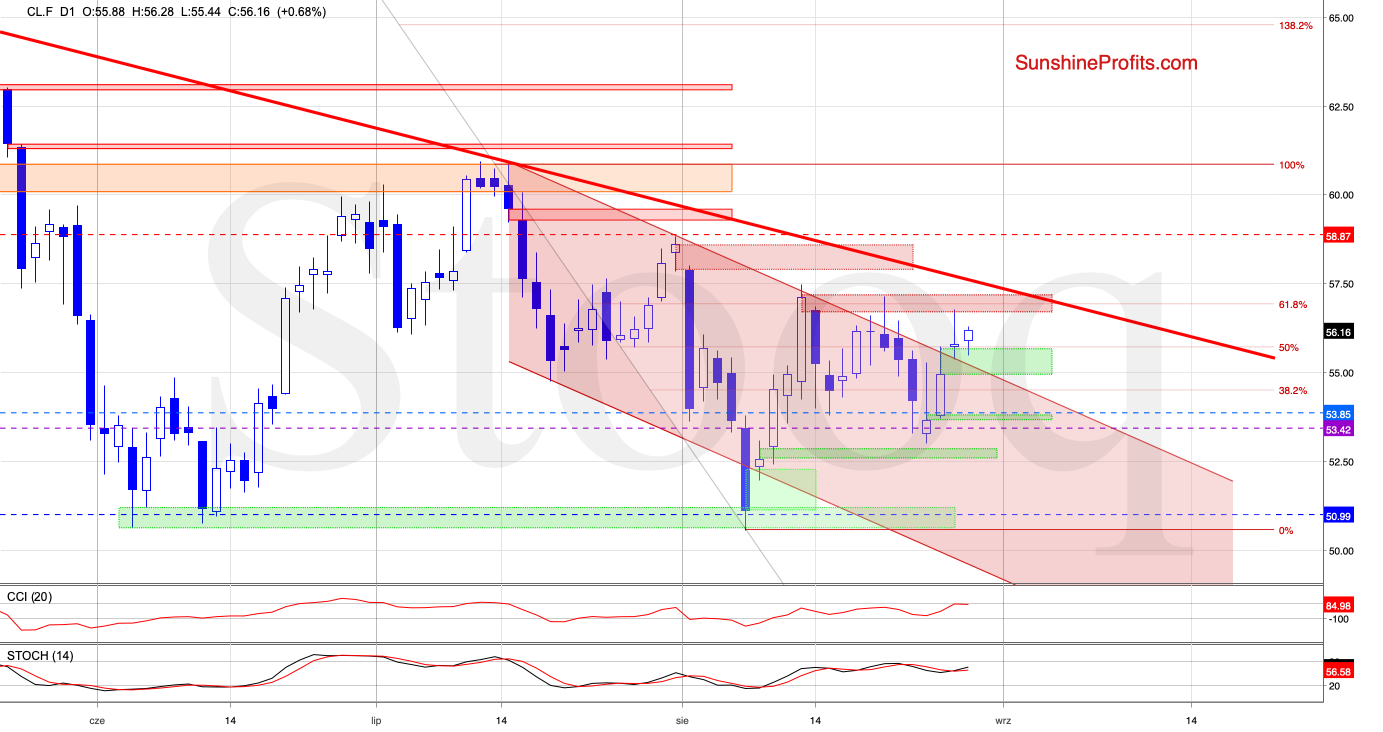

Trading position (short-term; our opinion): short position with a stop-loss order at $58.87 and the initial downside target at $53.85 is justified from the risk/reward perspective.

The bulls took oil prices right up to the resistances, and failed breaking above them. Yet they keep trying today. Do the charts favor such a move? Is this the effect of China confirming the upcoming trade talks, or can the bulls count on more than just hope of a swift resolution to the trade war that's dimming global growth (and oil demand) prospects?

Let's take a closer look at the charts below (charts courtesy of www.stooq.com ).

Yesterday, crude oil tested the red resistance zone created by the previous peaks and further reinforced by the 61.8% Fibonacci retracement. While the bulls' unsuccessful break above it triggered a pullback, the commodity still closed the day above the Wednesday's green gap.

Earlier today, we saw another test of the green gap - the unsuccessful attempt to move lower translated into a rebound. This suggests that we could see a retest of the red resistance zone later in the day.

The red zone is reinforced by the upper border of the declining purple trend channel and the upper border of the rising green trend channel of the 4-hour chart. These resistances combined with the position of the 4-hour indicators suggest a high likelihood of an upcoming reversal.

Where would the bears aim to take black gold then? Let's quote our yesterday's observations:

(...) Should the bulls fail to push prices higher (or should we see an invalidation of a potential breakout above the upper border of the channel), the sellers will likely take the reins. Then, crude oil futures can be expected to trade down to at least the lower border of the formation or even to the lower border of the purple declining trend channel and the recent lows.

Summing up, oil bulls have been stopped at the red resistance zone and the 61.8% Fibonacci retracement yesterday, and despite their attempts earlier today, they've not overcome these obstacles. There's also the recent history of failed breakout attempts over the many resistances at hand, and the 4-hour chart is leaning in favor of an upcoming downside reversal. The short position remains justified.

Trading position (short-term; our opinion): short position with a stop-loss order at $58.87 and the initial downside target at $53.85 is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist