Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Friday, crude oil lost 4.11% as the combination of a stronger greenback and the International Energy Agency commentary weighed on investors’ sentiment. In this environment, light crude dropped below the Feb low and other important support levels. Is it time foe a test of the Jan lows?

Although Friday’s data showed that producer prices fell 0.5% last month (missing expectations for a 0.3% gain) and core producer prices (without food, energy and trade) dropped by 0.5% in February (missing forecasts of a 0.1% rise), while the University of Michigan’s consumer sentiment index fell to 91.2 in March, the USD Index increased to an intraday high of 100.78, making crude oil less attractive for buyers holding other currencies.

Also on Friday, Baker Hughes reported that the number of oil and gas rigs for the week ending Mar. 6 declined by 67 to 1,125, which is nearly 600 rigs less compared to the last year at this time (it’s also worth noting that weekly rig counts dropped to their lowest level in four years ). Despite this drop, the price of crude oil didn’t move higher, because domestic production continues to hover near record-highs of 9.0 million per day, which is a bearish sign.

Additionally, the IEA said that although oil output declined in February among OPEC members, the global supply still rose by 1.3 million barrels per day year-on-year, to an estimated 94 million barrels per day in February. The uptick is due to a 1.4 million barrel-per-day rise among non-OPEC nations, led by the United States. In this environment, crude oil moved sharply lower, breaking below the Feb low and other support levels. What does it mean for the commodity? (charts courtesy of http://stockcharts.com).

Quoting our previous Oil Trading Alert:

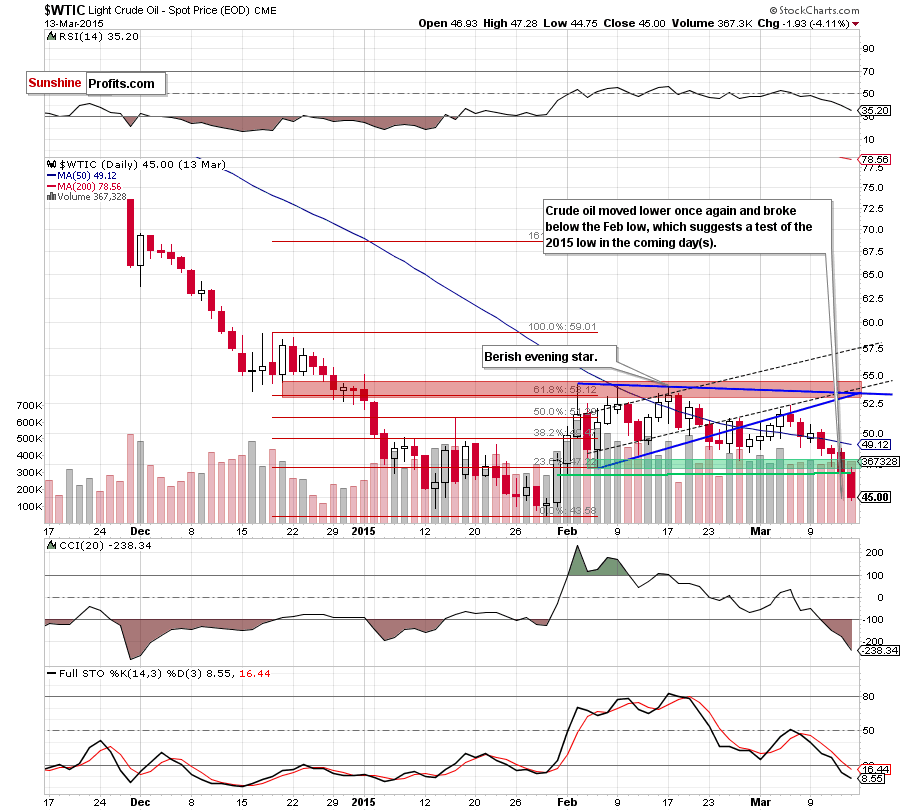

(…) oil bulls didn’t manage to push the commodity above the previously-broken 50-day moving average, indicating their weakness. As a result, light crude reversed and dropped (…) approaching the Feb low of $46.67. What’s next? If this area (…) is broken, the next downside target for oil bears would be around $43.58-$44.31, where the 2015 lows are. (…) From the daily perspective, we see that the sell signal generated by the Stochastic Oscillator remains in place, supporting the bearish case.

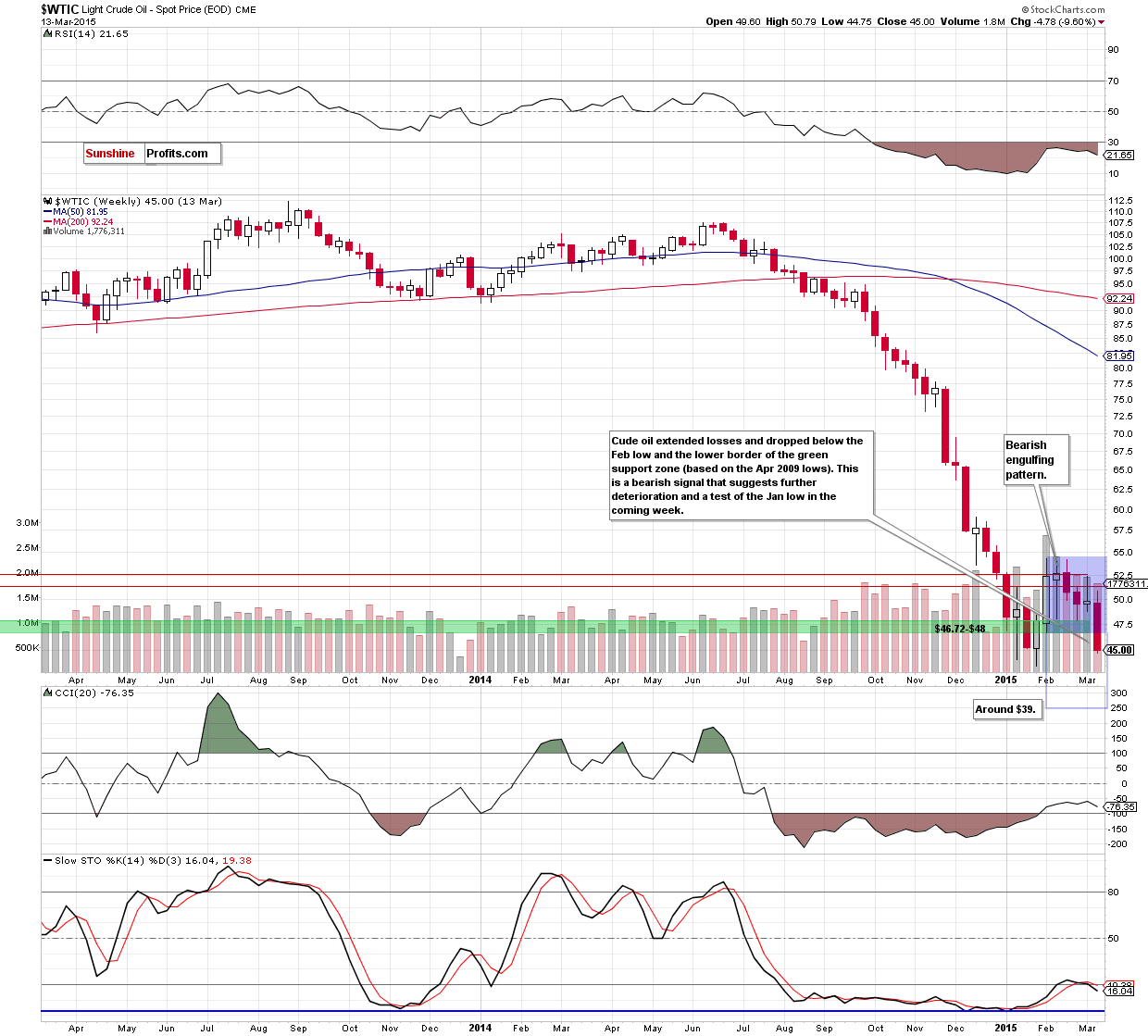

Looking at the daily chart, we see that crude oil extended losses and broke below the above-mentioned support level, accelerating further deterioration. With this downswing light crude also declined below the lower border of the green support zone based on the Apr 2009 lows, which is a strong negative signal that suggests a test of the Jan low.

Before we summarize today’s Oil Trading Alert, we would like to draw your attention to the breakdown under the lower border of the consolidation marked on the weekly chart. Taking this bearish event into account, it seems that we could see a fresh 2015 low around $39, where the size of the downward move will correspond to the height of the formation. Nevertheless, this scenario will be likely only if oil bulls won’t be able to hold the support area around $43.58-$44.31.

Summing up, the most important event of Friday’s session was the breakdown under the Feb low and the lower border of the support zone created by the Apr 2009 lows. In our opinion, this is a strong bearish signal that suggests further deterioration and a test of the Jan low in the coming day(s).

Very short-term outlook: bearish

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment, but we will keep you informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts