Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Although crude oil moved lower after the market’s open weakened by a bearish EIA weekly report, the commodity rebounded sharply as the combination of positive Chinese data and Saudi Arabia's oil minister commentary supported the price. Thanks to these circumstances, light crude invalidated the breakdown below its major support line, but is it as bullish news as it seems at the first sight?

Yesterday, the U.S. Energy Information Administration reported that domestic crude oil inventories rose by 8.4 million barrels in the week ended February 20, missing expectations for an increase of 4.0 million barrels. In this way, total U.S. crude oil inventories stood now at 434.1 million barrels, which the highest level since August 1982. The report also showed that in Cushing, Oklahoma, storage increased by 2.4 million barrel to 48.7 million, which is the highest level in over a year. Thanks to these bearish numbers, crude oil moved lower and hit an intraday low of $48.43.

Despite this deterioration, the commodity rebounded after Saudi oil minister Ali al-Naimi said oil demand was growing, calming the oil market. Additionally, China's factory sector data weighed o investors’ sentiment as well. As a reminder, HSBC/Markit Purchasing Managers' Index climbed to a four-month high of 50.1, indicating growth in activity, which could translate to higher crude oil’s demand (China is the world's biggest energy consumer and second largest user of oil behind the United States). In these circumstances light crude climbed to an intraday high of $51.28 and closed the day above the level of $50. Does it mean that the worst is behind oil bulls? (charts courtesy of http://stockcharts.com).

In our yesterday’s summary, we wrote the following:

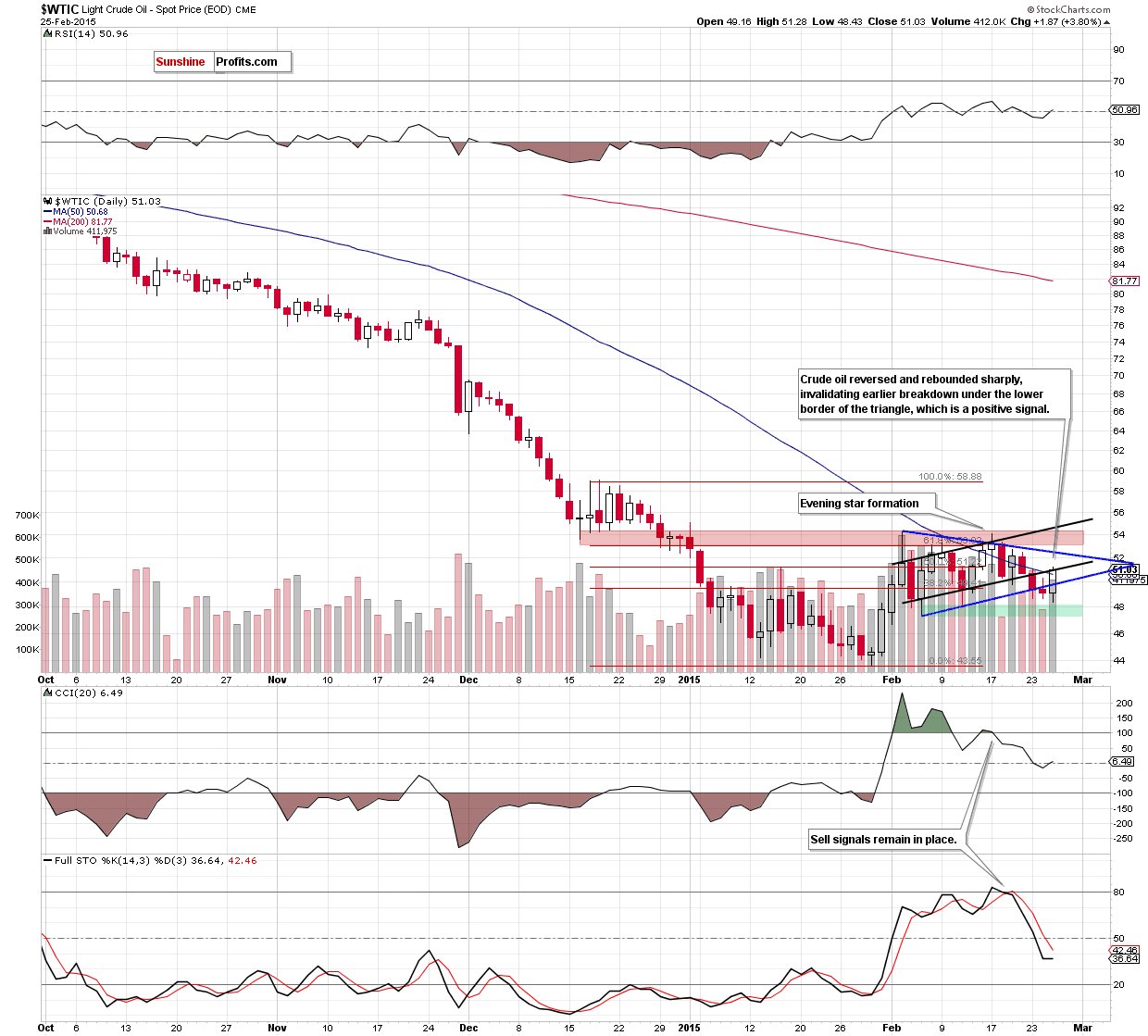

(…) crude oil moved lower once again and closed the day under the lower border of the blue triangle. (…) Nevertheless, as long as the breakdown is unconfirmed another attempt to push the commodity above the lower line of the formation can’t be ruled out.

As you see on the daily chart, although crude oil moved lower after the market’s open, the proximity to the support level based on the Feb 11 low encouraged oil bulls to act. As a result, the commodity reversed and rebounded sharply, invalidating earlier breakdown under the lower border of the blue triangle. Although this is a positive signal, we should keep in mind that yesterday’s move materialized on relatively low volume (compared to the increases that we saw earlier this month - for example Feb 3 or Feb 13), which suggests that oil bulls might not be as strong as it seems a the first glance. Additionally, light crude reached the previously-broken lower black resistance line, which could pause further improvement and trigger a pullback to the lower line of the triangle (currently around $50.15) later in the day.

Having said that, let’s check how yesterday’s upswing affected the medium-term picture.

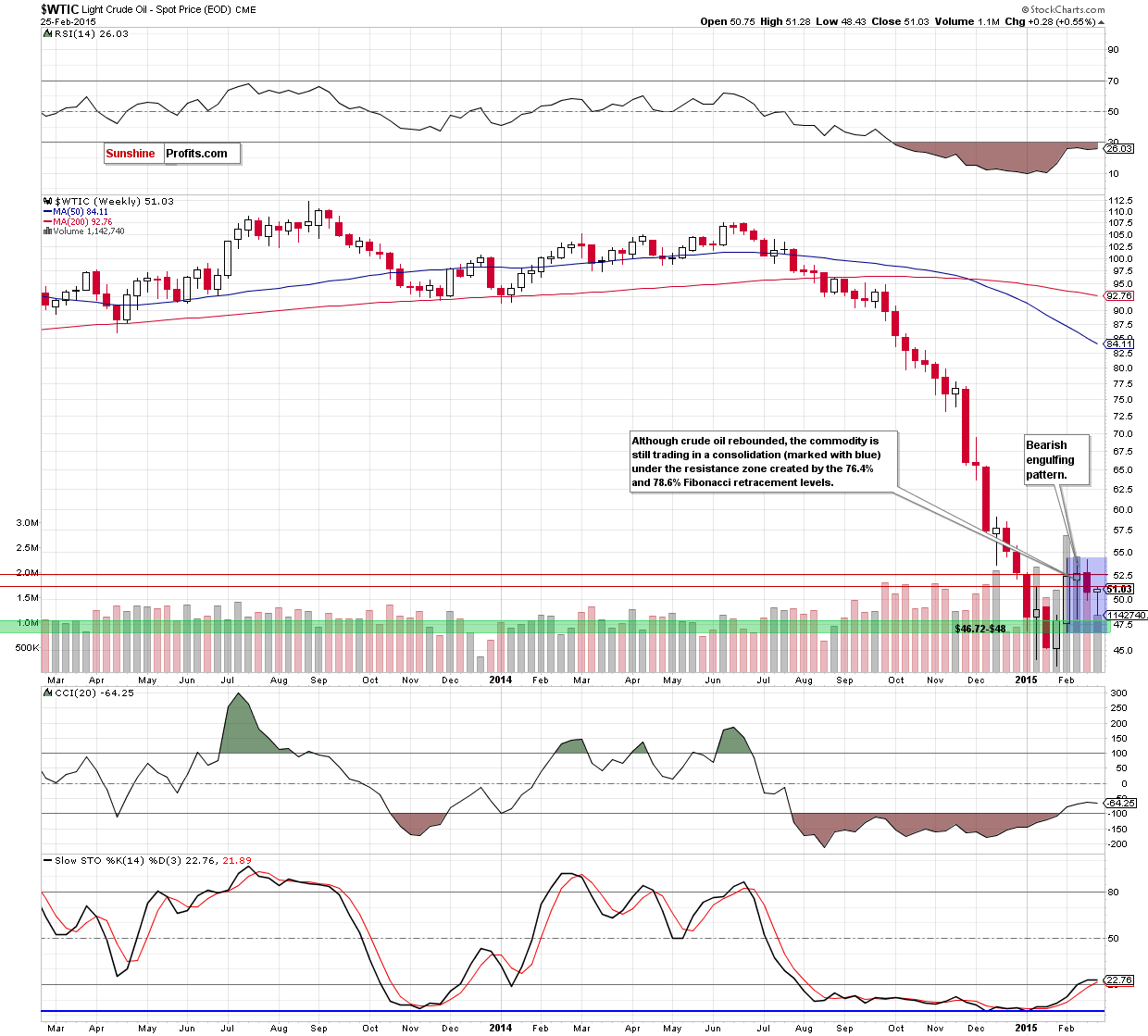

From this perspective we see that although crude oil rebounded, the commodity is still trading in the consolidation (marked with blue) under the resistance zone created by the 76.4% and 78.6% Fibonacci retracement levels. Additionally, it is reinforced by the bearish engulfing formation, which means that as long as this area is in play further rally is questionable and another pullback from here is likely.

Summing up, the most important event of yesterday’s session was an invalidation of the breakdown under the lower border of the blue triangle. Nevertheless, as we have pointed out before, although this is a positive signal (at the first sight), the size of volume that accompanied this increase, the black resistance line and the medium-term picture suggests that a pullback and another test of the lower line of the triangle should not surprise us. Therefore, we think that opening any position is not justified from the risk/reward perspective as the situation is still too unclear.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment, but we will keep you informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts