Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Wednesday, crude oil lost 4.26% as EIA weekly report showed the largest weekly build in domestic oil inventories since 2001. In response to this news, light crude reversed and invalidated earlier breakouts above resistance lines. What does it mean for the commodity?

Yesterday, the Energy Information Administration reported that U.S. crude oil inventories increased by 10.95 million barrels for the week that ended April 3, more than tripling its expected count of 3.28 million (please note that total U.S. crude oil inventories stood now at 482.4 million barrels as of last week, which is the highest level in at least 80 years). The report also showed that gasoline inventories increased by 817,000 barrels, missing expectations for a drop of 1.1 million, while distillate stockpiles fell by 250,000 barrels.

This bearish report fueled concerns that the U.S. will reach full storage capacity before the end of May, which could put further downward pressure on crude oil prices. As a result, light crude reversed and declined sharply, invalidating earlier important breakouts. Is the recent rally over? (charts courtesy of http://stockcharts.com).

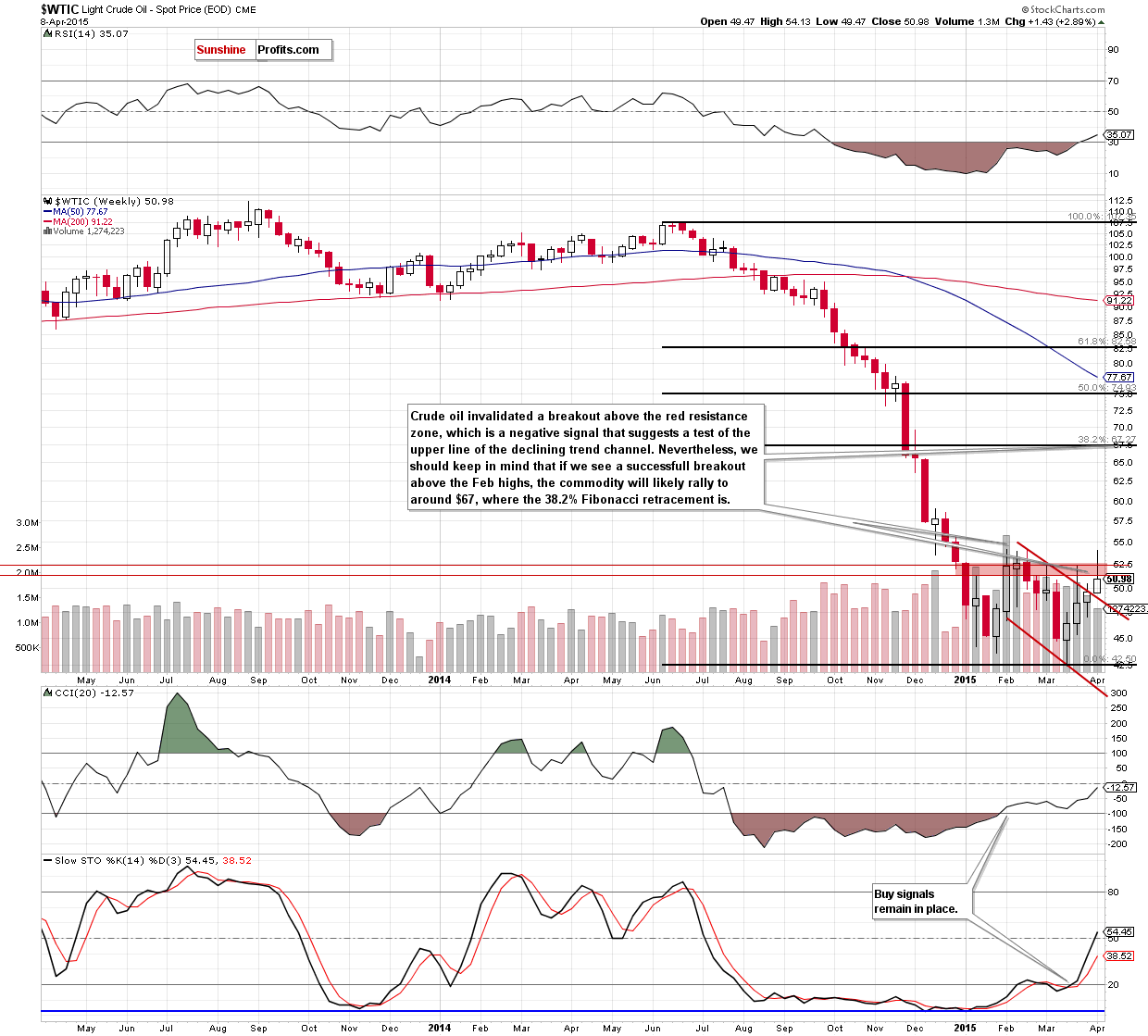

The first thing that catches the eye on the above chart is an invalidation of a breakout above the red resistance zone (created by the 76.4% and 78.6% Fibonacci retracement levels). This is a negative signal, which suggests a test of this week’s low or even the previously-broken upper line of the declining trend channel in the coming week.

How did this decline affect the very short-term picture? Let’s examine the daily chart and find out.

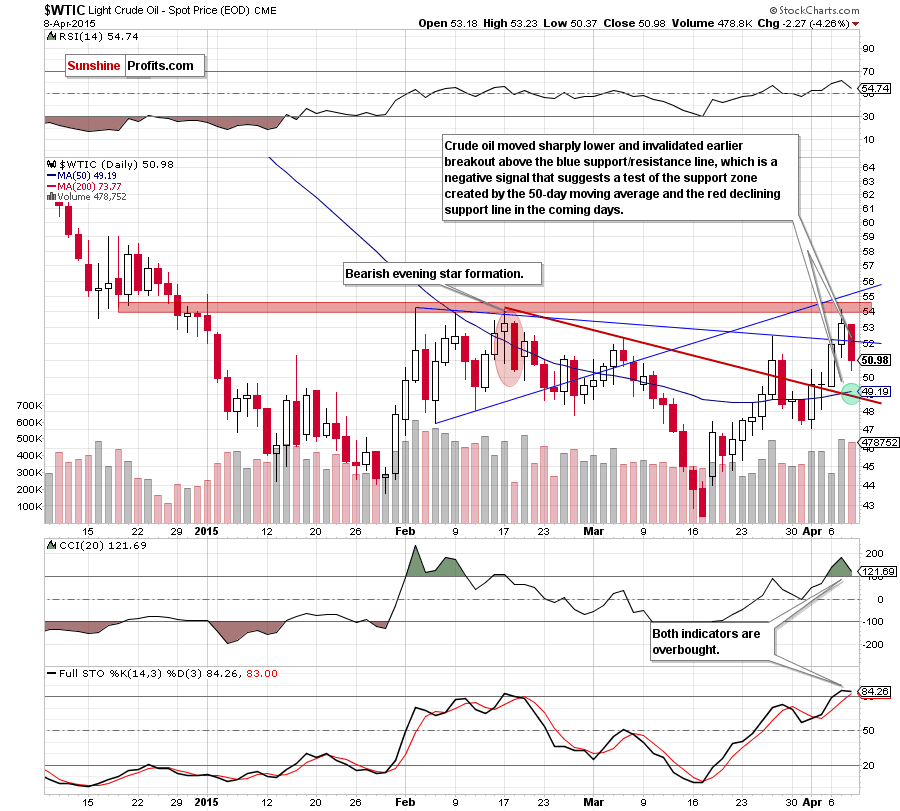

From this perspective, we see that yesterday’s downswing invalidated earlier breakout above the blue support/resistance line, which is a negative sign that suggests test of the support zone (marked with green) created by the 50-day moving average and the previously-broken red declining support line in the coming days (around $49.20).

Additionally, the size of volume that accompanied yesterday’s decline was quite big (compared to what we saw during recent price moves), which suggests that another downswing might be just around the corner (especially when we factor in the current position of the indicators – the CCI and Stochastic Oscillator are overbought, which could translate to sell signals in the near future).

Nevertheless, before we see such price action, the commodity could move little higher and verified yesterday’s breakdown under the blue resistance line because crude oil reached the 50% Fibonacci retracement level (based on the April’s rally), which serves as the support.

Before we summarize today’s Oil Trading Alert, we would like you to remember what we wrote yesterday:

(…) In our opinion, until crude oil moves above the Feb 2015 high, the outlook will not become bullish enough to justify opening long positions in crude oil.

Summing up, crude oil moved sharply lower and invalidated earlier breakout above the red resistance zone (created by the Fibonacci retracement levels and marked on the weekly chart) and the blue support/resistance line, which is a negative sign that suggests further deterioration. However, taking into account the fact that the commodity declined to the 50% Fibonacci retracement (based on the April’s rally), we could see a rebound to the above-mentioned blue line later in the day.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment, but we will keep you informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts