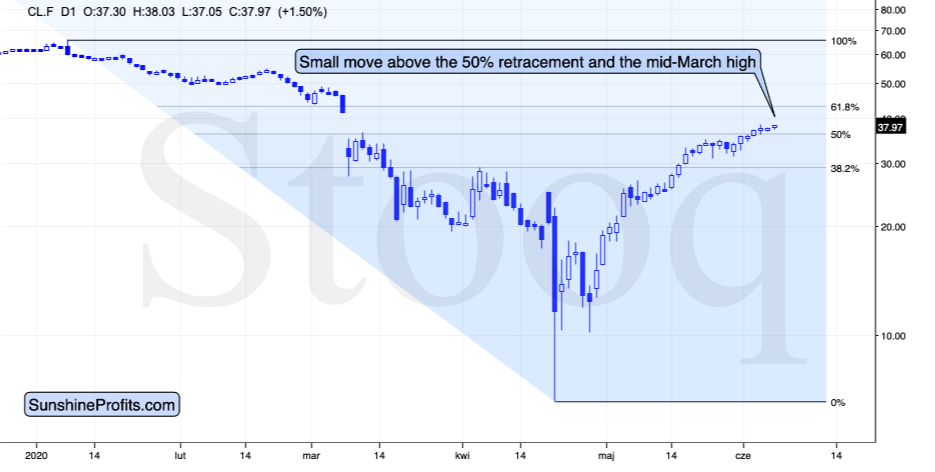

Trading position (short-term; our opinion; levels for crude oil's continuous futures contract): Small (50% of the regular positions size) short positions are justified from the risk-reward perspective with stop loss $38.63 at and $30.22 as the initial target price.

Today's Oil Trading Alert is going to be very short. In short, nothing changed with regard to crude oil's outlook in our view. Black gold is slightly below its recent highs, while the stock market futures moved above their recent highs. This means crude oil continues to underperform the stock market while at the same time being within the price gap.

In our view, the odds are that both will move lower. Crude oil below $10 was extreme, and it's no wonder that the reactive rally was huge. However, it doesn't mean that any market can move indefinitely in the same direction, and it seems that it's about time for crude oil to correct some of its gains - quite likely in a meaningful manner.

Summing up, we continue to think that small short positions in crude oil are justified right now.

Trading position (short-term; our opinion; levels for crude oil's continuous futures contract): Small (50% of the regular positions size) short positions are justified from the risk-reward perspective with stop loss at $38.63 and $30.22 as the initial target price. The July contract is trading at about $34.98 at the moment of writing these words.

In case of the futures contracts that are more distant than the current contract, we think that adding the premium (difference between the July and other contracts) to both: stop-loss and initial target prices is justified.

Thank you.

Nadia Simmons

Day Trading and Oil Trading Strategist

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager