Trading position (short-term; our opinion): No position is justified from the risk/reward perspective.

Oil bulls look to have failed in their push for higher prices again. Be it on Friday, or earlier today. But can they muster enough strength to break out of the recent consolidation to the upside? Or will it be their opponents who would take the initiative?

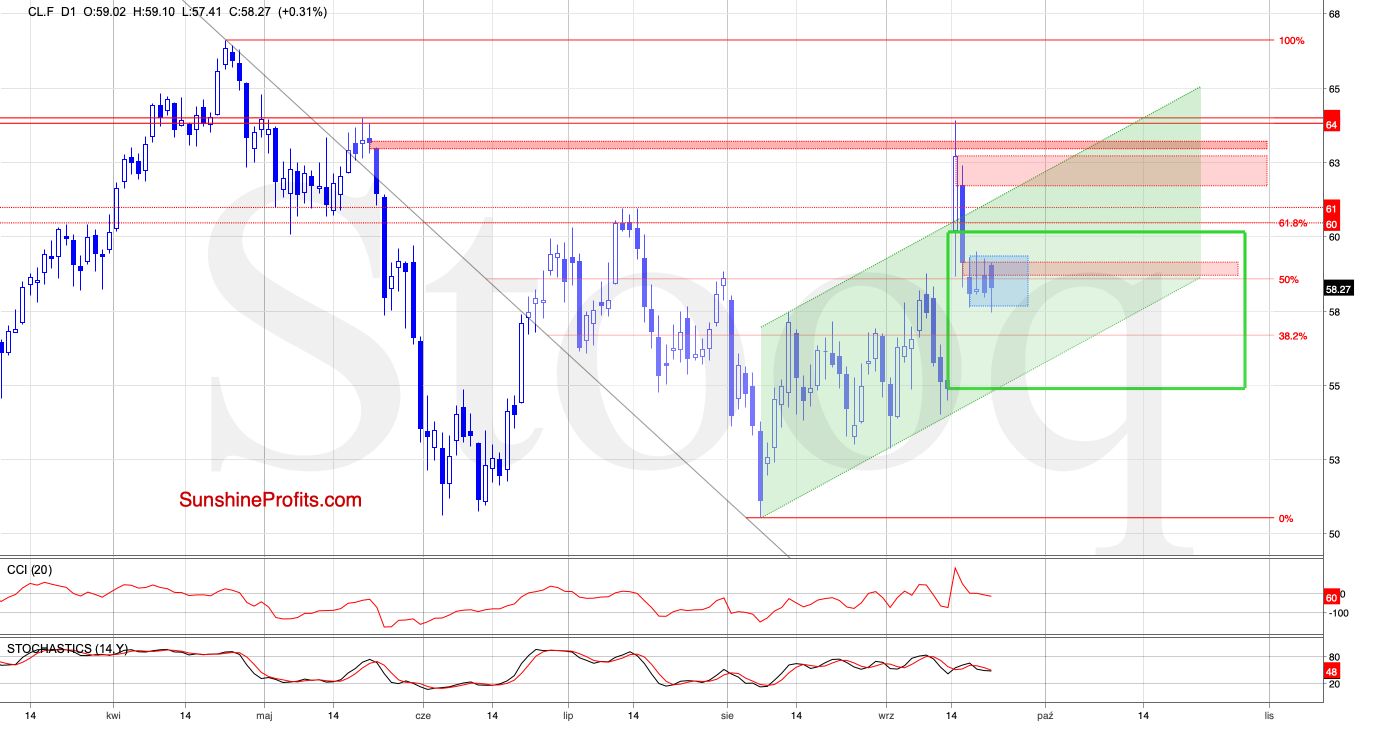

Let's take a closer look at the chart below (chart courtesy of www.stooq.com ).

On Friday, the bulls didn't manage to close the red gap, which triggered a pullback and a daily close below the gap. Earlier today, they made another unsuccessful attempt to move higher, but their failed efforts turned into a fresh weekly low.

Despite this drop, the very short term situation hasn't changed much as the futures are still trading inside the blue consolidation. Therefore, as long as there is no successful breakout above the upper border of the formation or a breakdown below its lower border, a sustainable move in either direction is questionable and opening any positions is not justified from the risk/reward perspective.

Summing up, neither on Friday or earlier today have the bulls managed to close Wednesday's gap. Overall, the short-term situation hasn't changed much and prices continue to trade inside the blue consolidation. Only prices breaking out of this sideways trend either way can usher in a tradable move. For now, remaining on the sidelines is the best course of action from the risk-reward point of view.

Trading position (short-term; our opinion): No position is justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist