Trading position (short-term; our opinion; levels for crude oil’s continuous futures contract): Short positions with $70.62 as stop-loss and $44.12 as initial price target as justified. We are moving the stop-loss for the current short position higher. If one’s short position was exited based on the overnight rally, it seems that getting back into the position is justified from the risk to reward point of view.

Crude is steadying today, and even though the black gold climbed earlier yesterday (Mar. 9), it ended the day in the red, just as it did on Monday. That’s two straight sessions of declines. Our analysis and trading positions currently remain unchanged. The chart has been updated as of March 8th.

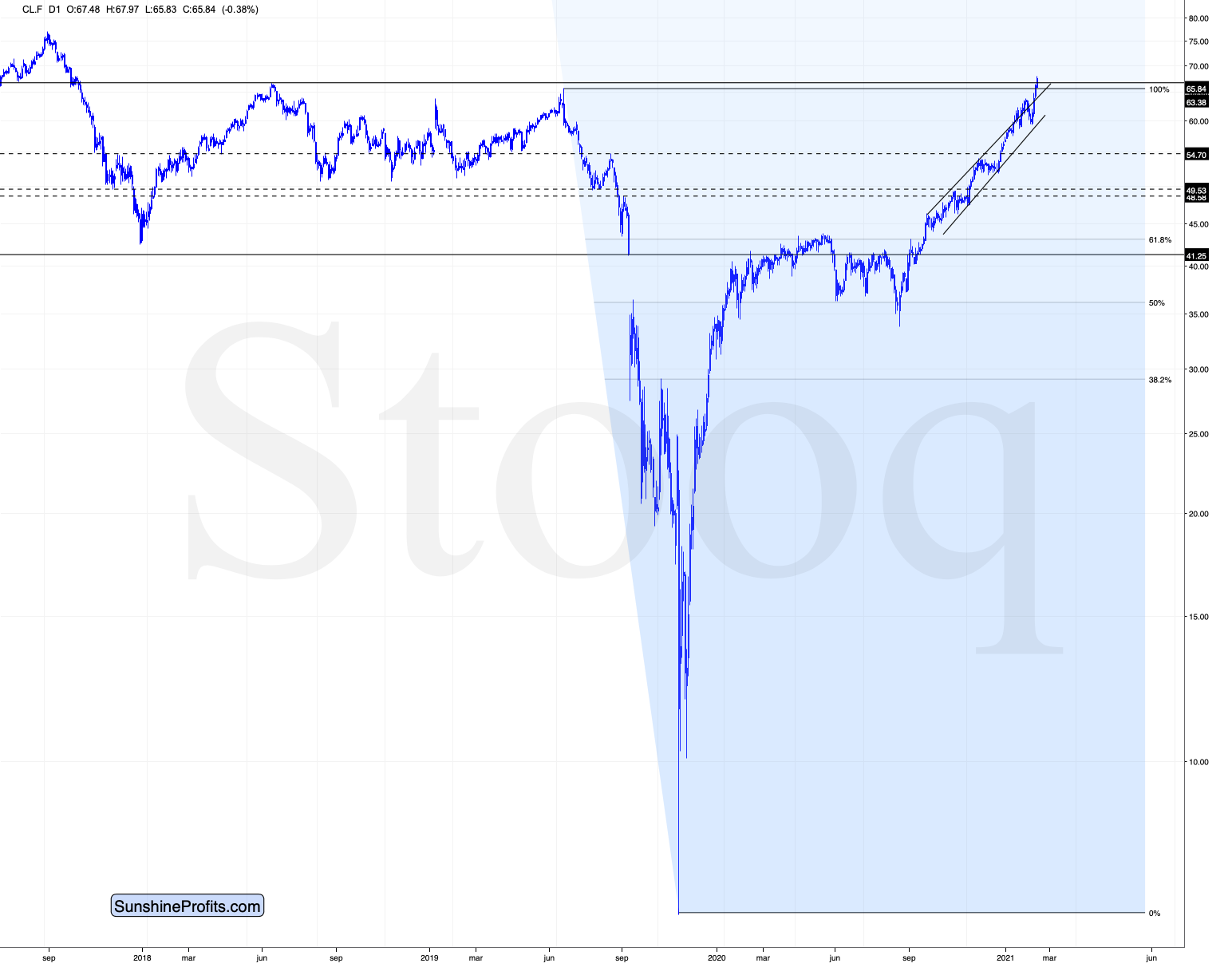

Before, oil even moved briefly above its 2019 high. Breakouts above previous highs are bullish, but their invalidations are way more bearish.

This is especially the case given that the epic 2020 decline started with a failed breakout.

Back in the first quarter of 2020, crude oil rallied temporarily above the late-2019 high and it immediately failed to hold this level as support. The initial decline was only the tip of the bearish iceberg.

What we see right now is an invalidation of the breakout above the early-2019 high ($66.60) and the very early 2018 high ($66.66). Today’s overnight high was $67.97 and the current price (at the moment of writing these words) is $66.19.

The other reasons that make the decline likely are not visible on the above chart, as they come from other markets. Crude oil is not 100% linked with any other market, but it does tend to move in tune with the general stock market and against the USD Index. After all, it’s priced in the U.S. dollar.

Now, the medium-term trend in the USD Index has almost certainly reversed, and it might have also reversed in the case of the general stock market. Consequently, crude oil’s chances for breaking higher – and verifying the breakout – here seem pretty slim. Instead, a reversal and a decline seem very likely.

To summarize, even though crude oil moved sharply higher recently, it seems that the days of this rally are numbered.

As always, we’ll keep you, our subscribers well informed.

Trading position (short-term; our opinion; levels for crude oil’s continuous futures contract): Short positions with $70.62 as stop-loss and $44.12 as initial price target as justified. We are moving the stop-loss for the current short position higher. If one’s short position was exited based on the overnight rally, it seems that getting back into the position is justified from the risk to reward point of view.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief