Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Crude oil continues to slide and it even managed to decline below March 2015 low, so the key question is if oil is about to slide much further or is the final bottom for this decline being formed.

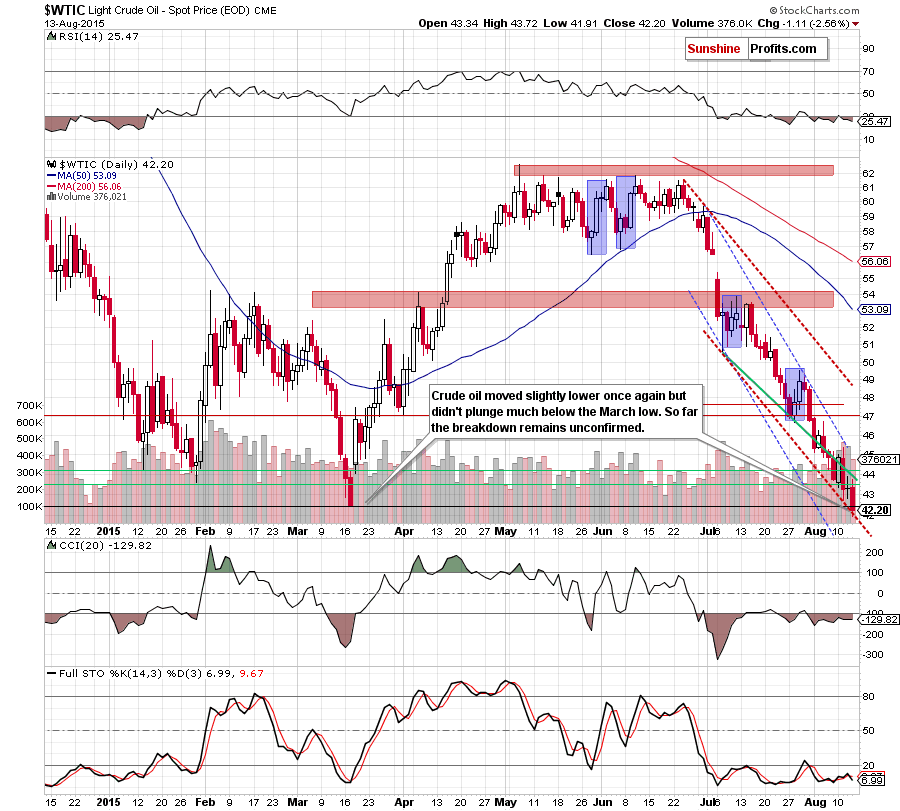

Our take is that the situation is still unclear and the risk of entering any position is simply too high. The below chart shows why (charts courtesy of http://stockcharts.com).

In yesterday’s alert we wrote the following:

At this point, it is worth noting that the above-mentioned support [red declining support line] intersects the support level based on the March low, which together could pause (or even stop) oil bears and further declines.

The above remains up-to-date, because the move below the March low was very insignificant (including today’s pre-market $0.30 decline) and there was no move below the declining red support line.

Even a small move below the March 2015 low might seem significant because this level is so significant, but we believe that waiting for this breakdown’s confirmation is necessary to decrease the risk of re-entering short positions and making the risk/reward ratio favorable (or we could see a combination of other bearish signals, but we don’t have them at this time).

Please consider the way crude oil declined in January 2015. Black gold declined sharply at first, but the final days (and weeks) of the decline were not sharp – crude oil declined slowly and the thing that was indeed sharp, was the corrective upswing that we saw in the final part of the month. We wouldn’t want to be holding short positions should something like that happened once again and the risk of such action is not negligible.

Summing up, crude oil moved once again lower but not low enough (and didn’t stay low for long enough) for us to say that the breakdown below the March low was verified. Consequently, in our opinion, the outlook for crude oil is not bearish enough to justify opening another short positions – at least not yet. We’re happy with the profits that we took off the table recently and we don’t want to risk losing capital before a trade is really justified from the risk/reward point of view. We will continue to monitor the market, look for another profitable trading opportunity and report to you accordingly.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed with bearish bias

LT outlook: mixed with bearish bias

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts