Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Thursday, crude oil gained 1.04% as OPEC forecasts and a weaker greenback supported the price. As a result, light crude hit a fresh 2015 high and approached the resistance levels. Will the commodity test them in the coming week?

Yesterday, the U.S. Department of Labor reported that the initial jobless claims in the week ending April 11 increased by 12,000 to 294,000, missing analysts’ expectations for a drop by 2,000 to 280,000. Additionally, the U.S. Commerce Department showed that the number of building permits issued in March dropped by 5.7% , while U.S. housing starts rose by 2.0% in the previous month also missing expectations for an increase of 15.9%. Thanks to these disappointing numbers, the USD Index extended declines and dropped below 98, breaking below the medium-term support line and making crude oil more attractive for buyers holding other currencies.

Additionally, OPEC said in its monthly market report that U.S. oil supply would increase to 13.65 million barrels per day through the second quarter before flattening for the remainder of the year. Thanks to these circumstances, light crude extended gains and climbed to an intraday high of $57.42. Will we see further rally in the coming week? (charts courtesy of http://stockcharts.com).

In our previous Oil Trading Alert, we wrote the following:

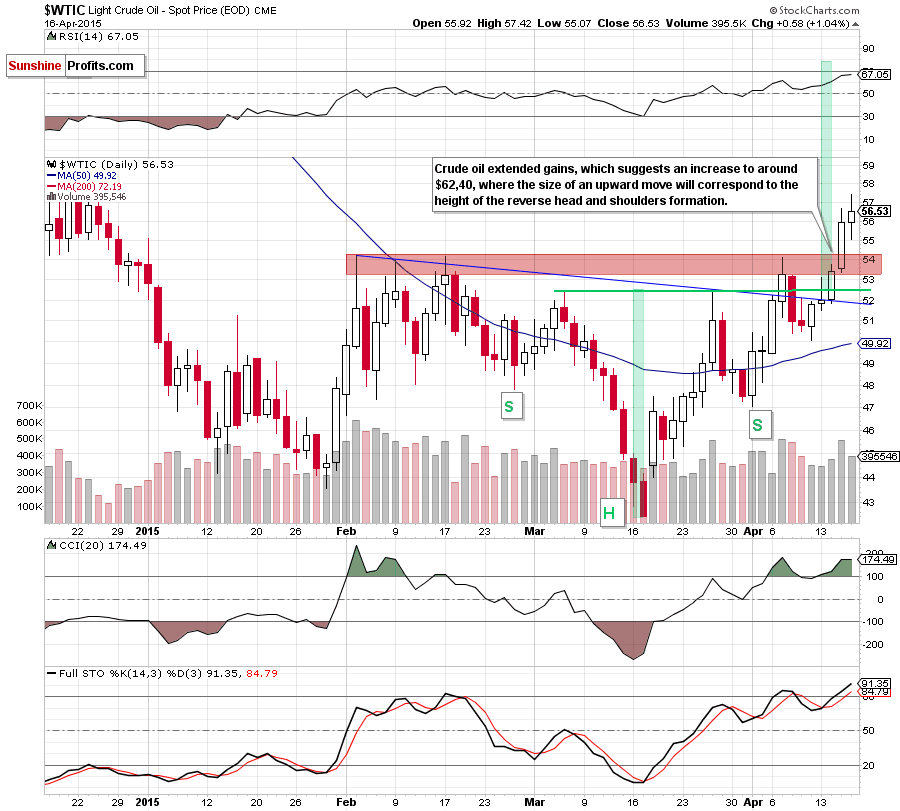

(…) The breakout above the red resistance zone (…) is a very bullish event as the red resistance zone is also the neck level of the reverse head-and-shoulder pattern. The implication is that crude oil is likely to move much higher – according to the target marked with green rectangle.

Looking at the daily chart we see that crude oil moved lower after the market’s open, but then the commodity reversed and climbed to a fresh 2015 high. Although this is a positive signal, we should keep in mind that the space for further rally might be limited by the solid resistance zone around the level of $60.

Let’s take a closer look at the charts below to see it more clearly.

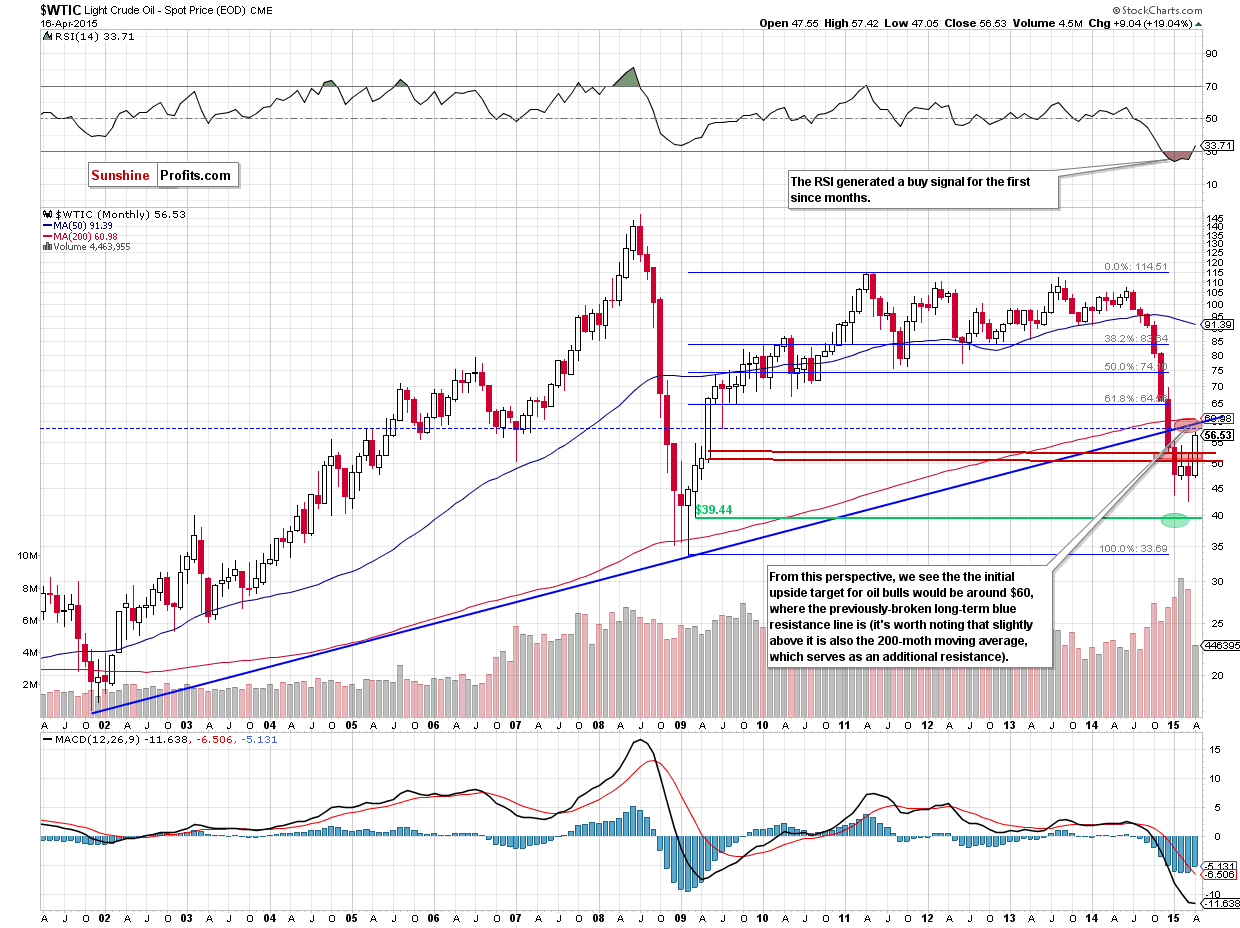

From the long-term perspective, we see that the above-mentioned resistance zone is created by the 200-month moving average (that stopped major declines 2 times: in 2001 and 2008/2009) and the very long-term rising resistance line based on 2001 and 2009 bottoms.

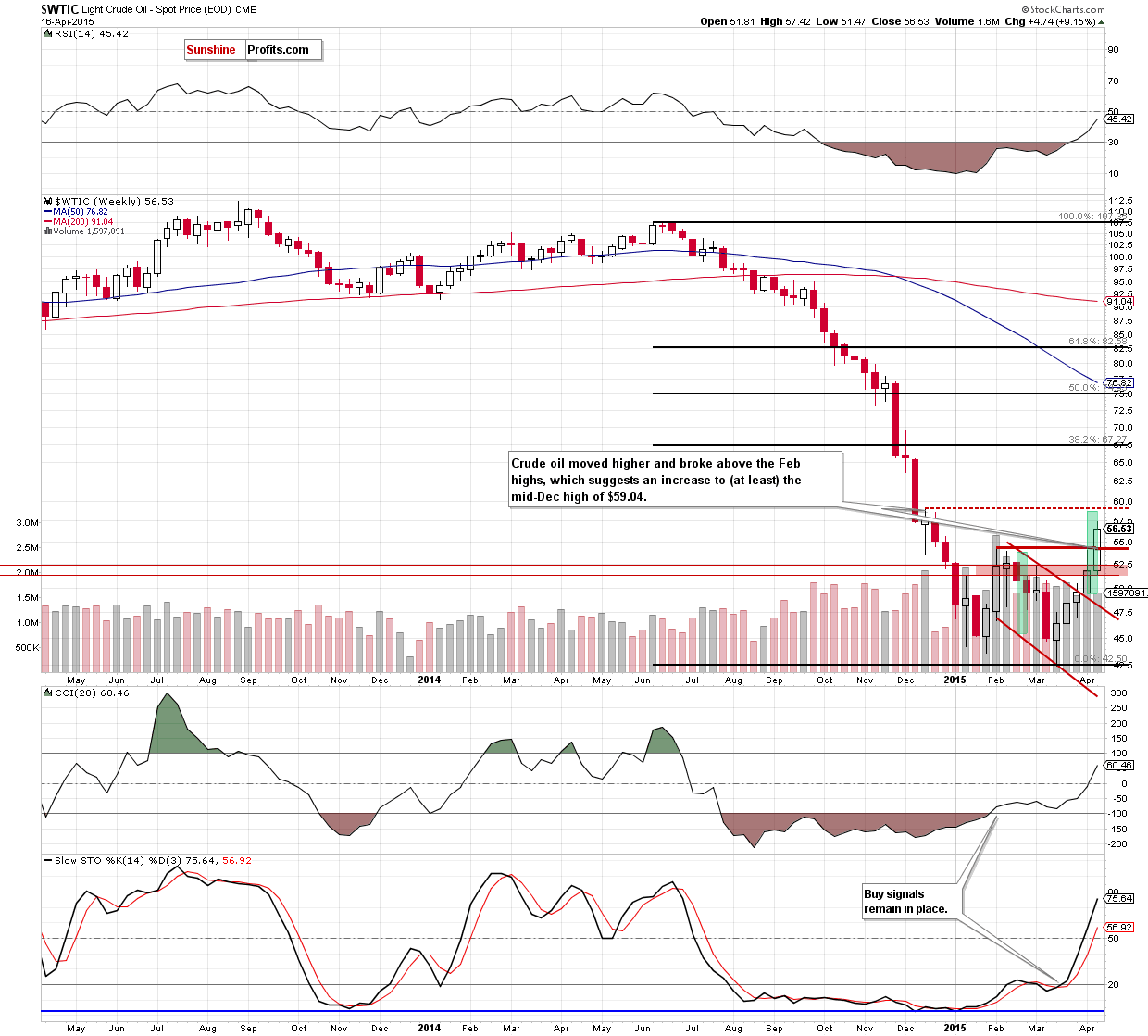

Additionally, in this area the size of the upward move will correspond to the height of the declining trend channel (marked on the weekly chart below), which could encourage day traders to take profits and trigger a pullback (please note that slightly lower is also the mid-Dec high of $59.04) in the coming days.

Connecting the dots, the combination of the above is just a few dollars higher, so the potential size of the additional upswing before we see a correction seems limited.

What happens after crude oil approaches the $60 level where the above-mentioned resistance levels coincide? We believe the best answer to this question will be a quote from our previous commentary:

(…) We’ll either see a breakout right away (less likely) or a correction that will quite likely take oil back to the recently broken 2015 high. In case of the former we’ll have much lower risk associated with long positions. In case of the latter we’ll have both: lower risk (if the correction is accompanied by low volume) and greater size of the potential rally. That’s when we plan to enter full long positions.

Summing up, the outlook for the crude oil market improved significantly based on Wednesday’s breakout, but it seems that waiting for a likely pullback before entering long positions is a good idea. Taking into account the proximity to the resistance zone and the size of volume that accompanied yesterday’s increase (it was much smaller than day before), we still believe that crude oil will correct shortly. This small move lower should at the same time lower the risk and increase the potential profits, thus greatly improving the risk/reward ratio. We’ll keep you – our subscribers – informed.

Very short-term outlook: bullish

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment, but we will keep you informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts