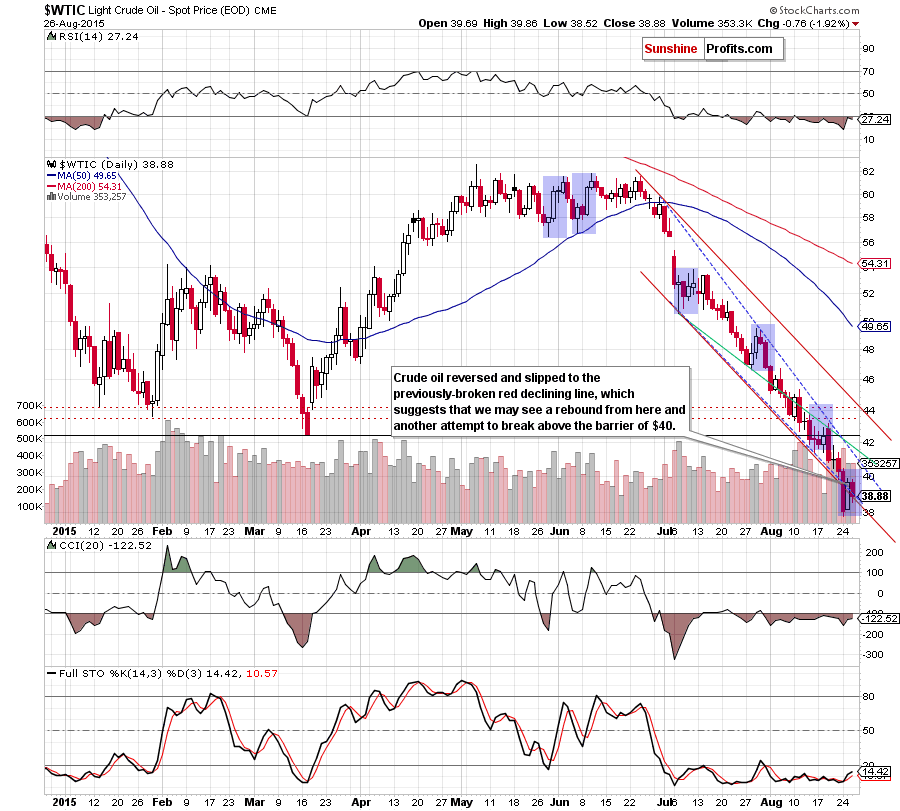

Although the U.S. Energy Information Administration reported that U.S. crude oil inventories fell by 5.5 million barrels in the week ended August 21 (beating analysts' expectations for a 1.1 million rise), yesterday’s data disappointed market participants as the American Petroleum Institute showed on Tuesday a decline of 7.3 million barrels. Additionally, the report also showed that gasoline inventories rose by 1.7 million barrels, while distillate stockpiles increased by 1.4 million barrels. On top of that, supplies at Cushing, Oklahoma, increased by 256,000 barrels last week. Thanks to these disappointing numbers, light crude reversed and slipped to the previously-broken support line. Will it encourage oil bulls to act? (charts courtesy of http://stockcharts.com).

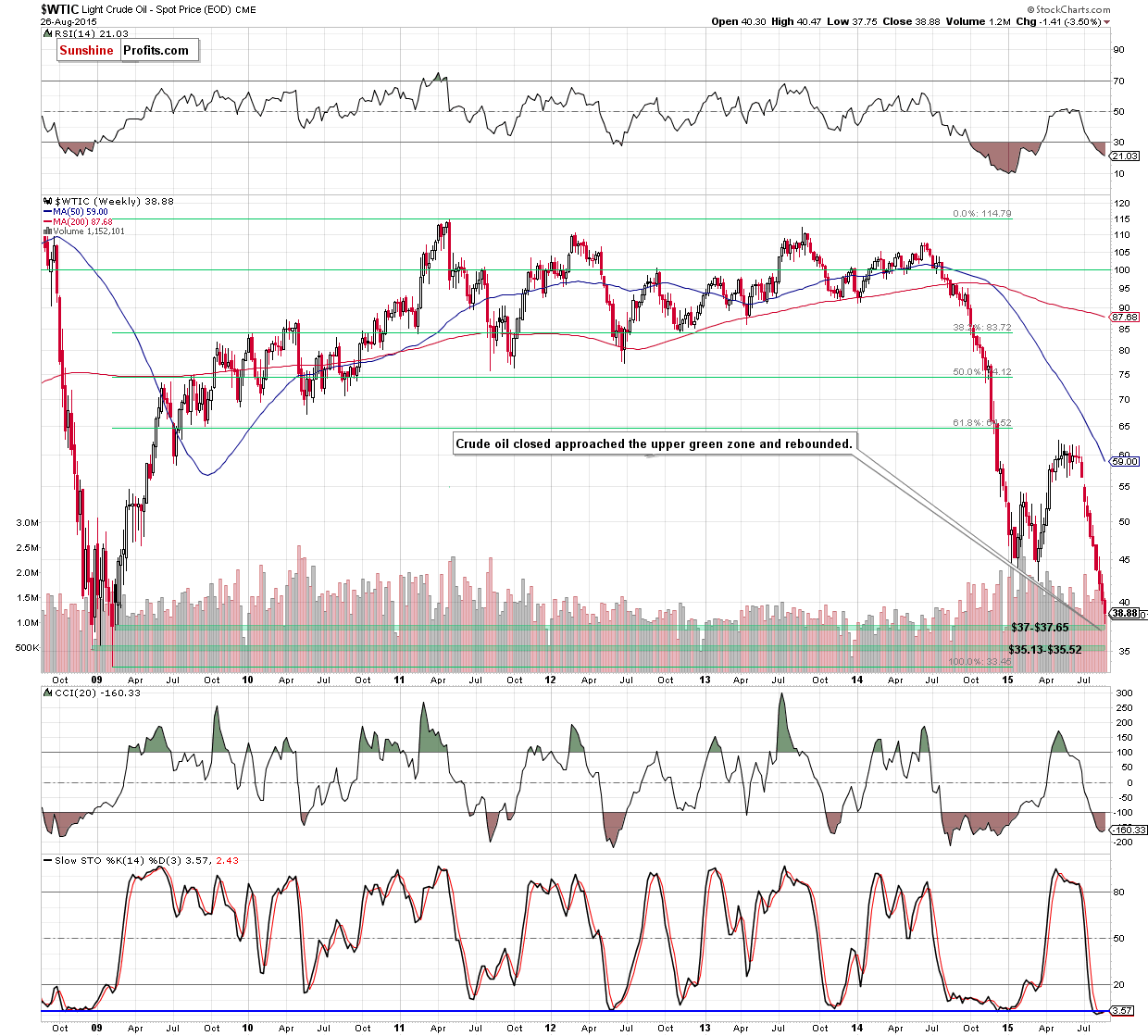

The situation in the medium term hasn’t changed much as crude oil is still trading in a narrow range between the green support zone and the barrier of $40.

What can we infer from the very short-term picture? Let’s examine the daily chart and find out.

In our previous Oil Trading Alert, we wrote the following:

(…) yesterday’s upswing materialized on smaller volume than Monday’s decline. Secondly, despite Tuesday’s increase, the commodity is still trading under the key technical level of $40 and also below the Mar low of $42.41. Thirdly (and the most importantly), the recent rebound is smaller than previous upswings (marked with blue), which suggests that oil bulls are not stronger than they were in previous weeks (…) and (…) lower values of crude oil are more likely than not.

Looking at the daily chart, we see that the situation developed in line with the above scenario and crude oil reversed, erasing over 75% of Tuesday’s rally. With this downswing light crude slipped to the previously-broken red and blue declining support lines, which suggests that we may see a rebound from here in the coming day – similarly to what we saw in the previous week.

Nevertheless, even if we see such price action (and an increase to around $40.80, where the blue resistance line is), we believe that as long as the commodity remains under the key technical level of $40, the blue and green resistance lines, the Mar low and there is no bigger upward move (bigger than previous upswings) downtrend remains in place, suggesting lower prices of the commodity.

Summing up, crude oil reversed and slipped to the red declining support line, which may trigger a small rebound in the coming day. Nevertheless, the technical picture of the commodity clearly shows that the downtrend remains in place, suggesting lower prices of the commodity in the coming days.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: bearish

LT outlook: mixed with bearish bias

Trading position (short-term; our opinion): Short positions with a stop-loss order at $45.32 and profit-take order at $35.72 are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts