Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

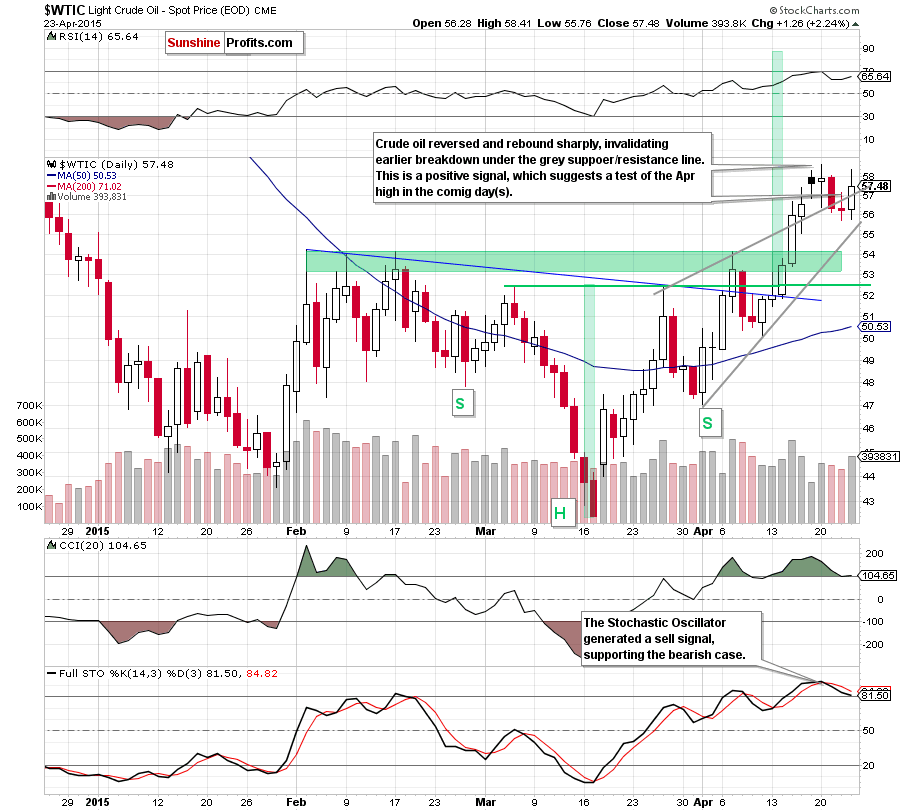

On Thursday, crude oil gained 2.24% as the combination of a weaker greenback and concerns over violence in the Middle East supported the price. As a result, light crude reversed and invalidated earlier breakdown under the support/resistance line. Is it enough to push the commodity to fresh 2015 highs?

Yesterday, the U.S. Department of Labor said that the number of jobless claims in the week ending April 18 increased by 1,000 to 295,000, missing analysts’ expectations for a 4,000 drop. Additionally, yesterday’s data showed that U.S. new home sales dropped 11.4% in March, also missing forecasts for a 5.3% decline. These disappointing numbers pushed the USD Index lower, making crude oil more attractive for buyers holding other currencies. On top of that, ongoing concerns over Middle East violence also supported the price and pushed it above $57 once again. In this way, light crude reversed and invalidated earlier breakdown, but will we see further rally? (charts courtesy of http://stockcharts.com).

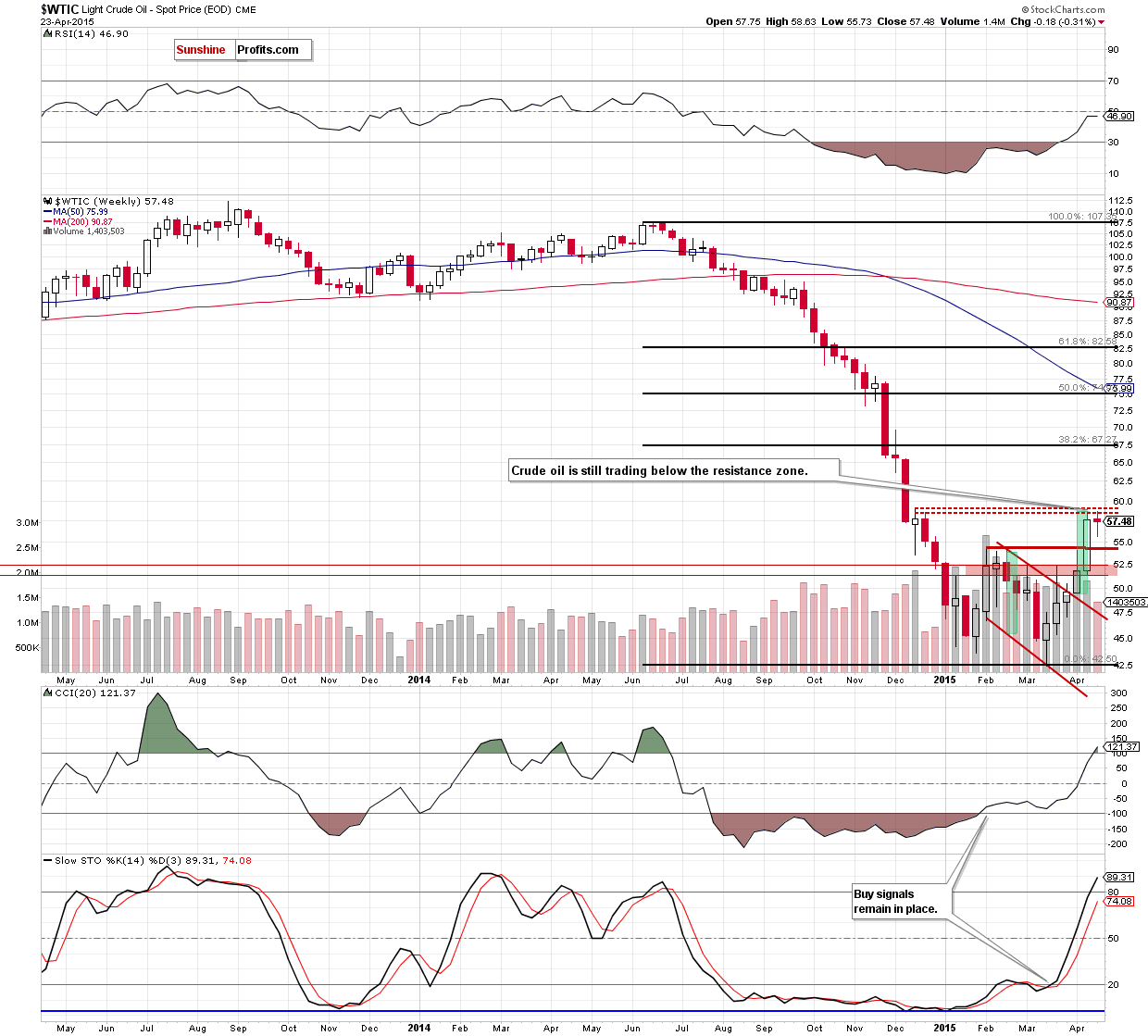

Looking at the weekly chart, we see that the situation in the medium term hasn’t changed much as the commodity is still trading under the resistance zone created by the Dec 15 and Dec 22 highs.

Will the very short-term picture give us more clues about future moves? Let’s examine the daily chart and find out.

From this perspective, we see that the proximity to the lower line of the rising wedge encouraged oil bulls to act and resulted in a sharp increase to an intraday high of $58.41. With this upward move light crude invalidated earlier breakdown below the upper border of the formation. This is a positive signal, which suggests a test of the Apr high in the coming day.

Nevertheless, despite this improvement, we should keep in minds that sell signals generated by the RSI and Stochastic Oscillator remain in place, supporting the bearish case. Additionally, the space for further rally seems limited as the resistance zone marked o the weekly chart is only $2 above the current price. These facts provide us with bearish implications and suggest that another pullback is just around the corner.

Summing up, crude oil invalidated the breakdown below the upper line of the rising wedge, which suggests further improvement and a test of the Apr high. Nevertheless, the current position of the indicators and the limited space for further growth suggest that the probability of reversal in the coming week is high.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment, but we will keep you informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts