Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Although Saudi Arabian oil minister commentary and attacks in Libya supported the price after the market’s open, the commodity reversed and declined as a stronger greenback pushed crude oil lower. As a result, light crude lost 1.22% and slipped below its important support line. Will we see further deterioration in the coming days?

Yesterday, Saudi Arabian oil minister Ali al-Naimi said that he expects prices to stabilize following a prolonged period of volatility that we saw last year, which improved oil investors‘ sentiment. Additionally, news that Islamic State militants have forced the closure of nearly a dozen oil fields in Libya over the last week supported the price as well. Thanks to these circumstances, light crude moved higher after the matket‘s open and hit an intraday hgh of $52.40. Despite his improvement, the commodity reversed later in the day. The reason? In the recent days, crude oil has moved higher in tune with the USD Index rally. Nevertheless, from today’s point of view, it seems that this positive correlation is over as yesterday’s fresh highs in the index pushed the commodity lower, which resulted in another drop below the lower border of the triangle. What does it mean for the commodity? (charts courtesy of http://stockcharts.com).

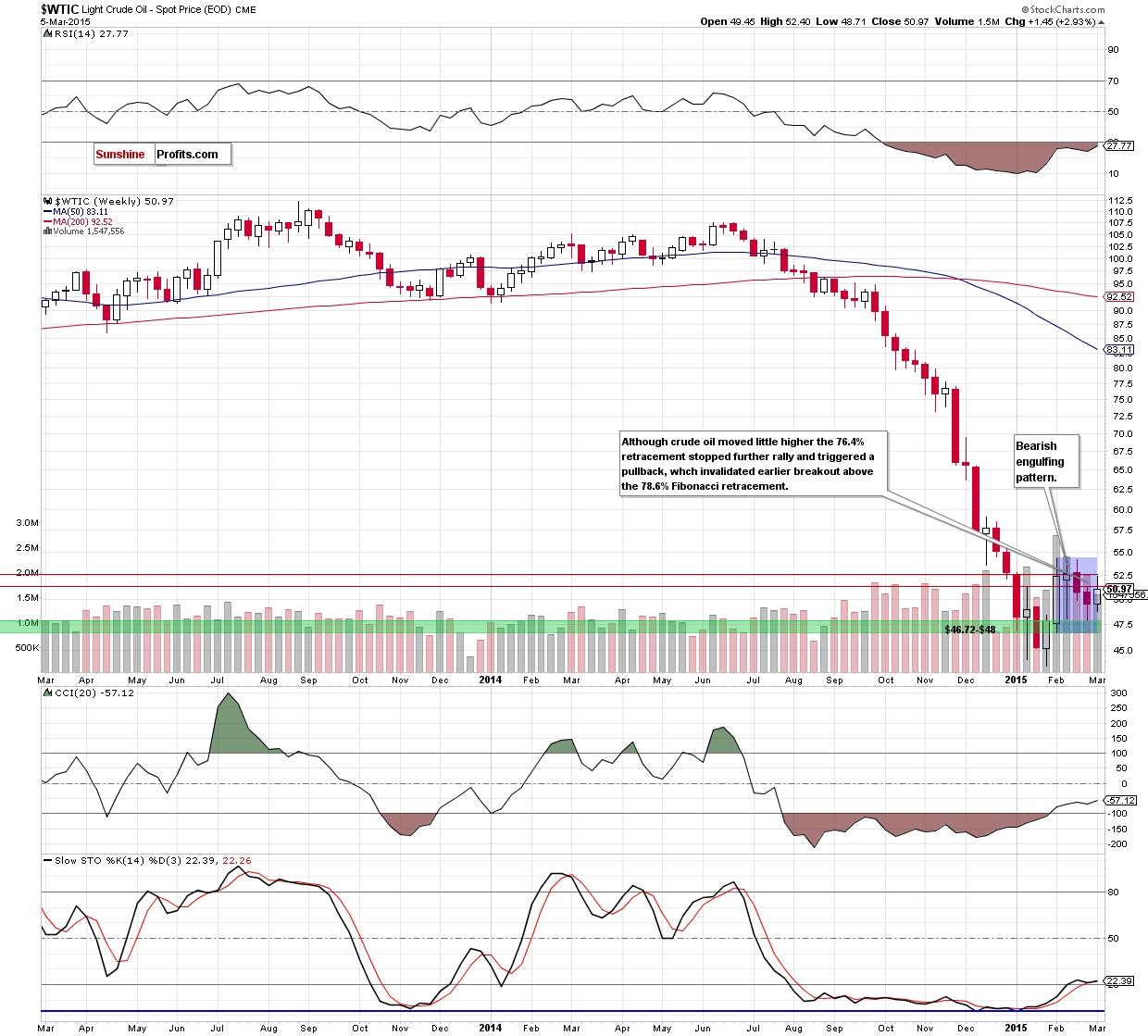

From the medium-term perspective, we see that although crude oil extended gains and climbed to the 76.4% retracement level, this resistance withstood the buying pressure, which resulted in a pullback. With this downswing, light crude invalidated earlier breakout above the 78.6% Fibonacci retracement, which is a negative signal that suggests further deterioration.

How low could the commodity go? Let’s examine the daily chart and look for an answer to this question.

In our previous Oil Trading Alert, we wrote the following:

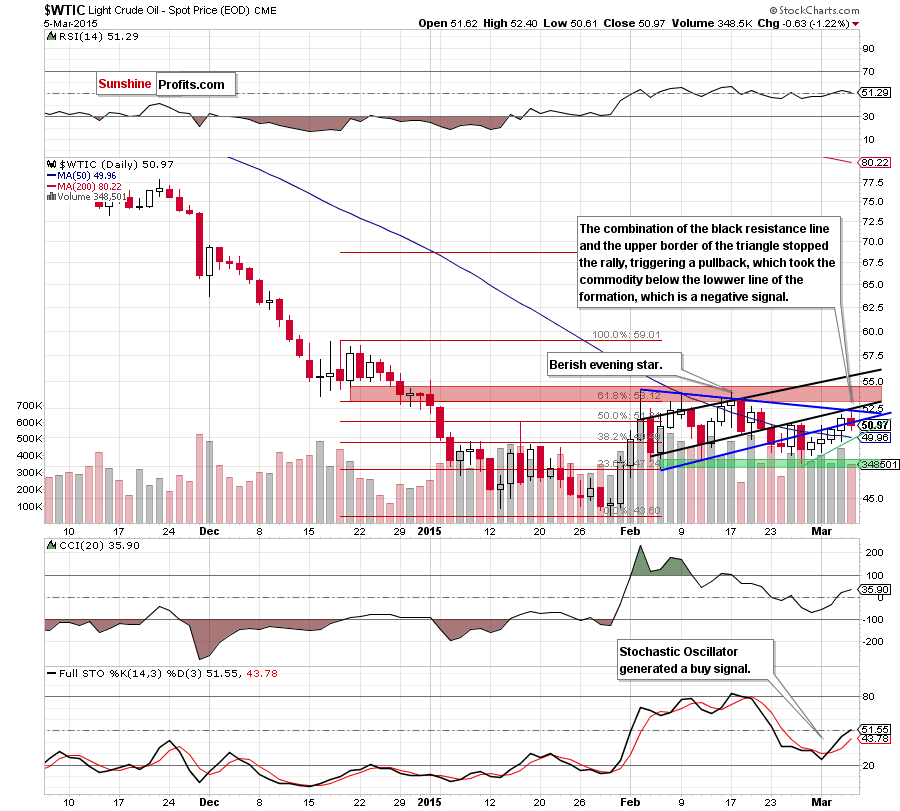

(…) crude oil moved higher once again and climbed above the lower border of the blue triangle, which is a positive signal. Additionally, yesterday’s move materialized on higher volume than we saw in the previous days, which suggests that we’ll see another attempt to break above the black resistance line in the coming day(s).

As you see on the daily chart, the situation developed in tune with the above-mentioned scenario and crude oil reached our initial upside target. Despite this improvement, the combination of the black resistance line and the upper border of the triangle stopped further improvement and encouraged oil bears to act. As a result, light crude reversed and dropped below the lower line of the formation. This is a negative signal, which suggests that lower values of crude oil are just round the corner. If this is the case, the initial downside target would be around $50, where the very short-term green support line (based on the recent lows) and the previously-broken 50-day moving average are. If this area is broken, oil bulls will find support around $47.36-$48.05, where the green support zone (created by the Feb 5 and Feb 11 lows) is.

Summing up, the most important event of yesterday’s session was an invalidation of the breakout above the 78.6% Fibonacci retracement and the lower border of the blue triangle. This price action clearly shows that as long as the commodity is trading under below the black resistance line, the upper line of the formation and the 76.4% Fibonacci retracement (marked on the weekly chart) further improvement is not likely to be seen and an attempt to move lower (to the initial downside target around $50) should not surprise us.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment, but we will keep you informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts