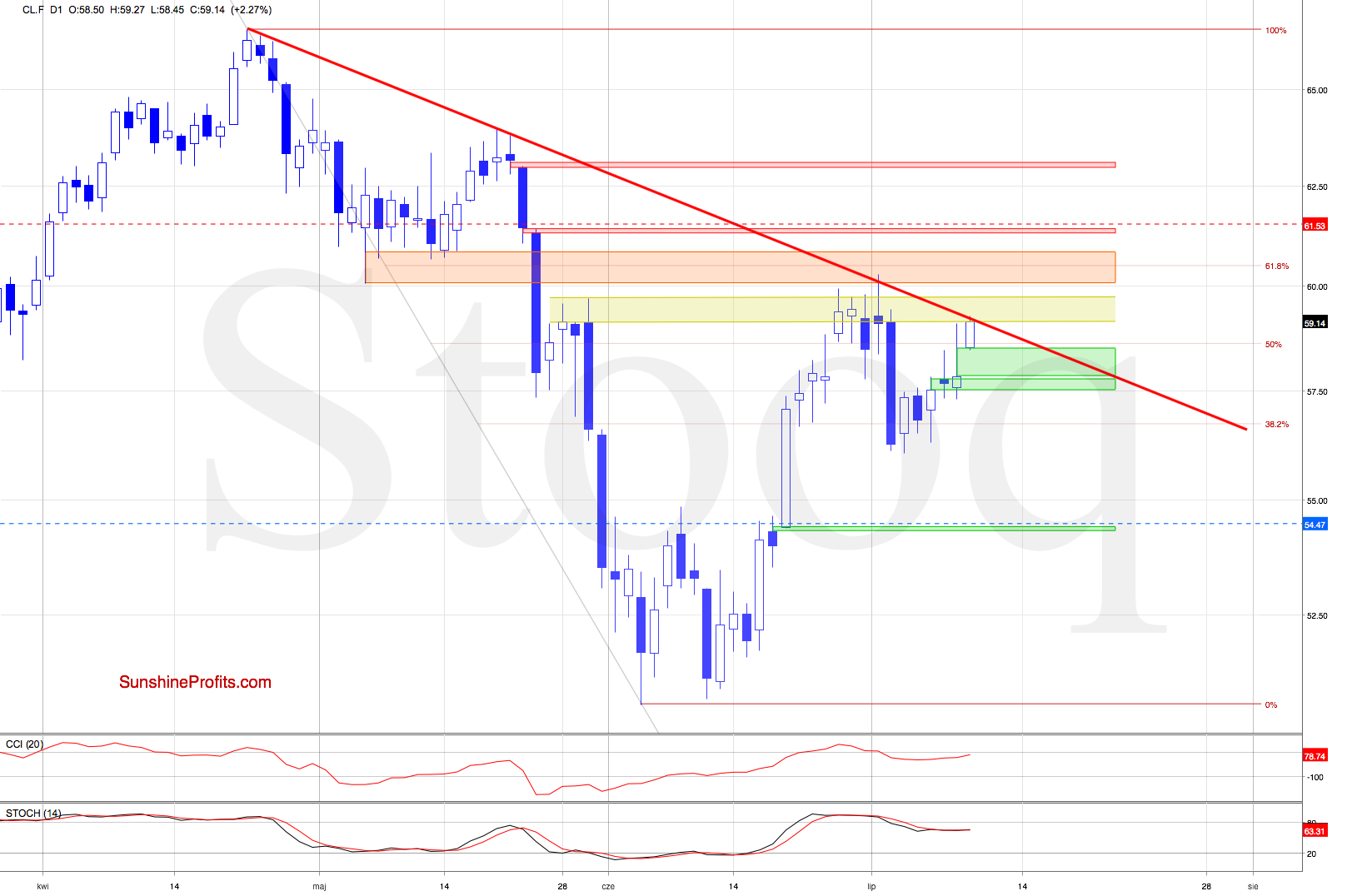

Trading position (short-term; our opinion): Short position with a fresh stop-loss order at $60.55 and the next downside target at $54.47 is justified from the risk/reward perspective.

Yesterday's price action has been eventful even though oil closed almost unchanged. Today has brought us a strong bullish gap. Instead of getting carried away by the day's spirits, let's examine the obstacles the bulls face just ahead. Will they be strong enough in overcoming them?

Let's take a closer look at the charts below charts courtesy of http://stockcharts.com and www.stooq.com ).

Crude oil futures opened Wednesday with another green gap and extended gains in the following hours. Although this is a bullish development, we should keep in mind that there has been a similar price action in June when the futures created several such bullish gaps (the early-June one didn't hold).

Additionally, crude oil futures climbed to the declining red resistance line based on the previous peaks, which could encourage the sellers to act - especially since this line has been strong enough to stop the bulls at the beginning of July. Additionally, the futures also reached another obstacle - the yellow resistance area based on the late-June and early-July highs.

Connecting the dots, we are of the opinion that lower prices of crude oil futures are still ahead of us and a reversal is not that far.

Summing up, while oil prices are moving higher today so far, they're at a strong combination of resistances: the declining red resistance line and the yellow resistance zone. The daily indicators do not support the bulls and our short position remains justified. As always, we'll keep you - our subscribers - informed.

Trading position (short-term; our opinion): Short position with a fresh stop-loss order at $60.55 and the next downside target at $54.47 is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist