Trading position (short-term; our opinion): Profitable short position with a stop-loss order at $58.57 and the exit target at $54.60 is justified from the risk/reward perspective.

The oil upswing of recent days has vanished in the heavy selling of yesterday. Has this been a one-off event that the bulls can recover from? They're enjoying some progress today but will it be enough to repair yesterday's damage? Let's explore the clues and the stories they tell.

Let's take a closer look at the charts below (charts courtesy of http://stockcharts.com and www.stooq.com ).

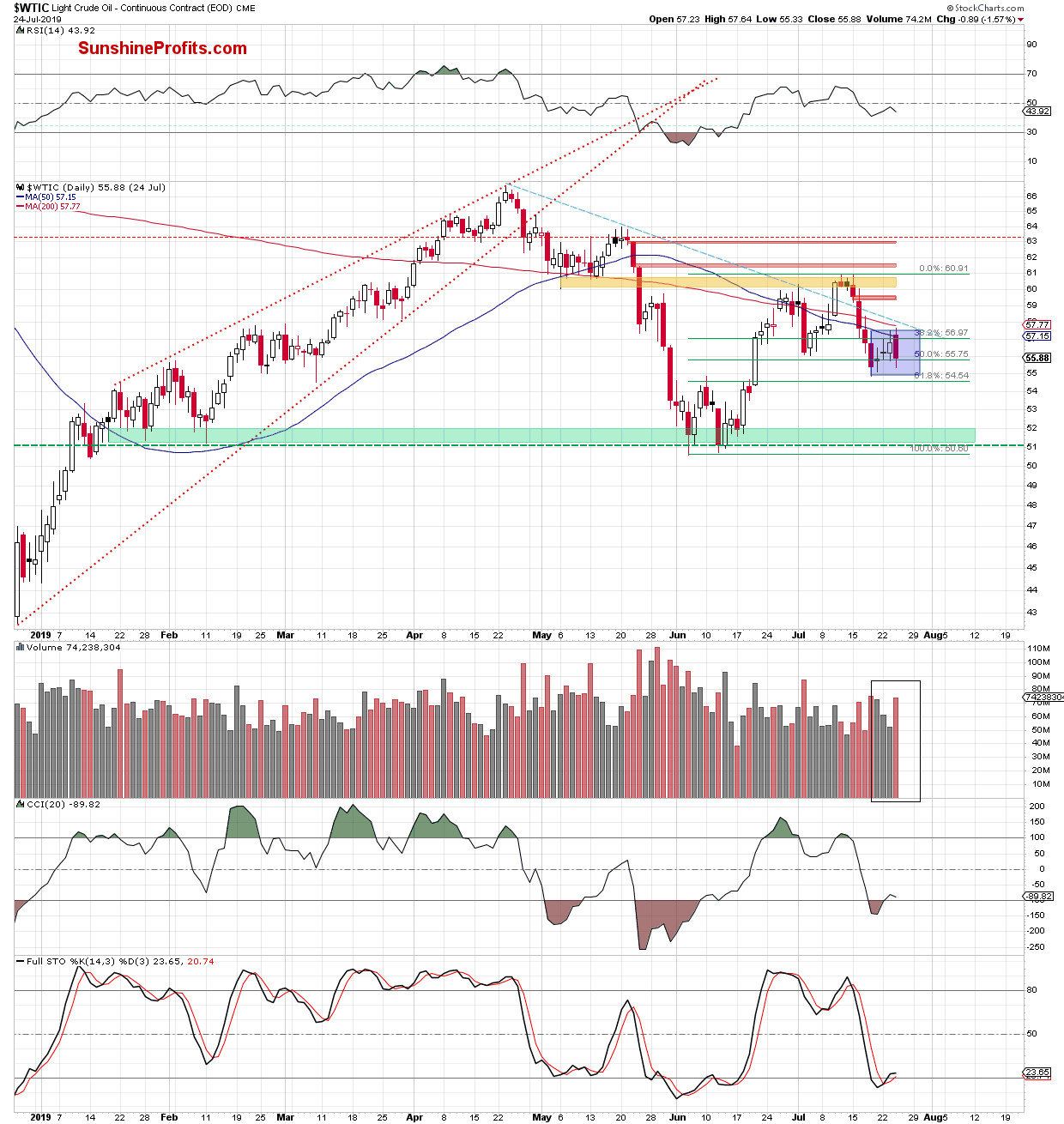

Yesterday, we have seen an unsuccessful attempt to break above both the upper border of the blue consolidation and the previously-broken 50-day moving average. Both obstacles have stopped the buyers for a second time in a row already, triggering a sharp move to the downside and a daily close below these resistances.

Connecting the dots, the overall situation remains almost unchanged as the commodity is still trading inside the blue consolidation.

There is one aspect to comment on though. The volume of yesterday's downswing increased significantly, pointing to the sellers' strength.

Let's check the oil futures for what has happened earlier today so far.

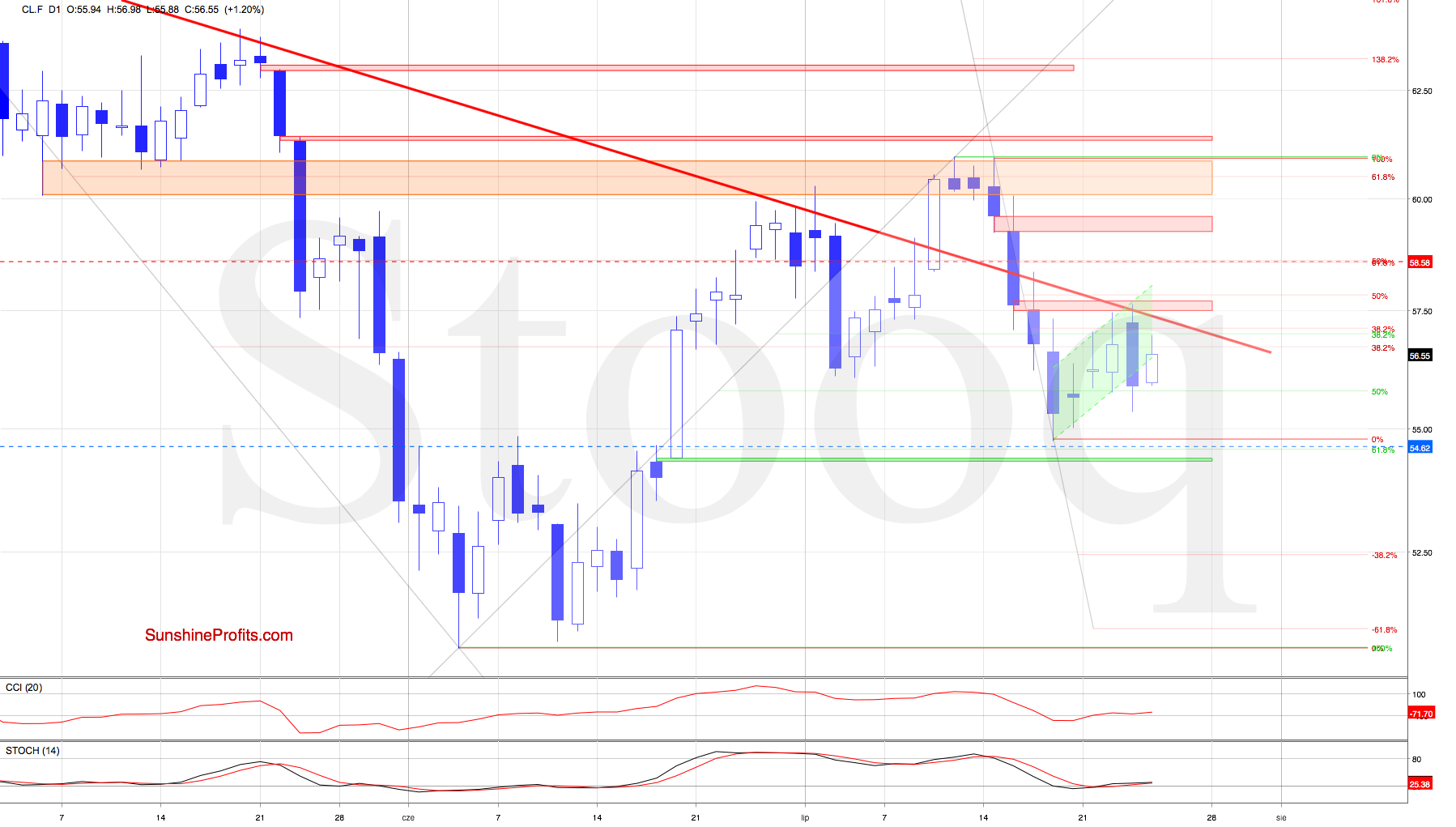

Crude oil futures erased some of yesterday's losses, but they are still trading below both major short-term resistances: the red gap and the declining red resistance line.

Additionally, the 4-hour chart shows that the futures are still confined to the very short-term rising green trend channel. Yesterday's tiny intraday breakout above the upper border of the formation has also been invalidated, just like the previous ones.

Connecting the dots, a test of the downside target remains probable. about which we wrote in previous alerts:

Let's recall our Tuesday's commentary:

(...) How low could oil go? The next downside target for the bears will be around $54.58, which is where the 61.8% Fibonacci retracement is.

Summing up, the crude oil upswing that happened on a relatively low volume has given way to a higher-volume decline yesterday. The odds continue favoring another move lower heavily. The 4-hour chart keeps hinting that the bulls aren't as strong as they appear to be. All the above factors support the bears and the short position remains justified.

Trading position (short-term; our opinion): Profitable short position with a stop-loss order at $58.57 and the exit target at $54.60 is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist