Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Although crude oil moved higher after the market’s open supported by the Abdalla Salem el-Badri’s (the secretary general of OPEC) commentary, the commodity reversed and approached the recent multi-year low. Will we see a double bottom or rather new low in the coming days?

Yesterday, Abdalla Salem el-Badri said that oil prices could rebound and reach $200 per barrel if there is a lack of investment following the recent price action. The secretary also added that he is open to meet with non-OPEC producers to balance the market. Thanks to this news, crude oil moved higher, hitting an intraday high of $46.41. Despite this improvement, the commodity reversed and declined into negative territory as the absence of other bullish drivers for supply and demand fundamentals weighed on the price and approached it to the recent low. Is it time for a double bottom or new lows? (charts courtesy of http://stockcharts.com).

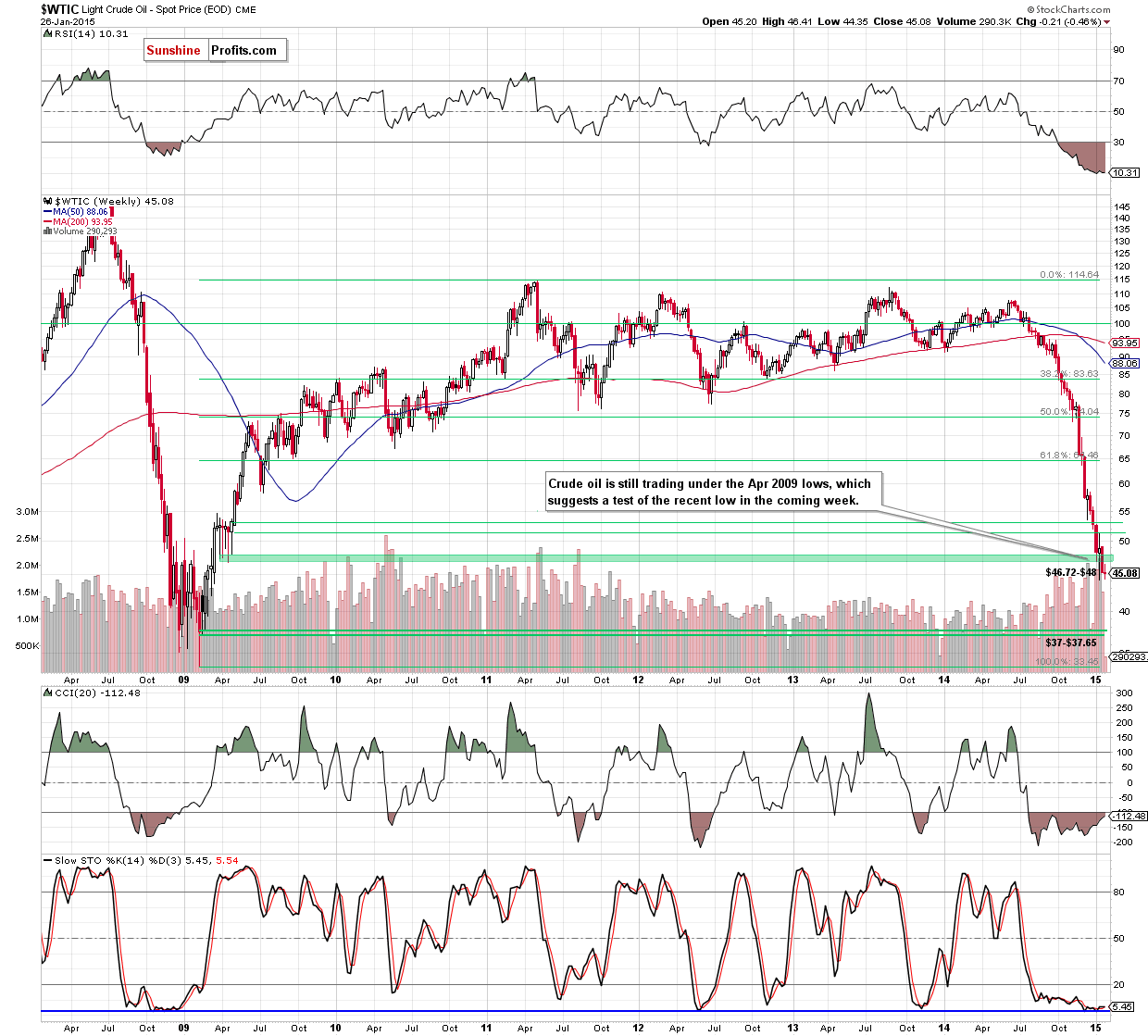

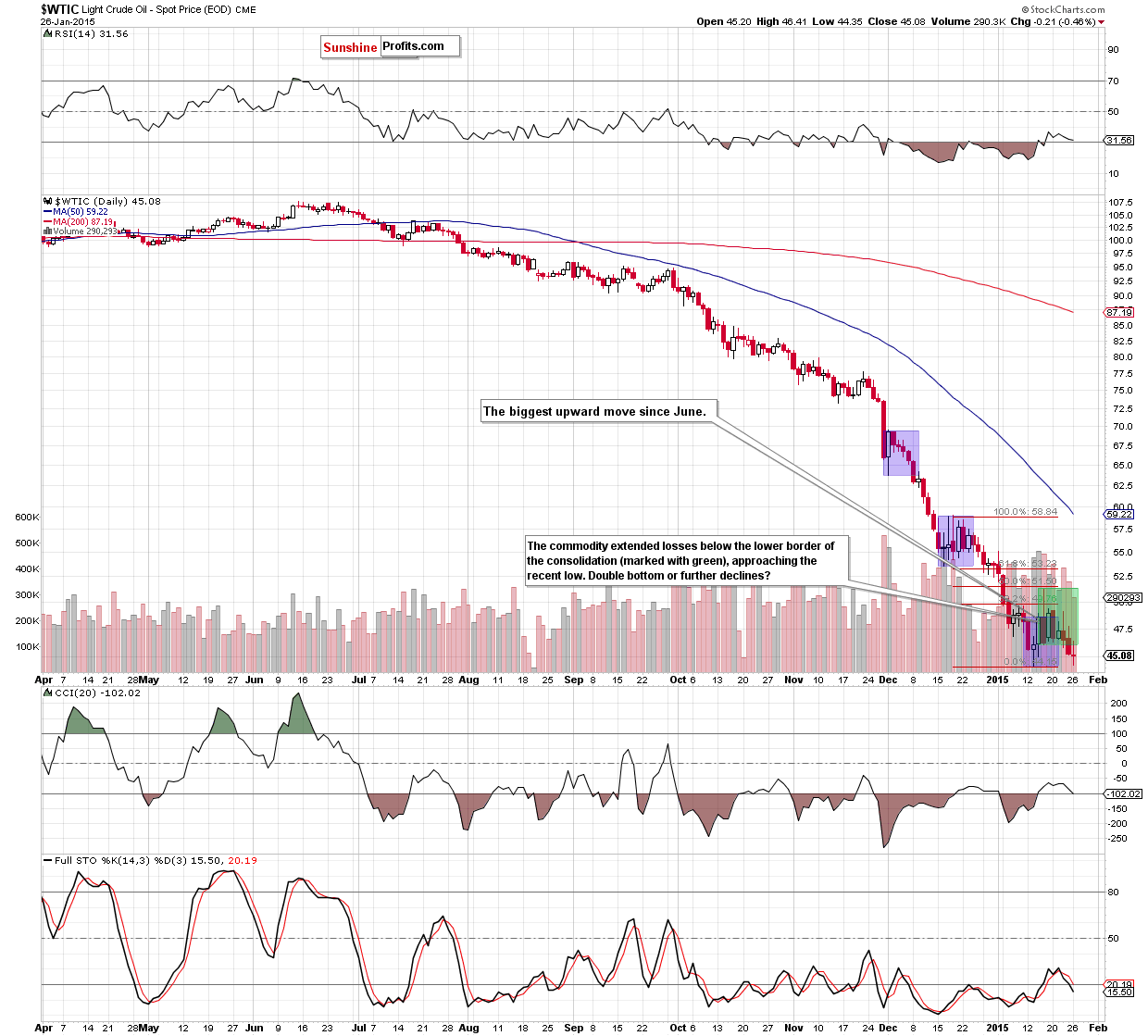

On the above charts, we see that although crude oil moved little higher after the market’s open, the previously-broken lower border of the consolidation stopped further improvement. As a result, the commodity reversed and declined. Taking this fact into account, we believe that our previous commentary is up-to-date:

(…) a breakdown below the lower border of the consolidation (marked with green), (…) is a bearish signal that suggests further deterioration in the coming day(s). At this point, it’s worth noting that we saw similar situations several times in the previous months (we marked them with blue). Back then, after short-lived consolidation, the commodity broke under the lower line of the formation, which triggered further deterioration and resulted in fresh, multi-month lows. (…) Taking all the above into account, and combining it with the medium-term picture (the commodity is still trading under the Apr 2009 lows), we believe that lower values of light crude and a test of the recent low are likely.

Summing up, from today’s point of view it looks like crude oil verified the breakdown below the lower border of the consolidation, which suggests further deterioration and a test of the recent low in the coming day(s).

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment, but we will keep you informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts