Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Monday, crude oil extended gains as Friday’s Baker Hughes report continued to weigh. The current situation in Yemen and speculations over China’s stimulus supported the commodity as well. Despite these factors, light crude gave up gains and declined, which resulted in a drop below its major resistance line. Will we finally see a comeback above it?

Friday’s Baker Hughes report (which showed that the number of rigs drilling for oil in the U.S. has fallen for 18 consecutive weeks) and ongoing fights in Yemen between Iranian-backed, Shiite-led Houthi rebels and Sunni-led troops from Saudi Arabia continued to boost the price of crude oil. Additionally, official data showed that China's crude oil imports were up 14 percent in March versus a year ago, which together pushed the commodity to an intraday high of $53.10.

Despite this improvement, light crude reversed and declined, closing the day below its key resistance line. Will we finally see a comeback above it (charts courtesy of http://stockcharts.com).

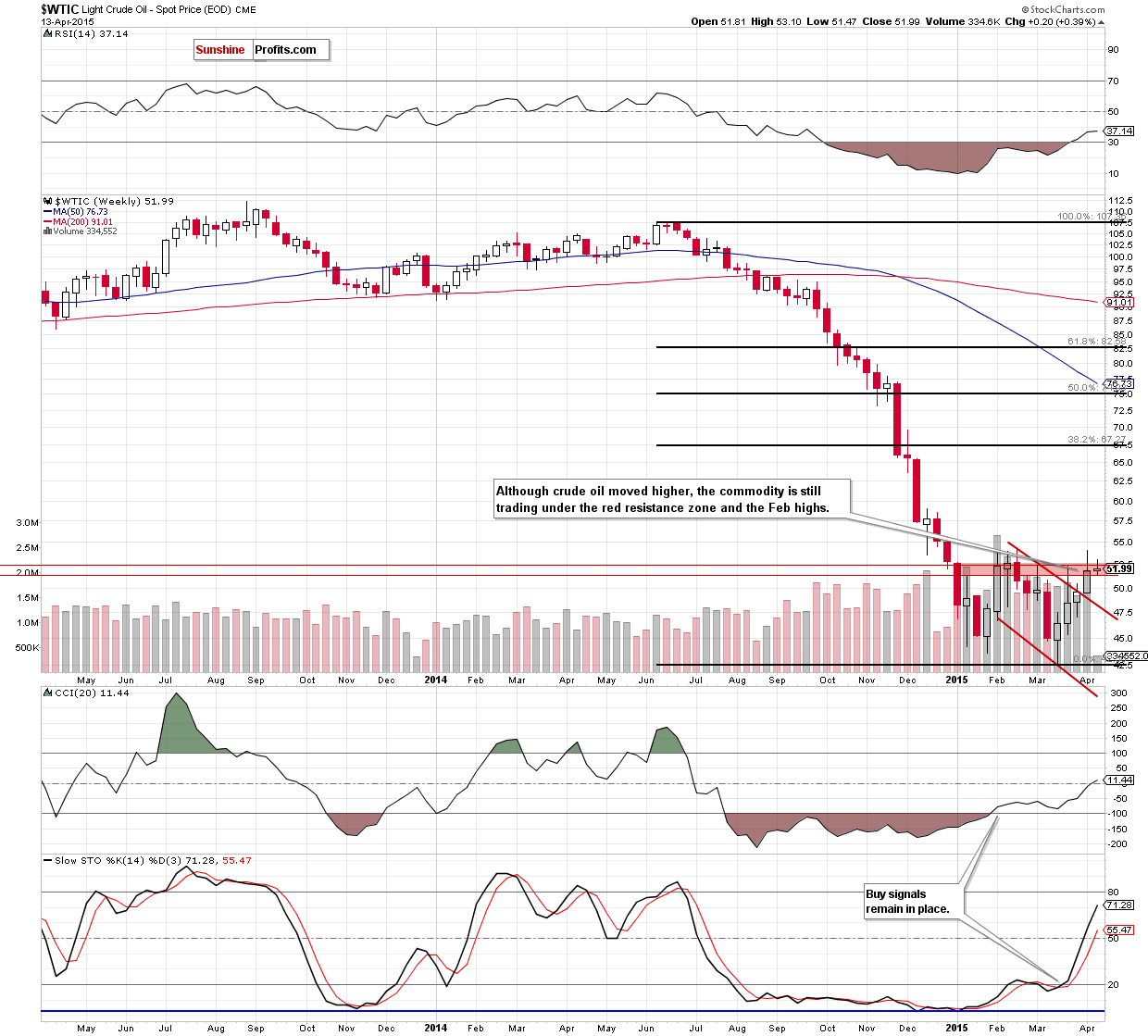

On the weekly chart, we see that although crude oil moved little higher, the commodity still remains under the Feb highs and the 76.4% Fibonacci retracement level. Therefore, what we wrote yesterday is up-to-date:

(…) as long as there is no breakout above this key resistance zone further improvement is not likely and another pullback can’t be ruled out. Please note that if light crude moves lower, the initial downside target would be the last weeks’ low (at $49.47) or even the previously-broken upper line of the declining trend channel (around $49) in the coming week.

Has anything changed from the very short-term perspective? Let’s examine the daily chart and find out.

In our previous Oil Trading Alert, we wrote the following:

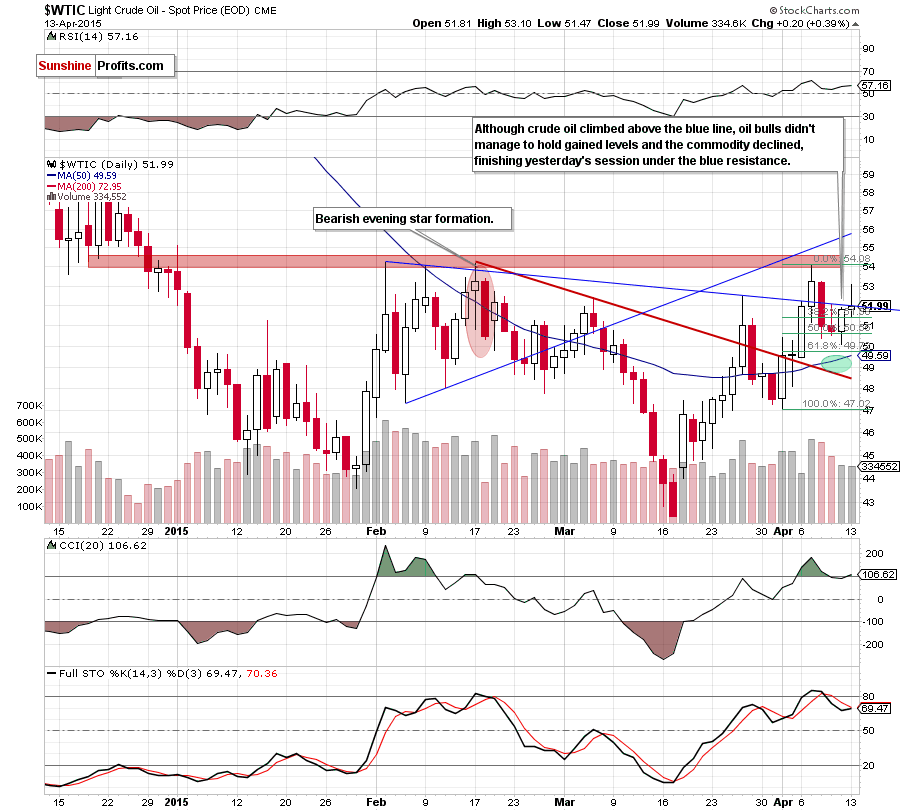

(…) taking into account the fact that the commodity invalidated the breakdown under the 50% Fibonacci retracement level (based on the Apr rally), it seems that oil bulls might try to push light crude higher once again. If this is the case, and crude oil invalidates the breakdown under the blue line, we might see an increase to around $53.23, where the Apr 8 high is.

Looking at the daily chart, we see that oil bulls pushed crude oil higher as we expected. With this upswing, light crude came back above the blue line, but as it turned out in the following hours this improvement was only temporary. As a result, the commodity reversed and declined, finishing yesterday’s session slightly below its key resistance.

This is a negative signal, which suggests further deterioration and a test of Friday’s low of $50.08 in the coming days (especially if the resistance zone marked on the weekly chart withstands the buying pressure).

Nevertheless, taking into account the fact that crude oil remains above the 38.2% Fibonacci retracement (based on Apr rally), it seems that oil bulls will try to push the commodity higher in the coming day. If this is the case, the initial upside target would be around $53.10-$53.23, where the recent highs are.

Summing up, crude oil climbed above the blue resistance line, but then reversed and closed the day slightly below it, which suggests further deterioration. However, it seems that as long as the commodity remains above the level of $50 oil bulls will try to break above this resistance.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment, but we will keep you informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts