Trading position (short-term; our opinion): Short positions with a stop-loss order at $65.23 are justified from the risk/reward perspective.

Last week crude oil price declined by more than 6% and the move materialized on high volume, which suggests that the decline is not over. However, almost entire decline took place early last week, and we saw some strength before the week was over. Is the decline over or close to being over?

We don’t think so. In fact, the situation is quite similar to what happened in the early part of the 2014 slide. Let’s take a closer look (charts courtesy of http://stockcharts.com).

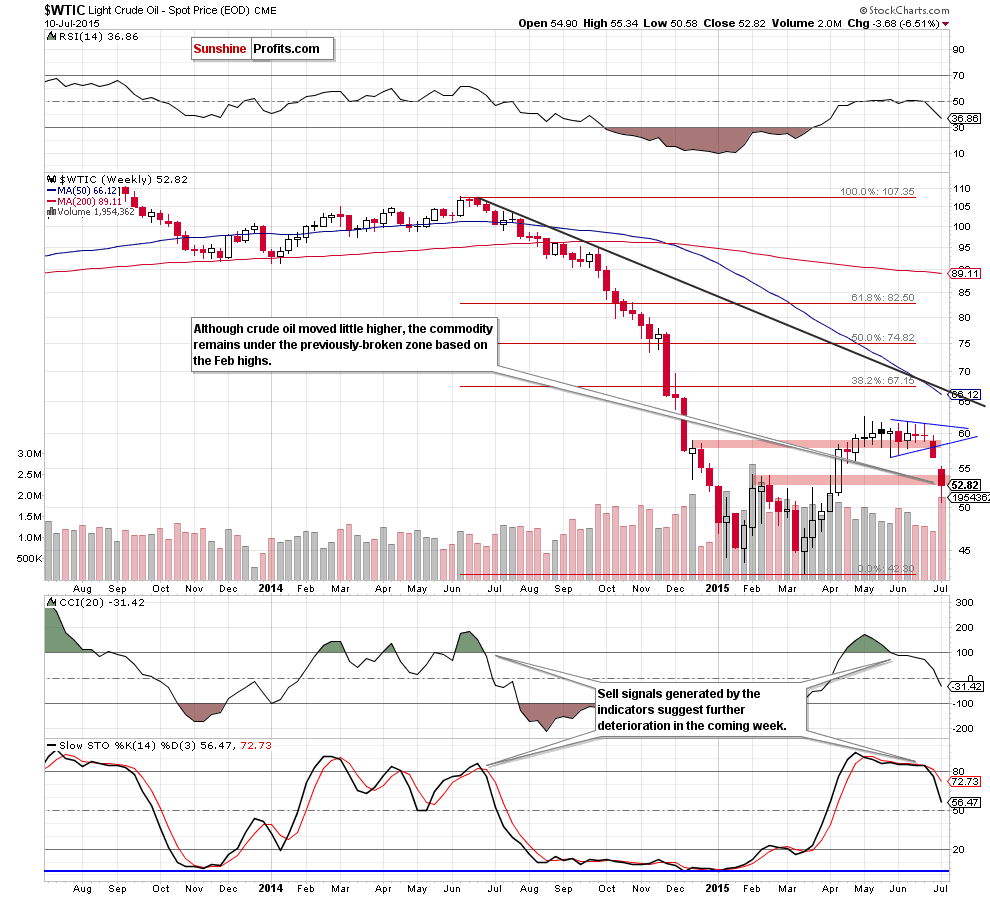

Both important indicators: CCI and Stochastic have recently flashed major sell signals. The sell signal from the Stochastic indicator was the most important one as it took place in the overbought territory (above 80) and this was very often the case at major tops in crude oil’s price. The sell signals were actually generated some time ago, but now we see that these moves were not accidental and that price is actually following them. Based on how crude oil performed when we previously saw these signals, it seems that the decline is just beginning – back in 2014, these signals were seen when crude oil was trading at more than $100 and the following decline continued for several months and cut oils price in half. While the following decline doesn’t have to cut crude oil’s price in half once again, it does seem that the current decline has only begun.

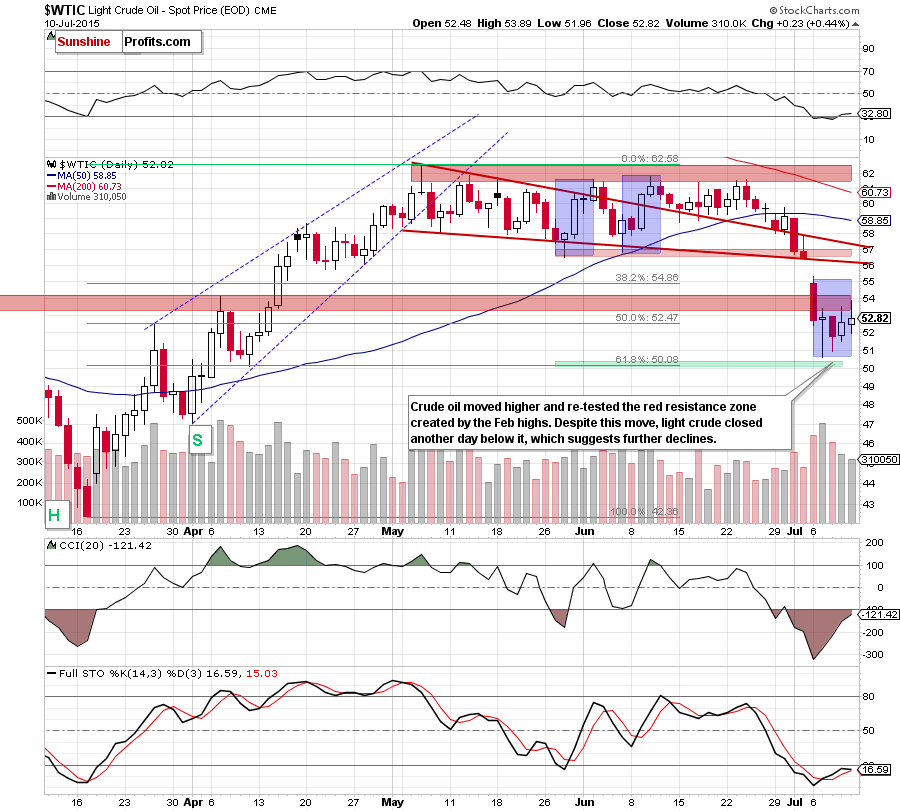

On the short-term chart we see that not much changed on the short-term picture as crude oil didn’t move above the previously-broken resistance zone. Moreover, the black gold moved higher on relatively low and declining volume. It seems that last week’s moves higher were just a counter-trend bounce, and not a beginning of another decline.

Consequently, we can summarize the situation today just like we did previously.

Summing up, in our opinion, short positions in crude oil are justified from the risk/reward perspective as crude oil verified the breakdown under the zone created by the Feb highs. Additionally, not only the long-term, but also short-term downward trend remains in place, suggesting lower values of the commodity in the coming days.

It seems that the profits from the already-sizable profits from the current short positions in crude oil will become even bigger in the future.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: bearish

LT outlook: bearish

Trading position (short-term; our opinion): Short positions with a stop-loss order at $65.23 are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts