Trading position (short-term; our opinion): Profitable short position with a stop-loss order at $58.57 and the exit target at $54.60 is justified from the risk/reward perspective.

Oil bulls have attempted to repair Wednesday's plunge also on Friday and earlier today, yet their efforts have come to naught. As oil trades in a narrow range, can the bulls pull a rabbit out of their hats? Let's assess the probability of such a development and what it means for our open position.

Let's take a closer look at the charts below (charts courtesy of http://stockcharts.com and www.stooq.com ).

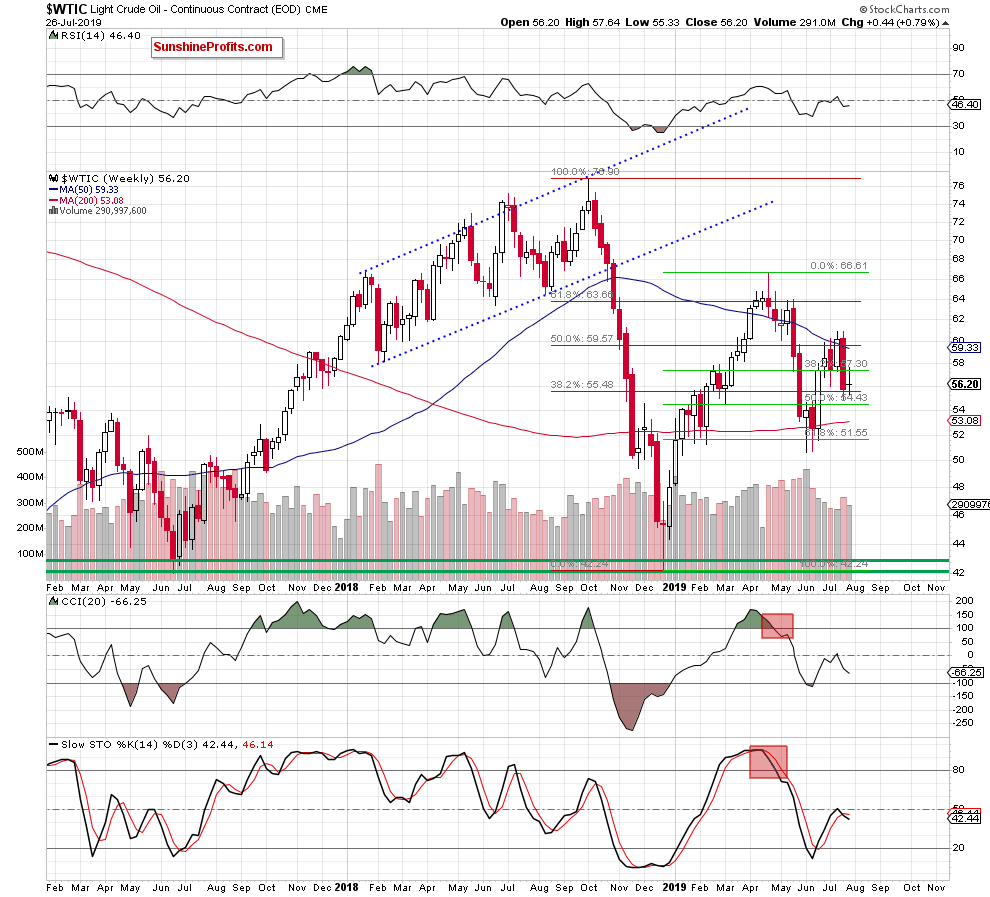

Although crude oil increased slightly during the previous week, the volume was lower than the week earlier. This doesn't attest to the bulls' strength. The weekly indicators' sell signals remain on the cards, and they support another move lower.

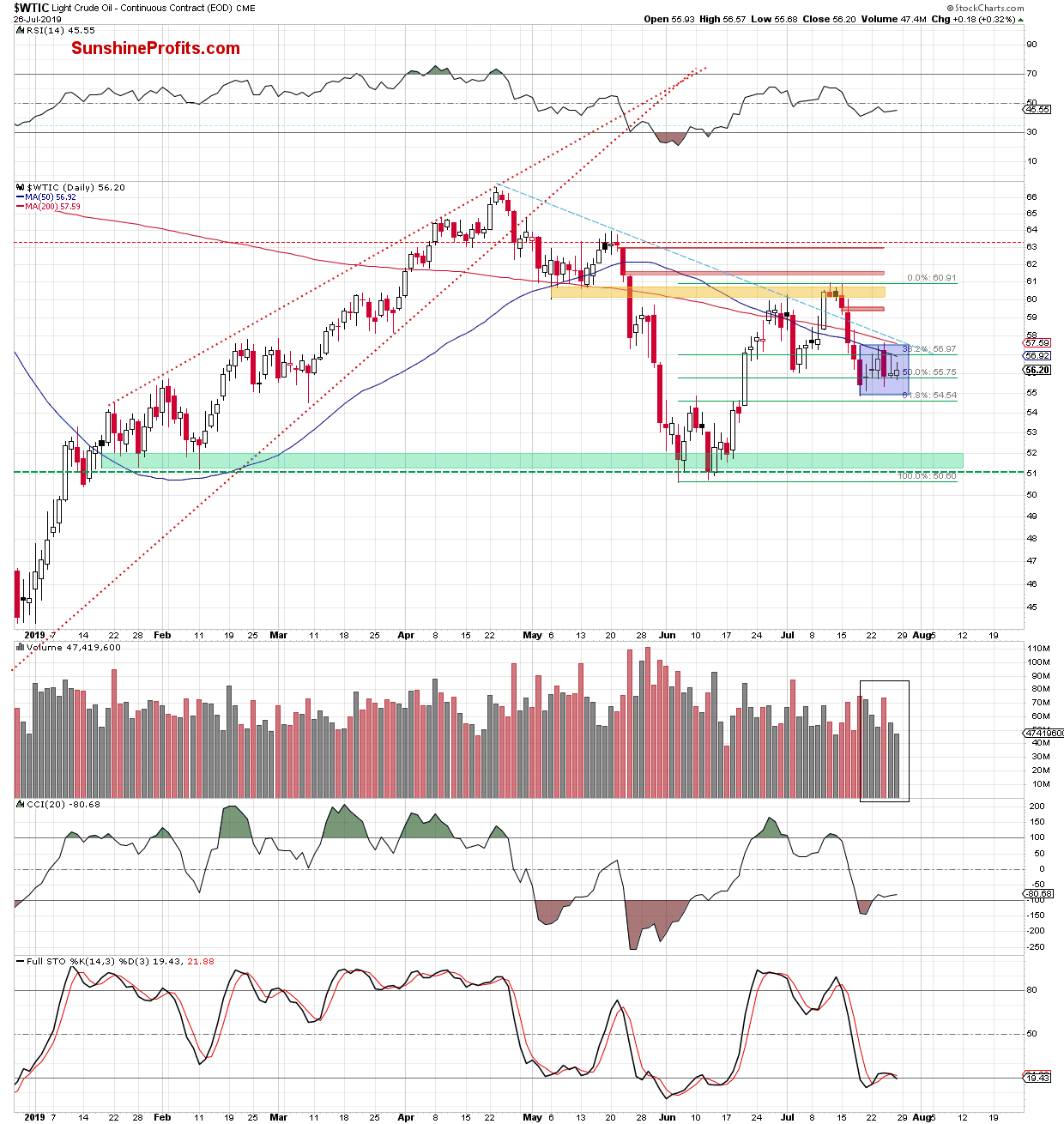

The daily chart reveals that the commodity is still trading inside the short-term blue consolidation. While crude oil rose on Friday, its volume has decreased - this doesn't point to the bulls' strength.

Can crude oil futures tell us more?

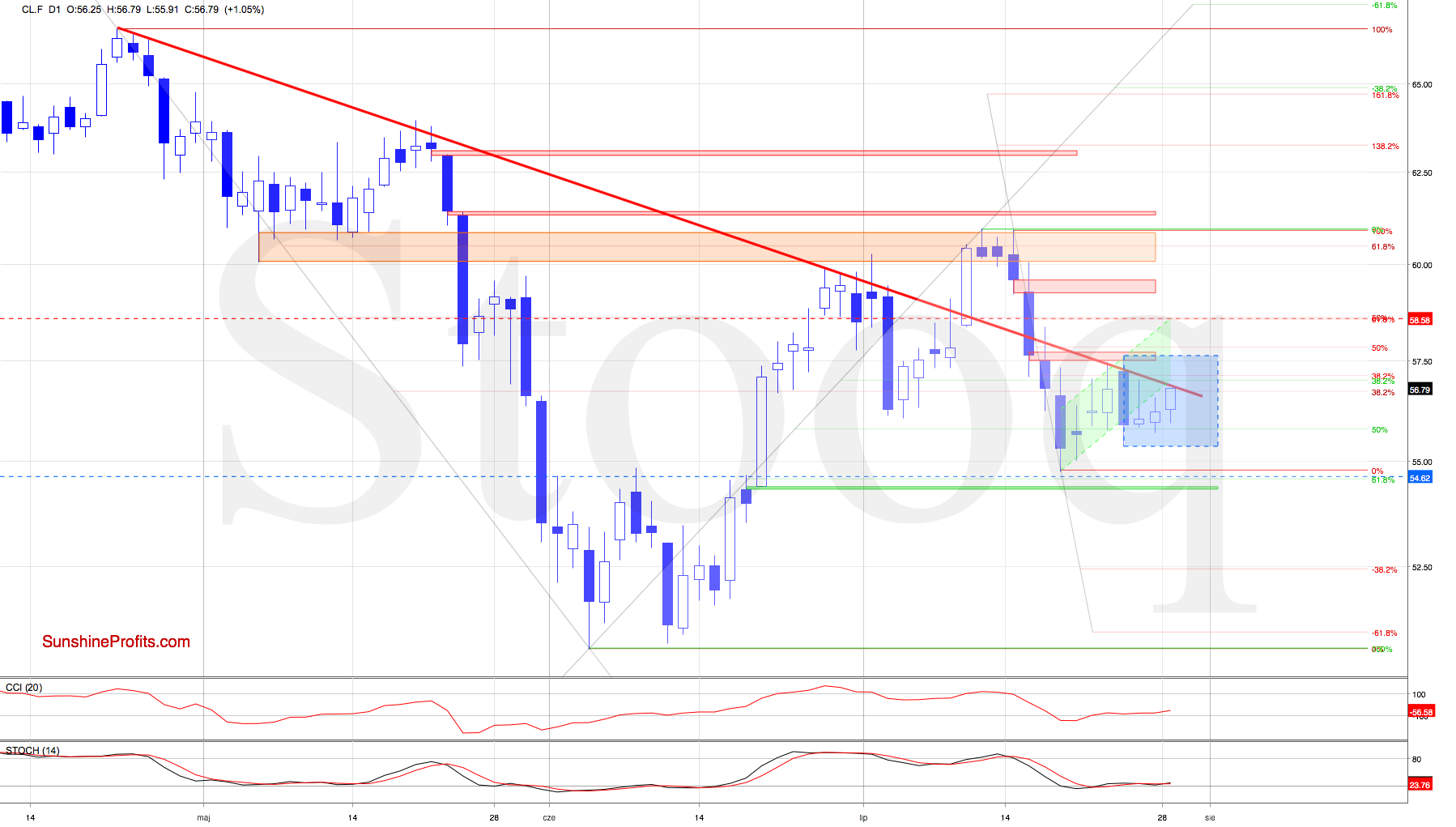

Earlier today, they have moved higher, yet have remained below both major short-term resistances (the red gap and the declining red resistance line). Black gold has also remained inside the blue consolidation. The bulls went on to give up all of their gains, and the commodity currently trades slightly below $56.00.

Additionally, the 4-hour chart shows that the futures are trading below the lower border of the very short-term green rising trend channel. This doesn't look like bullish price action.

Connecting the dots, we are of the opinion that we'll see a test of the downside target mentioned in previous Alerts. Let's recall our Tuesday's commentary:

(...) How low could oil go? The next downside target for the bears will be around $54.58, which is where the 61.8% Fibonacci retracement is.

Summing up, the crude oil upswing looks to have fizzled out and the odds continue favoring another move lower. This is supported by both the weekly chart and daily chart's declining volume on the upswings, and also by the 4-hour chart's technical posture. The bulls aren't as strong as they appear to be. All the above factors support the bears and the short position remains justified.

Trading position (short-term; our opinion): Profitable short position with a stop-loss order at $58.57 and the exit target at $54.60 is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist