Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Wednesday, crude oil gained 1.50% ahead of inventory data and the European Central Bank's monthly policy meeting. A weaker greenback supported the price as well. In this way, light crude closed the day above $47, but did this increase change anything?

Yesterday, although the U.S. Commerce Department reported that the number of building permits issued in December declined by 1.9%, the data also showed that U.S. housing starts increased by 4.4% last month. Thanks to these mixed numbers, the greenback moved lower, making crude oil more attractive for buyers using foreign currencies. As a result, light crude climbed to an intraday high of $48.20 and erased some of Tuesday’s losses.

Nevertheless, it seems that the biggest impact on today’s price moves will have a weekly report on U.S. oil stockpiles and the European Central Bank's decision on quantitative easing program. The reason? Domestic inventories are expected to post another increase, which could bring total crude-oil and fuel supplies to a record high. At this point, it’s worth noting that the American Petroleum Institute showed yesterday that crude supplies rose by 5.7 million barrels, while gasoline stocks gained 2.1 million barrels and distillate inventories fell by 1.8 million barrels. If today’s EIA report confirms these numbers, oil bears will have an additional argument to push the commodity lower. On top of that, any expanded stimulus in Europe could strengthen the dollar, posing a headwind to oil-price gains. Will the technical picture of the commodity give us any clues about future moves? Let’s check (charts courtesy of http://stockcharts.com).

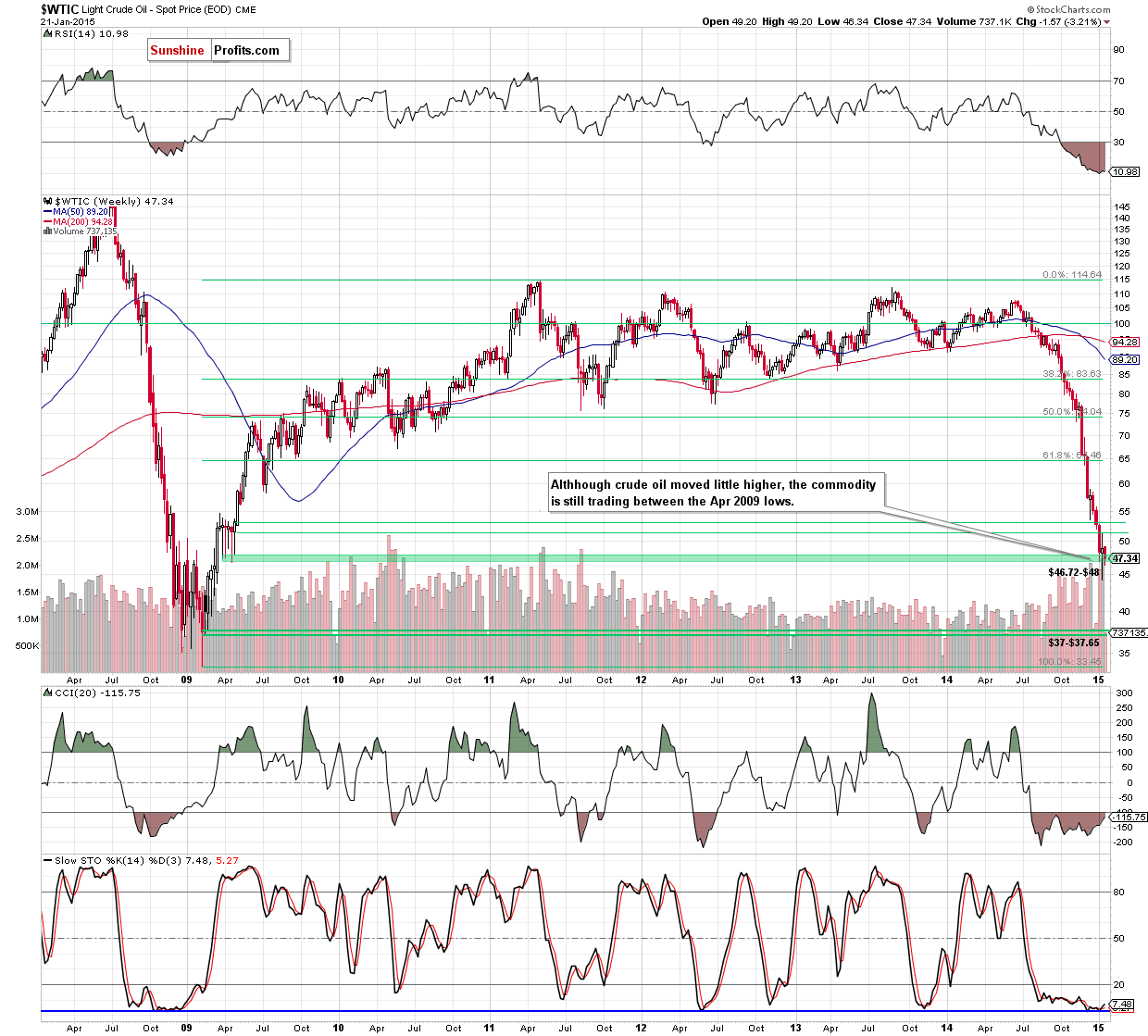

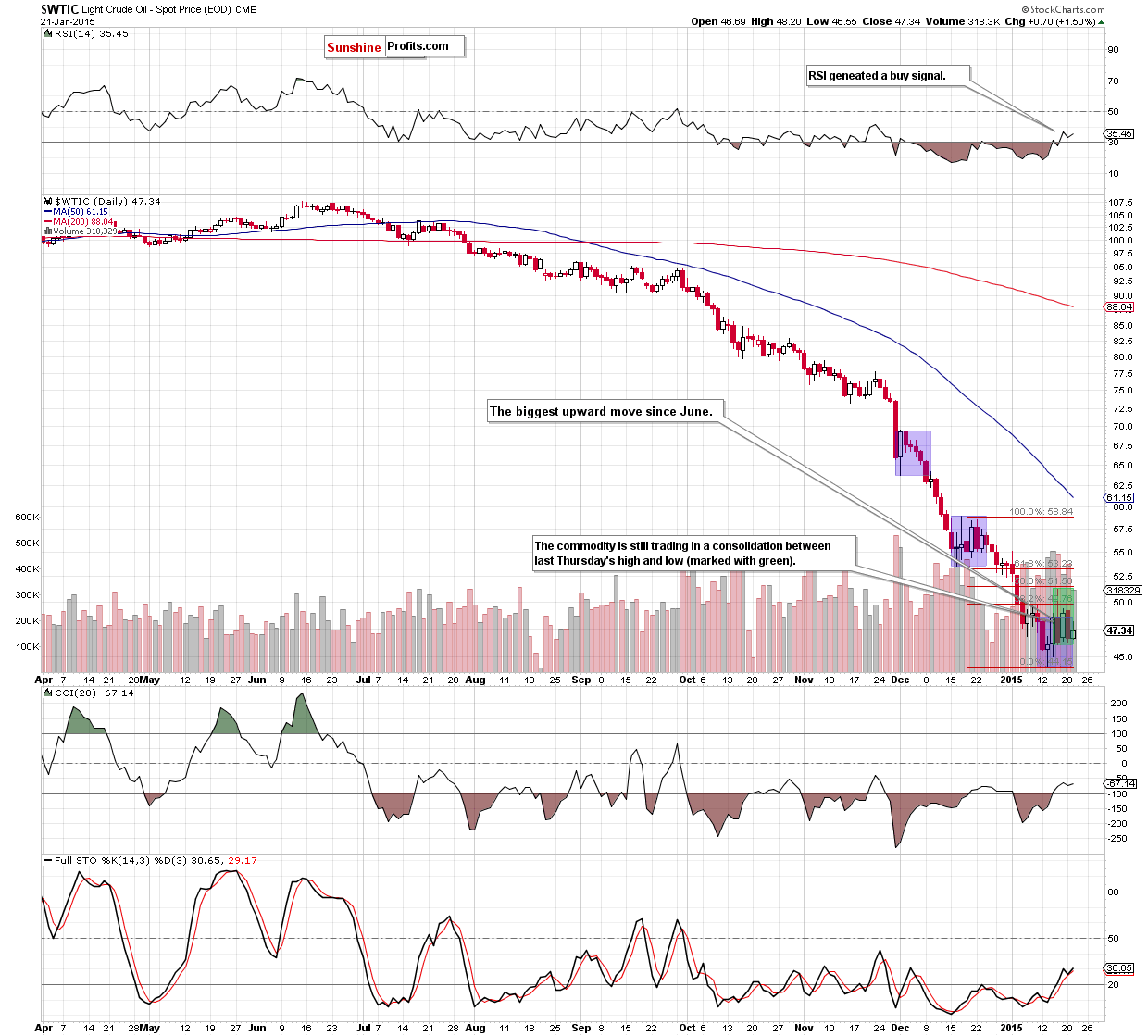

Yesterday, crude oil moved higher and erased some of Wednesday’s losses. Despite this increase, the commodity is still trading in a consolidation between the last Thursday’s high and low (and also between Apr 2009 lows). As you see on the above charts, the upper line of the formation is reinforced by the previously-broken 76.4% and 78.6% Fibonacci retracement levels (marked with green on the weekly chart) and the 50% Fibonacci retracement based on the mid-Dec-Jan decline. Additionally, the last week’s rally was the biggest upward move since June. In all previous cases, bigger corrections (marked with blue) were just another stops before new lows. Taking all the above into account, we believe that as long as crude oil is trading under these levels, another pullback and a test of the recent low is likely. Nevertheless, buy signals generated by the indicators suggest that oil bulls will try to test the strength of this resistance zone in the coming day(s).

Summing up, although crude oil moved little higher, the overall situation hasn’t changed much as the commodity is still trading under the 50% Fibonacci retracement based on the mid-Dec-Jan decline. Therefore, we think that a trend reversal (and an upward move to the Dec highs around $60) will be likely only if we see a breakout above this key resistance, which won’t be followed by a fresh low.

When the next powerful rally emerges it will likely create a tremendous buying opportunity, however at this time the evidence that we have don’t support this scenario to the degree that is necessary to push the risk/reward ratio into the levels that would justify opening long position. Simply put, the risk of another downswing is too big for us to mention opening long positions in crude oil. As always, we’ll keep you – our subscribers – informed.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment, but we will keep you informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts