Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Wednesday, crude oil lost 2.98% after the EIA weekly report showed that domestic stockpiles hit record highs. As a result, light crude extended losses and dropped to the Apr 2009 lows once again. Will we see another rebound from here in the coming day(s)?

Yesterday, the U.S. Energy Information Administration reported that U.S. crude oil inventories rose by 4.9 million barrels in the week ended February 6, higher than expectations for an increase of 3.8 million barrels. In this way, domestic crude oil inventories stood now at 417.9 million barrels, which is the highest level since Aug 1982. The report also showed that gasoline inventories increased by 2.0 million barrels, compared to expectations for a gain of 0.2 million, while distillate stockpiles decreased by 3.3 million barrels. Thanks to these bearish numbers, the commodity declined sharply and reached the Apr 2009 lows once again. Where light crude head next? (charts courtesy of http://stockcharts.com).

Quoting our previous Oil Trading Alert:

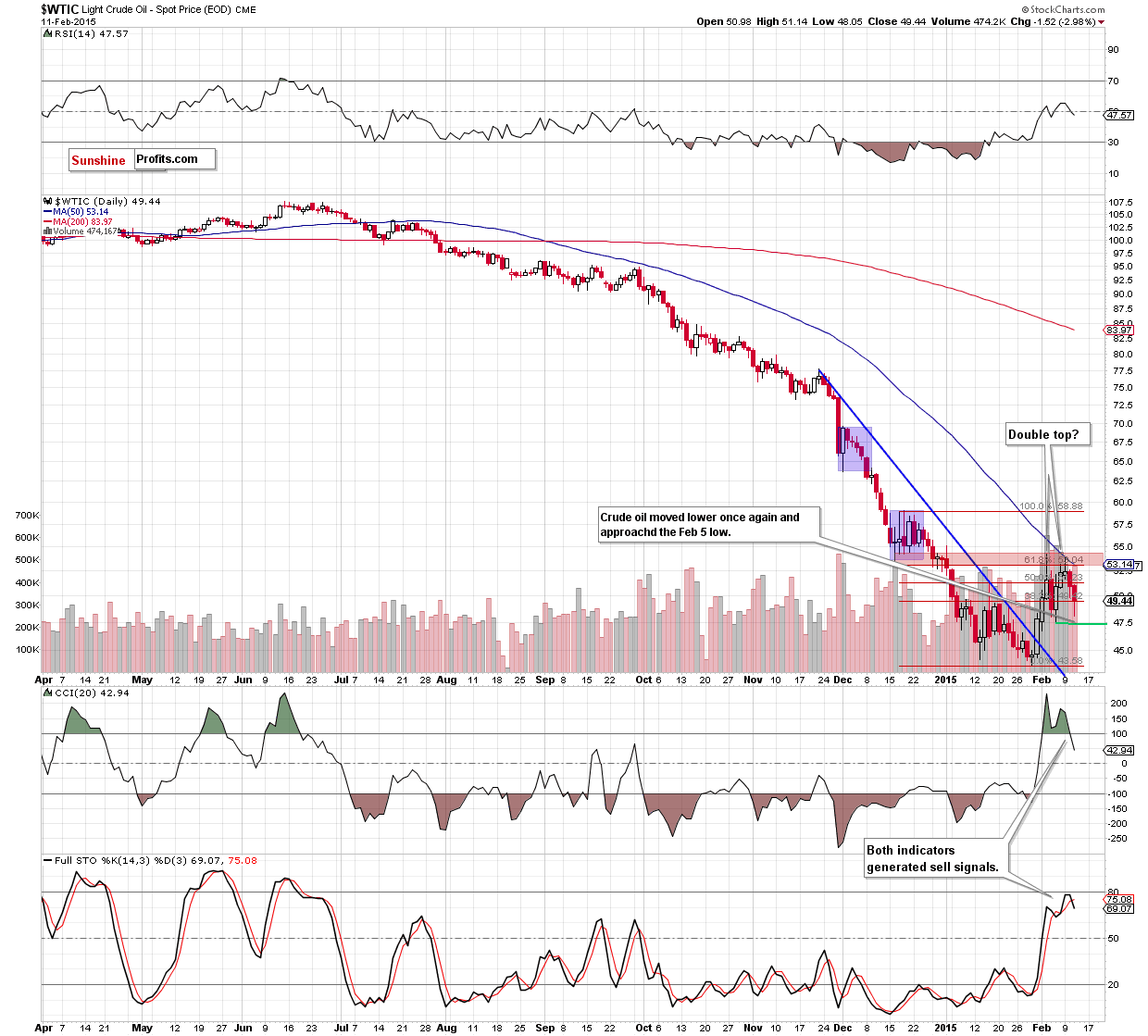

(...) light crude closed the day below the previously-broken 50% Fibonacci retracement (based on the Dec-Jan decline and seen on the daily chart), invalidating earlier breakout.

(…) the commodity also slipped under the 78.6% Fibonacci retracement level (marked on the weekly chart), which means that the breakout was invalidated. These are bearish signals, which together with the current position of the daily indicators (the CCI is very close to generating a sell signal, while the Stochastic Oscillator is overbought) suggest further deterioration. If this is the case, the initial target for oil bears would be the 50% Fibonacci retracement based on the entire Jan-Feb rally (around $48.91) or even the Feb 5 low of $47.36.

Looking at the daily chart, we see that the situation developed in line with the above-mentioned scenario and crude oil extended losses. With this downswing, light crude erased almost 60% of the Jan-Feb rally, hitting an intraday low of $48.05 and approaching the Feb 5 low. How did this move affect the medium-term picture? Let’ examine the weekly chart and find out.

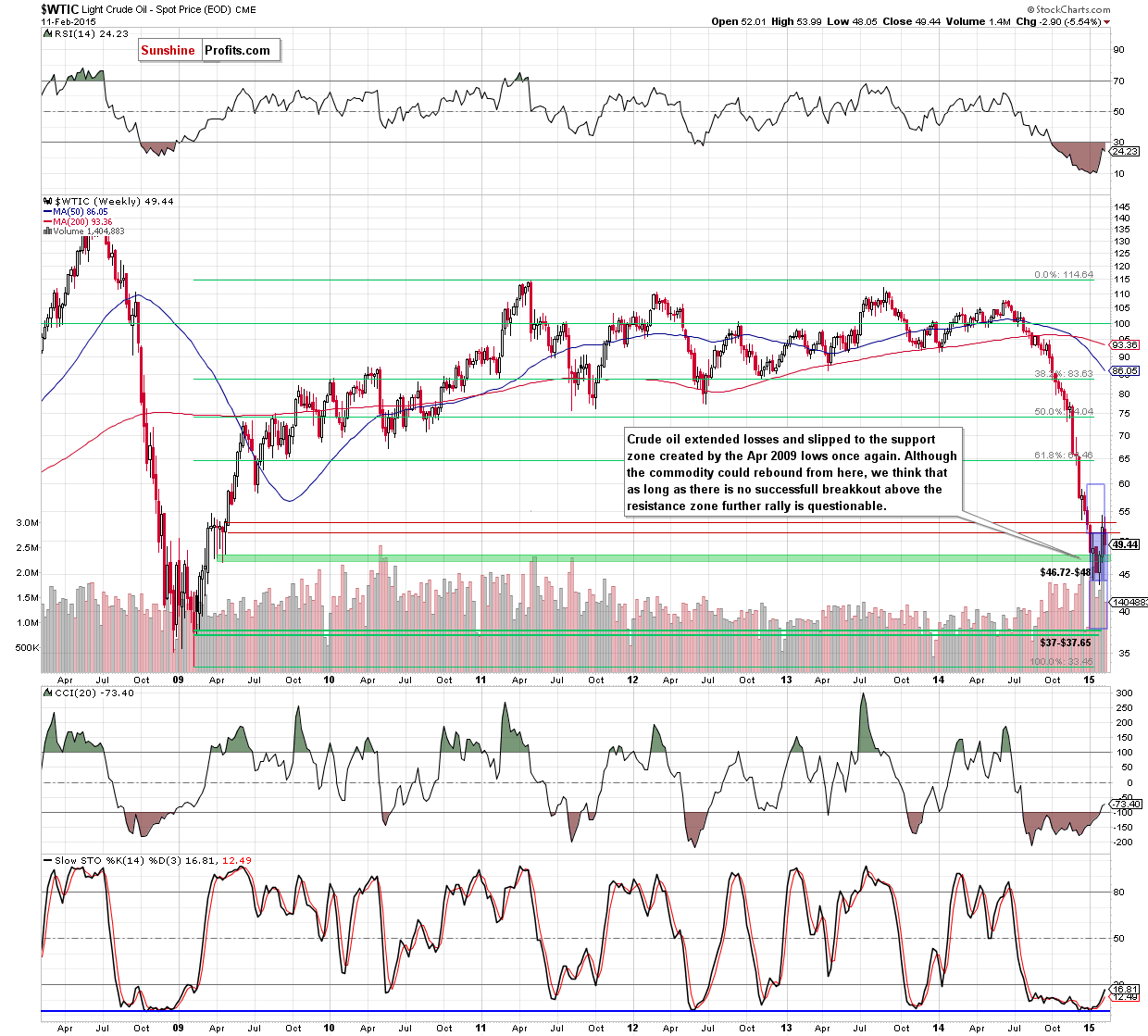

From this perspective, we see that yesterday’s downswing took the commodity to the support zone (marked with green) created by the Apr 2009 lows. Taking this fact into account, and combining it with the proximity to the 61.8% Fibonacci retracement (based on the Jan-Feb decline at $47.65) and the bottom of the previous bigger pullback (the Feb 5 low), it seems to us that we could see some strength in the coming session(s). If this is the case, the initial upside target for oil bulls would be around $51.40, where the previously-broken 78.6% (seen on the weekly chart) and the 50% (marked on the daily chart) Fibonacci retracement levels are. If this area is broken, the next target would be the major resistance zone (around $53.13-$54.24).

Nevertheless, as long as the commodity is trading below it, further improvement is questionable and another pullback can’t be ruled out (especially when we factor in sell signals generated by the daily CCI and Stochastic Oscillator).

Summing up, crude oil extended losses as we expected. With this move, the commodity reached the support zone created by the Apr 2009 lows and approached the 61.8% Fibonacci retracement (based on the Jan-Feb decline), which suggests that we could see a rebound from here in the coming session(s). Nevertheless, long as the commodity is trading below the major resistance zone further rally is not likely to be seen.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. Nevertheless, if we see a daily close above the 61.8% Fibonacci retracement based on the Dec-Jan decline, we’ll consider opening long positions. We will keep you informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts