Trading position (short-term; my opinion; levels for crude oil’s continuous futures contract): Hold long positions with entry at $59-61, with $54.81 as a stop-loss and $65.50 as the initial price target.

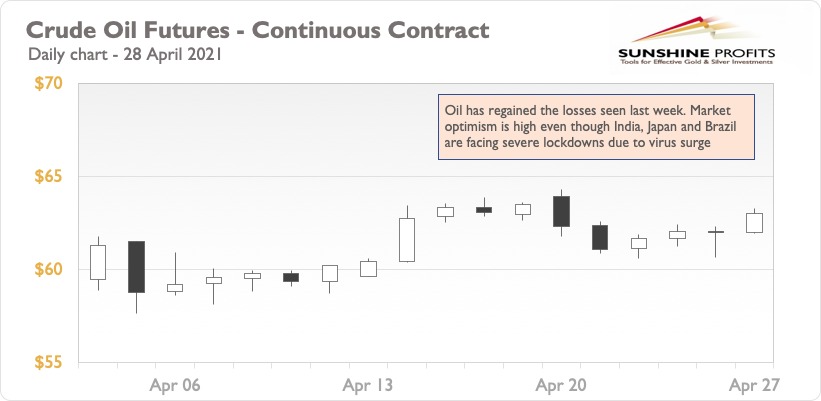

Oil has been rangebound for the past couple of weeks. Can this week be different and provide the ingredients for a potential breakout?

Oil’s rally today (Apr. 28) is most likely attributable to the optimistic statements by two major leaders in the oil value chain. Russian Deputy PM Alexander Novak thinks that global mobility is on the rise and there is optimism in the global oil market. Additionally, OPEC Secretary-General Mohammed Barkindo stated that the global oil market continues to reap the benefits of the cooperation between OPEC and its allies - remaining positive about the H2 2020 demand outlook.

Another positive signal came from the OPEC+ group meeting today (Apr. 26), where they decided not to change their latest crude production policy. Therefore, the gradual phase-out of the production cuts is going to continue, indicating strong optimism about overall demand recovery in the coming months.

Oil consumption in the mobility sector is also undergoing a paradigm shift. Knowledge workers don’t have the need to live in large cities, as they can work from anywhere. Not only do people move to inexpensive locations, but many of them also experiment with a life on the road. Recreational Vehicles (RV) sales hit an all-time high in the US indicating gasoline consumption may easily surpass pre-Covid levels this summer.

I foresee signals coming in the next few days which will put upward pressure on the black gold prices. First, the dollar is weak and is expected to remain so, thereby strengthening crude. Second, Goldman Sachs has reiterated its bullish views on oil, anticipating a demand rise of 5.2 million in the next 6 months. Last, a significant rise in supply risks in forms of geopolitical issues involving Iran and attacks on Saudi oil facilities keeps the outlook bullish.

To summarize, the oil market is on the rise, as multiple influential reports and statements express demand optimism. Barring Asian demand concerns, other factors point towards a bullish oil market. Once the market is in the $66-67 range, I will re-evaluate it to determine my position.

As always, we’ll keep you, our subscribers well informed.

Trading position (short-term; my opinion; levels for crude oil’s continuous futures contract): Hold long positions with entry at $59-61, with $54.81 as a stop-loss and $65.50 as the initial price target.

Thank you.

Nishant Jain, MBA, CPSM

Oil Trading Strategist