Trading position (short-term; our opinion): Short positions with a stop-loss order at $65.23 are justified from the risk/reward perspective.

On Monday, crude oil lost 0.53% as worries over the situation in Yemen eased after the general secretary of the United Nations opened peace talks in Switzerland. In this environment, light crude re-tested the strength of the short-term support, but will it hold in the coming days?

Yesterday, general secretary of the United Nations opened peace talks in Geneva, calling for an immediate two-week ceasefire for Ramadan between Saudi Arabia and Iranian-backed rebels in Yemen. As is well known, oil investors are very sensitive to any geopolitical risky news involving Saudi Arabia (which is the world's largest exporter of crude), therefore, yesterday’s event pushed the price of crude oil lower, easing concerns over potential disruptions in crude oil’s transport (the Energy Information Administration ranked the Bab el-Mandab strait as the fourth-largest chokepoint in the world for global oil transport). Will we see lower values of the commodity in the coming days? (charts courtesy of http://stockcharts.com).

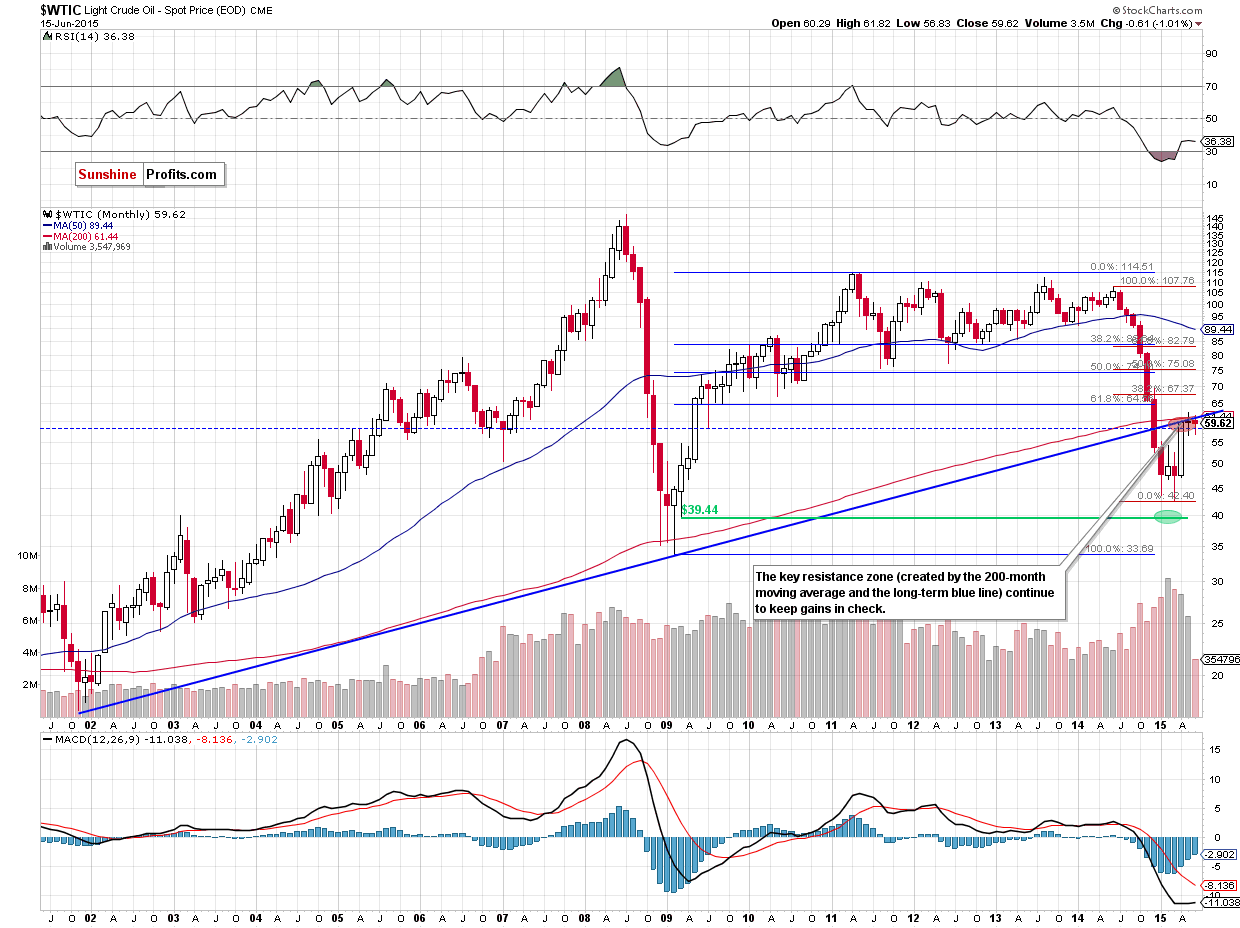

The long-term perspective remains unchanged as the key resistance zone (created by the long-term blue resistance line and the 200-month moving average) continues to keep gains in check. Therefore, we believe that as long as there is no successful breakout above this area further improvement is not likely to be seen and another attempt to move lower should not surprise us.

Having said that, let’s take a closer look at the very short-term picture of the commodity. What can we infer from it?

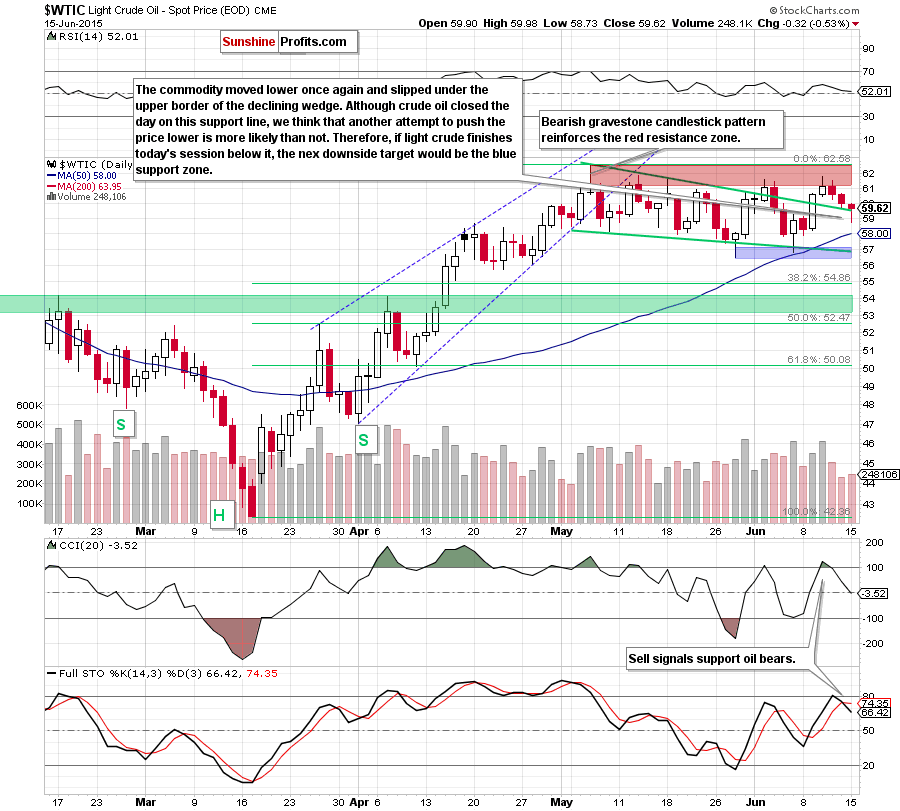

Looking at the daily chart we see that although crude oil slipped under the upper border of the declining wedge, the commodity reversed and closed the day on this support line. Although light crude could rebound from here (and re-test the red resistance zone once again), we think that the proximity to the key resistance zone in combination with the current position of the indicators (the CCI and Stochastic Oscillator generated sell signals) will trigger further deterioration in the coming days.

Please note that if the green support line is successfully broken (and we’ll see a daily lose below it), the next downside target for oil bears would be the 50-day moving average (currently at $58) or even the blue support zone ($56.50-$57.60).

Finishing today’s alert, we would like you to keep in mind what we wrote about crude oil priced in "other currencies" yesterday:

(…) although there were several attempts to break above the 38.2% Fibonacci retracement level (based on the entire Aug-Jan decline) they all failed, which resulted in a another decline to the green support line. Although this support triggered a rebound in the previous week, the current position of the indicators (the CCI and Stochastic Oscillator generated sell signals) suggests that further declines are just around the corner. At this point, it is worth noting that similar readings of these indicators have preceded declines in the past, which increases the probability of reversal especially if the ratio drops under its major support line at 2.59).

Summing up, crude oil closed the day on the green support line, which could trigger a small rebound from here later in the day. Nevertheless, we believe that as long as the red resistance area (reinforced by the 200-month moving average and the long-term blue line) keeps gains in check further improvement is not likely to be seen and another downswing is just around the corner.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: mixed with bearish bias

LT outlook: mixed with bearish bias

Trading position (short-term; our opinion): Short positions with a stop-loss order at $65.23 are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts