Trading position (short-term; our opinion; levels for crude oil’s continuous futures contract): No positions in crude oil are justified from the risk to reward point.

First, we’d like to say that we hope you had a safe Thanksgiving weekend and that you are all in good health, particularly in this trying time.

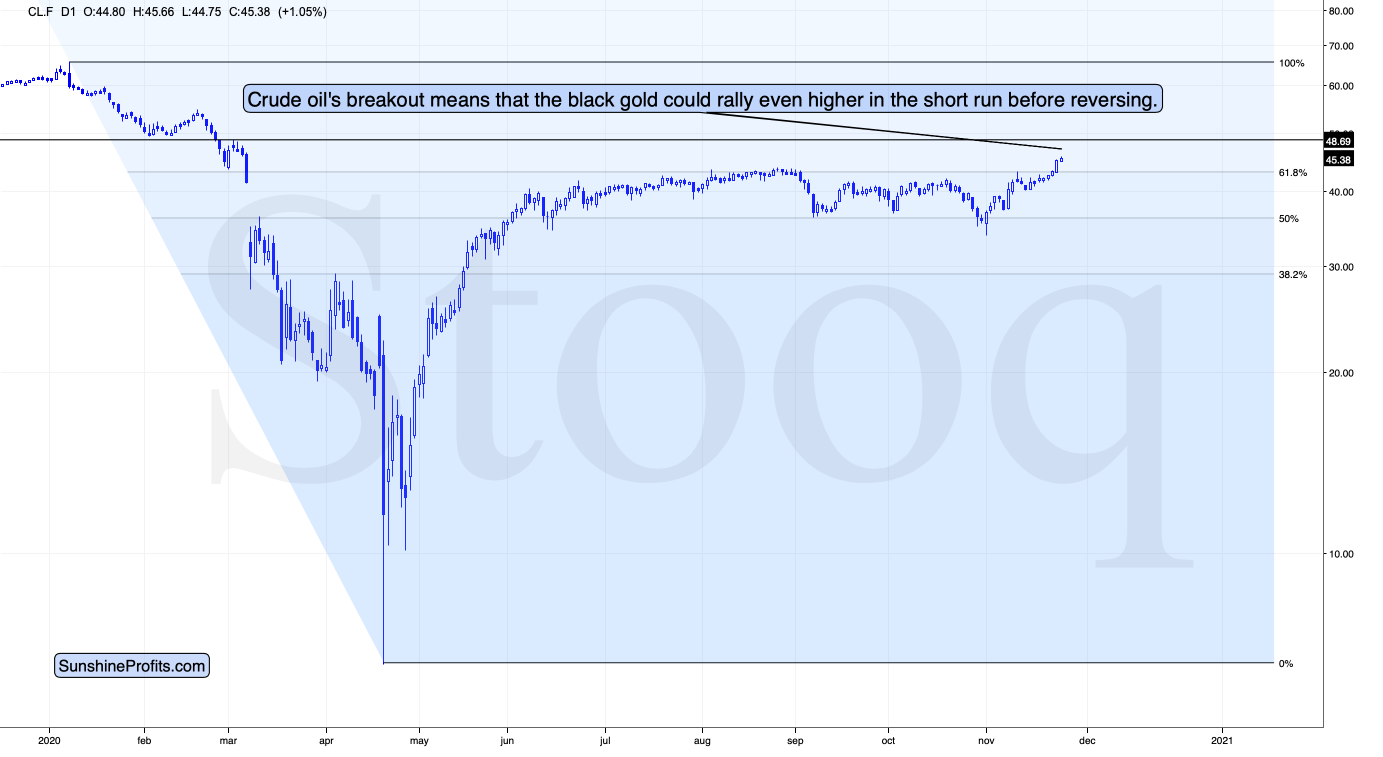

Crude oil declined today as OPEC+ did not meet traders’ expectations and only slightly curbed output for the next month or two, although oil remains relatively far from declining below the 61.8% Fibonacci retracement level and the previous 2020 highs.

Consequently, our bearish outlook for the next several weeks remains up-to-date, but so does our relatively neutral view. In other words, we think that waiting for a better risk to reward ratio before re-opening a speculative trading position continues to be a good idea.

Our analysis for the time being remains unchanged from last Wednesday (Nov 25). Please note that the chart and trading positions remain unchanged as well.

There is a strong sense of hope among investors, if not at all of us, that the world will return to a semblance of normality sometime in 2021. Crude oil is a strong reflection of that sentiment, serving as a barometer that points to a rising appetite for spending and travelling.

Buoyed by positive news, crude oil has just moved sharply higher and it’s now visibly above the previous highs as well as the 61.8% Fibonacci retracement level.

While this doesn’t necessarily mean that the next big move will be to the upside, it does significantly increase the chance that crude oil will continue to climb before topping. The next resistance will be at about $48.7 – the early-March high. And the next target would be the February high of about $54.7.

Consequently, since the moves to these price levels became more probable, we are closing our short position in crude oil – it’s simply too risky at this time. I expect to re-open it shortly, as the situation in the U.S. Dollar Index continues to point to a near-term rally, and I think that this would be likely to trigger further declines in crude oil.

However, at the same time it seems that given the breakout in crude oil, adopting a wait-and-see approach is currently justified. In case of gold, the weakness relative to the USDX is apparent, but we can’t say the same thing about crude oil, which just managed to break higher without a breakout in stocks or a breakdown in the USDX.

To summarize, for the upcoming weeks, the outlook for crude oil remains bearish, but given crude oil’s short-term breakout above the previous highs and the 61.8% Fibonacci retracement level based on the 2020 decline, it’s not bearish enough for us to keep featuring a short position in crude oil. We’re expecting to re-open this position when the risk associated with holding it becomes smaller.

As always, we’ll keep you, our subscribers well informed.

Trading position (short-term; our opinion; levels for crude oil’s continuous futures contract): No positions in crude oil are justified from the risk to reward point of view

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief