Trading position (short-term; my opinion; levels for crude oil’s continuous futures contract): Hold long positions with entry at $59-61, with $54.81 as a stop-loss and $65.50 as the initial price target.

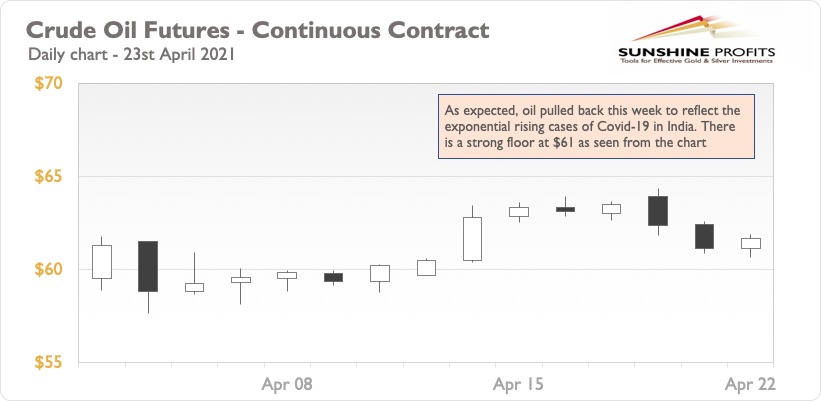

The bearish events have played out as expected. However, their strength slightly surprised everyone – so far, oil has been kept itself away from a second rally.

The question is, for how long?

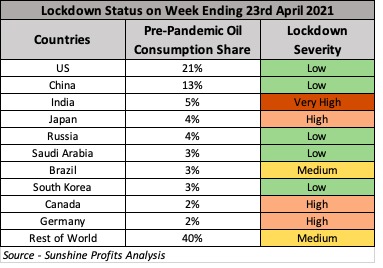

This week’s risks are actualized one after another. Whereas the demand slide caused by the ratcheting Covid-19 cases in India is not a surprise, the speed at which it all happened is shocking. Along with less demand, one of the refineries in India cut refining capacity by 15% this month. The market has responded by pulling back and staying at the favorable range of the market entry point. The earlier expectations of a slight pullback followed by a rally are now pushed back by a few days, which heavily depends upon India handling the situation.

Notwithstanding, the dollar has continued its cooldown this week providing support to the oil prices.

Let’s talk about the bearish factors at play here:

- The nuclear deal talk is advancing further. The US has provided indications that sanctions on Iran, including the one about selling oil, will be lifted.

- The response of OPEC+ to the NOPEC - anti-trust bill introduced by the US - is to state lifting production quotas in the coming months.

- India’s oil demand is estimated to be down by 0.5mbpd in May, due to the virus outbreak.

- Crude oil inputs into the refineries in the US have gone down by around 2% on a week-to-week basis, indicating a softening demand.

On top of that, supply risks in Libya are expected to get worse in the coming days as insufficient financing for the energy sector led to operational halts. As per the National Oil Corporation (NOC), funds received were less than 2% of the needs of NOC to achieve its targets for 2021.

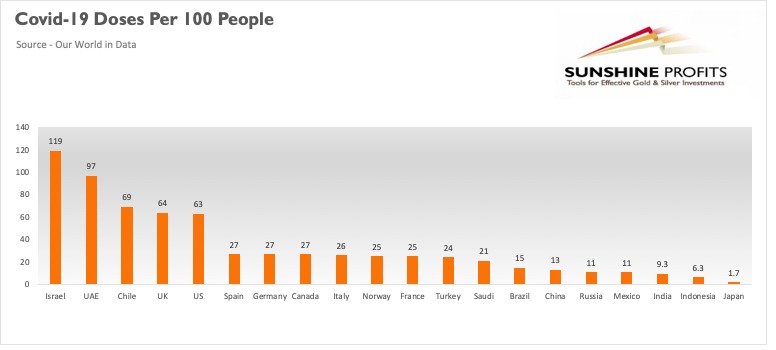

Let’s take a look at the useful chart below to understand the vaccination progress across the world. The leaders in this area have administered above 60 doses per 100 people. These countries comprise both the US and the UK - which are also high in the list of oil consumption. Please note that since most vaccines require two doses, the highest value for each country is going to be 200.

What is noteworthy, Japan is doing quite poorly in the vaccination race. Considering it is the 4th highest oil consuming country in the world the impact on oil demand would be significant in case of possible future surge in Covid-19 cases.

While fundamentals still point to a bullish oil market, oil prices are restraining in the middle of mixed signals. In the short term, we may see some back and forth moves, however, it is quite clear there is a strong baseline support at the $60 level. Hence, keeping the bullish outlook appears quite reasonable these days.

Letters to the Editor

A: The target is $65.5, current is $62, stop-loss is 54.81. I’m having trouble understanding why stops are not raised to a higher level. We risk 7.19 points down to only get 3.5 points up.

Thank you,

Mark

Q:

We look at the target and stop-loss prices from the expected returns’ point of view. In expected returns, the range of the price movement is adjusted with the probability of the movement. In the above case, the estimated probability of a bullish movement is around 80%, while the odds for a downward movement are at around 20%, resulting in the expected values being as follows:

Expected Profits – 80%*3.5 = 2.8

Expected Losses – 20%*7.19 = 1.44

One more reason to keep the stop-loss a bit further is the fact that the market sometimes overreacts unreasonably in response to negative news. In that case, a momentary sharp dip can trigger the stop-loss when we don’t want to. Hence, it has been kept far behind as the probability of an overall bullish trend is quite high.

To summarize, the oil market rally has been verified by the bearish news this week involving India’s virus surge and the US refineries’ crude oil input reduction. In the upcoming week, oil might look for some strong indicators to find direction – being more prone to bullish news, though

As always, we’ll keep you, our subscribers well informed.

Trading position (short-term; my opinion; levels for crude oil’s continuous futures contract): Hold long positions with entry at $59-61, with $54.81 as a stop-loss and $65.50 as the initial price target.

Thank you.

Nishant Jain, MBA, CPSM

Oil Trading Strategist