Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Monday crude oil lost 1.34% as ongoing concerns over global supply overshadowed support from the conflict in Yemen and a weaker greenback. In this environment, light crude slipped below its support line once again. Does it mean that we will see lower values of the commodity in the coming days?

Yesterday, crude oil moved higher after the market’s open supported by the escalation of fighting in Yemen between Saudi Arabia and Shiite-led Houthi rebels. Additionally, the USD Index extended last week’s losses, making crude oil more attractive for buyers holding other currencies, which pushed the commodity to an intraday high of $57.89.

Despite these supportive factors, the commodity reversed and declined as Saudi Arabia pledged to supply more oil to China if needed. These comments from top Saudi oil officials maintained the country's position of keeping production high and fueled worries over supply glut. As a result, light crude hit an intraday low of $56.52 and approached Friday’s low. How low could the commodity go in the coming days? (charts courtesy of http://stockcharts.com).

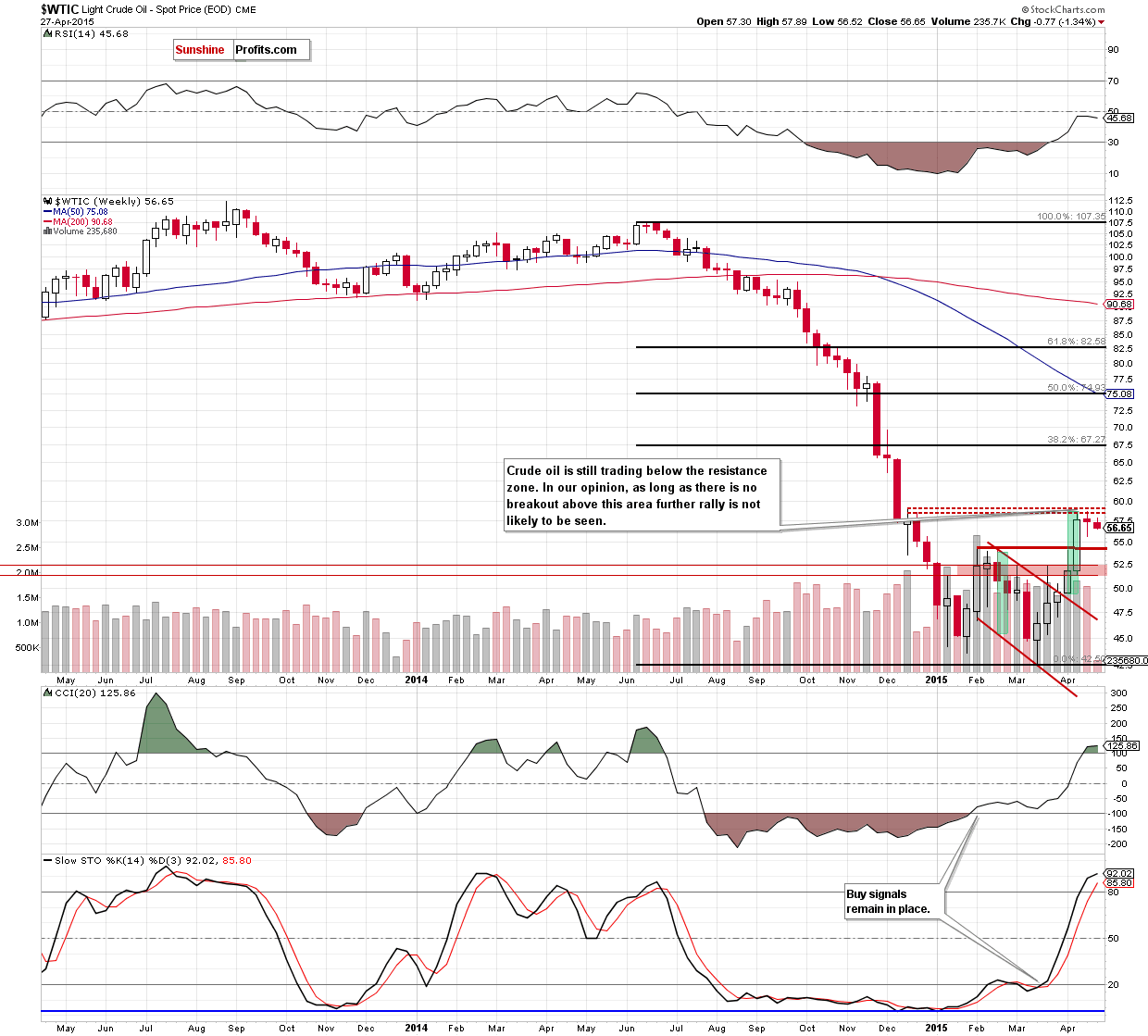

On the weekly chart, we see that although crude oil moved little lower, the situation in the medium term hasn’t changed much as the commodity is still trading in a narrow range between the last week’s low and the resistance zone created by the Dec 15 and Dec 22 highs. In our opinion, as long as there is n breakout above this area, further rally is not likely to be seen and further declines should not surprise us.

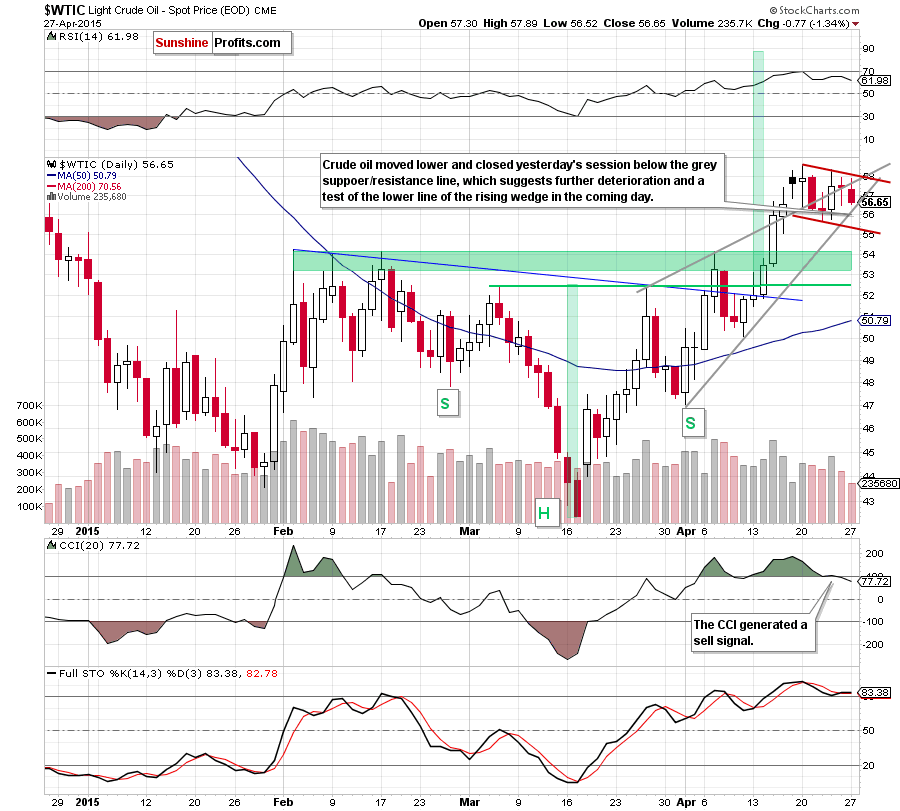

What can we infer from the daily chart? Let’s check.

As you see on the daily chart, although crude oil moved higher after the market’s open, the combination of the upper line of the rising wedge and the upper border of the very short-term declining trend channel stopped further improvement and triggered a pullback. As a result, light crude declined below $57 and approached Friday’s low.

Taking this fact into account and combining it with the proximity to the resistance zone marked on the weekly chart and sell signals generated by the CCI and RSI we think that the next move will be to the downside. Therefore, what we wrote in our previous Oil Trading Alert is up-to-date also today:

If this is the case, and light crude declines, the initial downside target would be around $56.20, where the lower border of the rising wedge is. At this point, it is also worth nothing that slightly below this line (currently around $55.33) is also the lower line of the very short-term declining trend channel. If this area withstands the selling pressure, we’ll see another upswing and an attempt to move higher. However, if currency bears manage to push crude oil lower, we’ll see a test of the green support zone based on the Feb highs in the coming week.

Summing up, crude oil closed the day below its key support/resistance line, which in combination with the current position of the indicators and the limited space for further growth suggests another attempt to move lower in the coming days.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment, but we will keep you informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts