Trading position (short-term; our opinion): No position is justified from the risk/reward perspective.

Oil prices experienced a strong down day yesterday but black gold is still comfortably up for the week. But what do the technicals say about the next move's direction and magnitude? In today's Alert, we'll take a look at where the current move might reach...

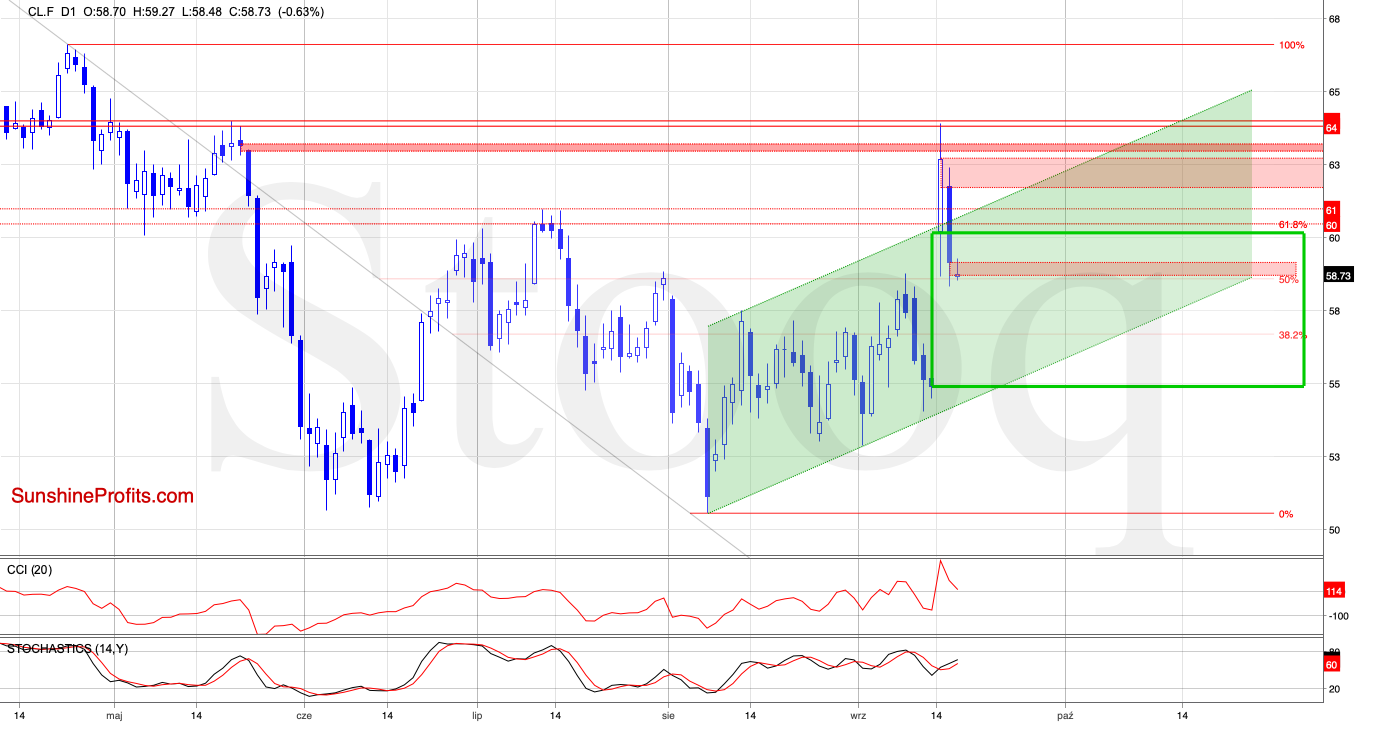

Let's take a closer look at the chart below (chart courtesy of www.stooq.com ).

We wrote these words yesterday:

(...) The futures moved to the red gap created on May 22 and then also tested the resistance area created by the May peaks (marked with red horizontal lines).

The bulls however didn't manage to hold gained levels, the prices pulled back and the breakout above the upper border of the red gap has been invalidated. As a result, the red gap remains open, and this encouraged the sellers to act earlier today.

The futures opened today with another red gap, which triggered further deterioration in the following hours. Taking this fact into account, we think that the futures will extend losses and test the previously-broken mid-July peaks and the upper border of the rising green trend channel that intersects these peaks, in the very near future.

The situation developed in tune with the above and crude oil futures have extended losses since. The sellers not only tested the above-mentioned supports, but also broke below them. This way, the earlier breakouts above these levels have been invalidated.

This is certainly a bearish development. Earlier today, the futures opened the day with another gap, suggesting further deterioration ahead.

How low could the futures go? In our opinion, the bears could reach to even around $56.87, where the 61.8% Fibonacci retracement based on the recent sharp rebound currently is.

Summing up, the bears scored important successes yesterday, breaking below the mid-July peaks and the upper border of the rising green trend channel. Today's opening gap suggests yet another day of price deterioration.

Trading position (short-term; our opinion): No position is justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist