Trading position (short-term; our opinion): Profitable short position with a stop-loss order at $58.57 and the exit target at $54.60 is justified from the risk/reward perspective.

Oil prices haven't moved much on Friday, and today's price action points to modestly higher prices so far. Can we trust these attempts at recovery, or is more downside ahead? The combination of weekly and daily charts presents a fitting answer, and we are bringing you the below detailed analysis to answer the above questions decisively.

Let's take a closer look at the charts below (charts courtesy of http://stockcharts.com and www.stooq.com ).

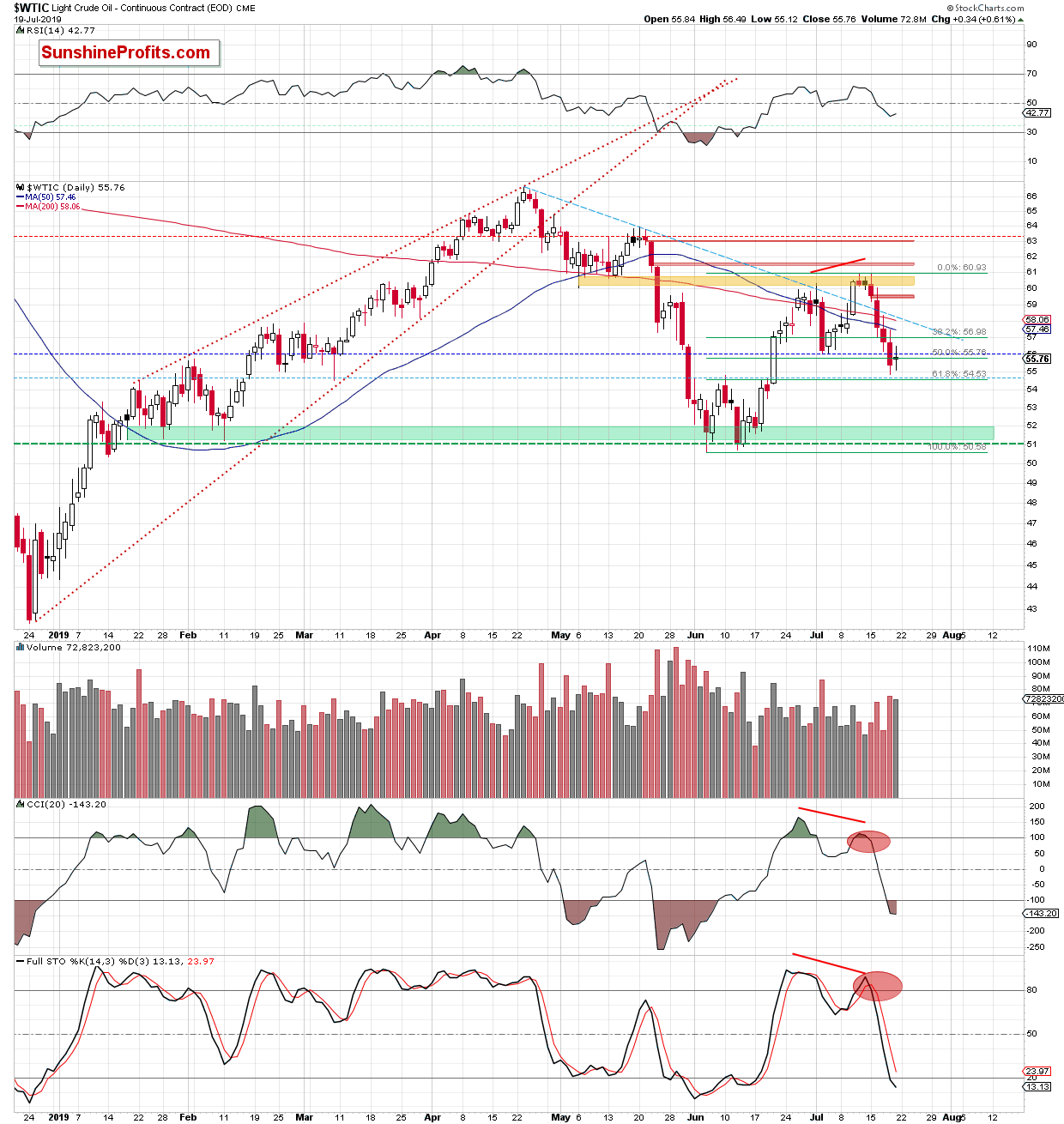

The daily chart reveals that on Friday, neither the bears nor the bulls had much success moving the oil price either way. It shows as the doji candle, which is positioned inside the previous candle. As for the daily indicators, they keep supporting the bears as their sell signals remain on the cards.

What happened in the oil futures arena so far?

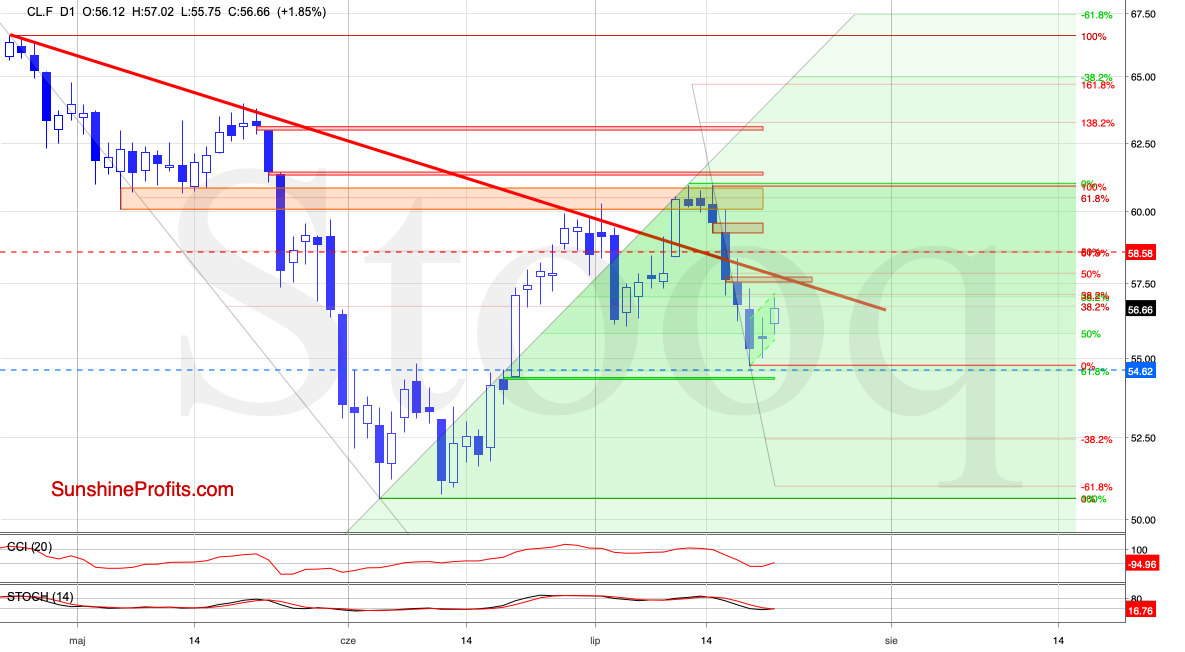

While crude oil futures extended move to the upside earlier today, they still remain well below the nearest resistance area created by the red declining resistance line and the red gap.

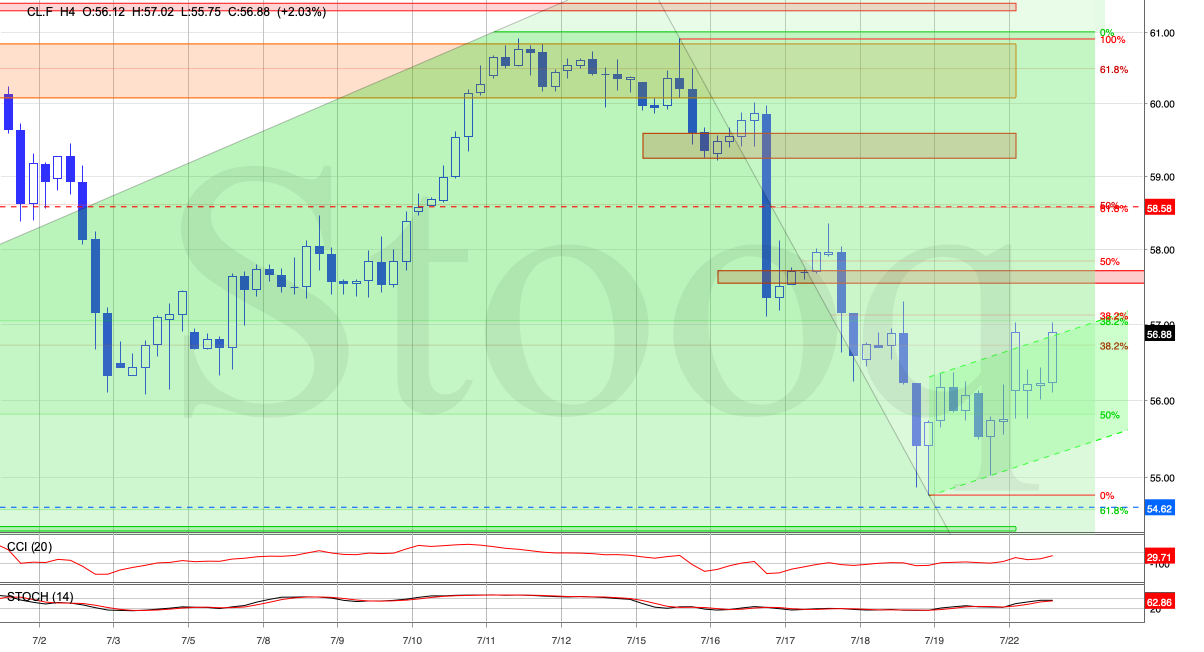

Additionally, when we zoom in and take a look at the 4-hour changes, we see that crude oil futures are also trading inside the very short-term green rising trend channel and below the 38.2% Fibonacci retracement based on the entire recent downward move.

Therefore, even if the futures move a bit higher and test the above-mentioned retracement, the short-term picture will remain unchanged as the CCI and the Stochastic Oscillator still have some space for grow. In other words, our Friday's comments on the downside target are up-to-date also today - let's quote the relevant part:

(...) How low could the crude oil futures fall if they extend losses? The next downside target for the sellerbears will be around $54.58, which is where the 61.8% Fibonacci retracement is.

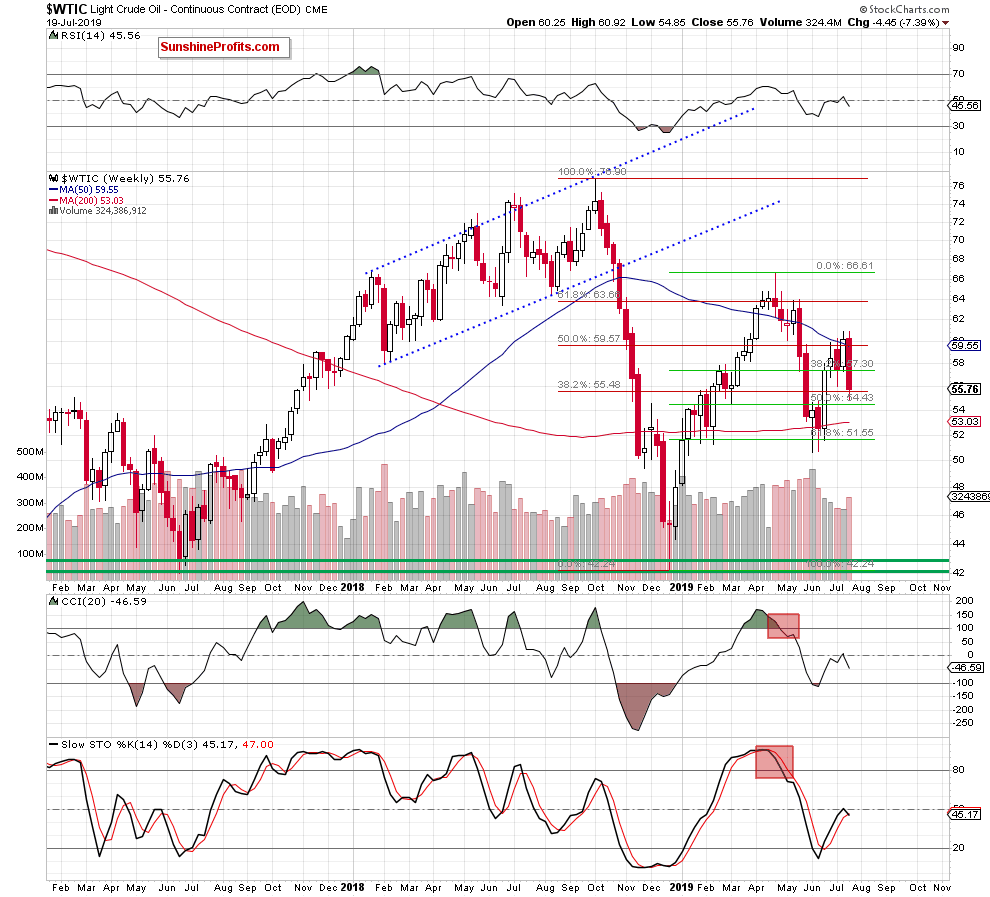

Today's final chart will be the weekly one below.

We see that crude oil lost over 7% in the previous week, making our short positions even more profitable. Additionally, the Stochastic Oscillator flashed its sell signal again, increasing the probability of another attempt to move lower in the coming week.

This bearish scenario is also reinforced by the volume accompanying last week's decline - it's a notable increase compared to the volume the immediately preceding increase was made on.

Summing up, Friday's session was one of consolidation in an environment, where the odds favor the bears heavily. The increased weekly volume attests to the strength of the bears' involvement. The bearish divergences (between the CCI and oil prices, and between the Stochastic Oscillator and oil prices) are still being resolved to the downside. The above factors support the bears and the short position remains justified.

Trading position (short-term; our opinion): Profitable short position with a stop-loss order at $58.57 and the exit target at $54.60 is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist