Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Wednesday, crude oil lost 0.70% as EIA weekly report weighed on the price. Thanks to another build in domestic inventories light crude extended losses and slipped to the Apr 2009 lows. North or south from here?

Yesterday, the U.S. Energy Information Administration showed that domestic crude inventories increased by 4.5 million barrels last week and reached almost 490 million, in a ninth straight week of record builds. On top of that, the report also showed that stockpiles in Cushing, Oklahoma rose more than 2 million barrels, which weighed on investors’ sentiment and pushed crude oil to an intraday low $47.33. Although light crude rebounded slightly later in the day, the commodity still remains very close to the support zone. Will it encourage oil bulls to act in the coming days? (charts courtesy of http://stockcharts.com).

Yesterday, we wrote the following:

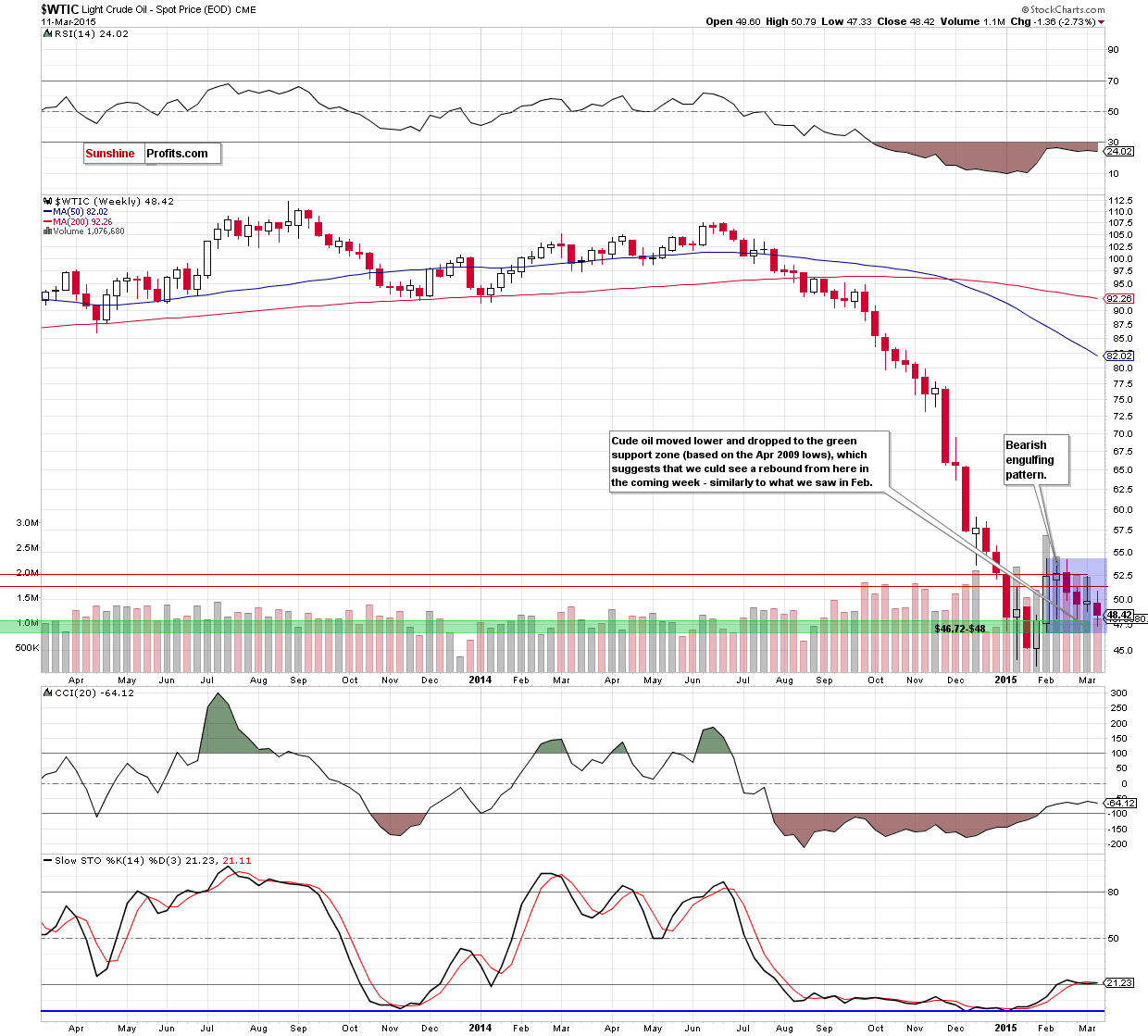

(…) we could see another test of the green support zone (based on the Apr 2009 lows) in the coming week – similarly to what we saw at the end of the previous month.

Looking at the weekly chart, we see that the situation developed in line with the above-mentioned scenario and crude oil moved lower, reaching the green support zone created by the Apr 2009 lows. As you see on the above chart, in previous cases, this support area was strong enough to stop further deterioration and trigger a rebound, which suggests that we could see a similar price action n the coming day(s).

Are there any short-term factors that could support (or hinder) this scenario? Let’s check.

Quoting our previous Oil Trading Alert:

(…) crude oil dropped under the 50-day moving average and approached the green support zone created by the Feb 5 and Feb 11 lows. (…) it seems that the medium-term picture in combination with the sell signal generated by the Stochastic Oscillator will encourage oil bears to act once again. If this is the case, light crude will move lower and test the support area around $47.36-$48.05 in the coming day(s).

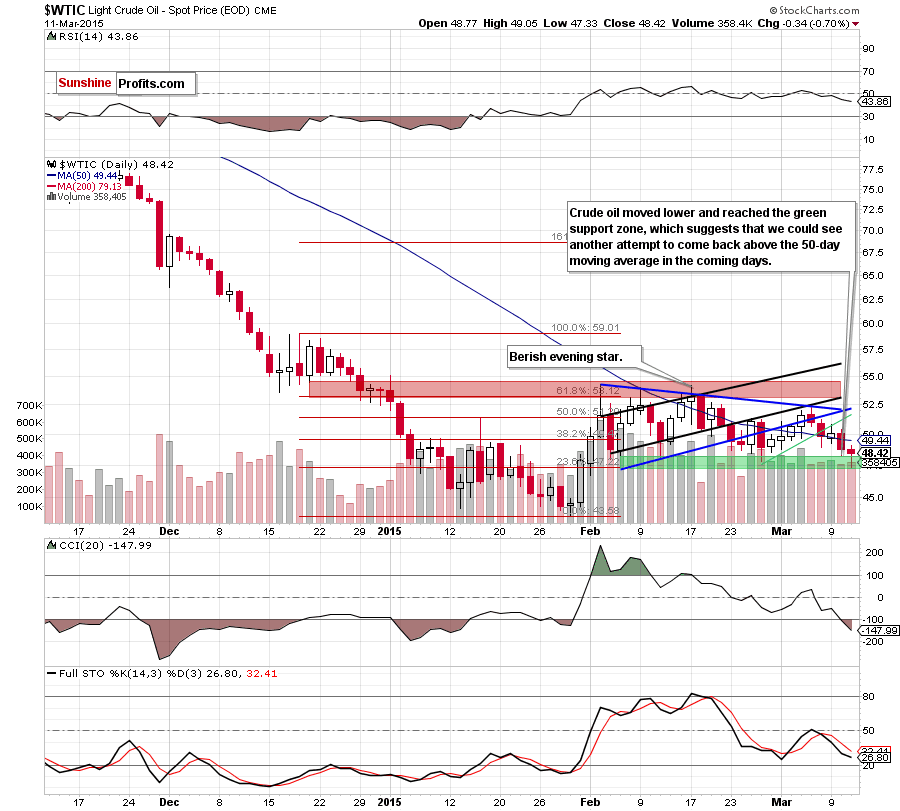

From today’s point of view, we see that oil bears pushed the commodity lower as we expected. With yesterday’s downswing light crude tested the lower border of the above-mentioned support zone, hitting an intraday low of $47.33. Although the commodity rebounded slightly from here, crude oil is still trading very close to the mid-Feb lows, which suggests that another test of these levels should not surprise us.

If this area withstands the selling pressure, we’ll likely see an attempt to come back above the previously-broken 50-day moving average in the coming days. However, if it is broken, the next downside target for oil bears would be around $43.58-$44.31, where the 2015 lows are.

In our opinion, the situation in the very short term will improve if we see an invalidation of the breakdown under the borders of the blue triangle. Such improvement would open oil bulls the way to the red resistance zone created by the Dec lows, the 61.8% Fibonacci retracement and the Feb highs. However, it seems to us that until this time short-lived upswings and downswing will be in play.

Summing up, crude oil moved lower and tested the green support zone. Although the commodity rebounded slightly, it seems that as long as there is no comeback above he previously-broken 50-day moving average another test of the area around $47.36-$48.05 should not surprise us.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment, but we will keep you informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts