Trading position (short-term; my opinion; levels for crude oil’s continuous futures contract): Long positions with entry at $63-63.5, with $59.7 as a stop-loss and $68.20 as the initial price target.

A whiff of the US-Iran deal conclusion and, consequently, about 2m bpd of Iranian oil supply availability has spooked the market causing oil price fall.

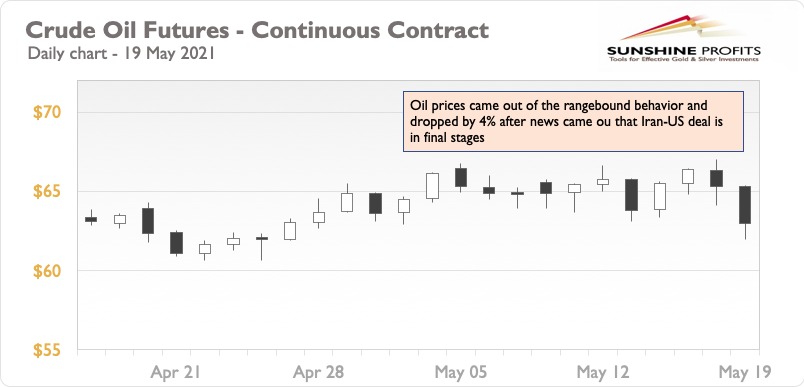

Oil is in a free fall and down by 4% at below $62 levels at the time of writing this piece. The market has finally reacted to the US-Iran nuclear deal discussion which is apparently in the final phase of talks. It all started with the BBC report of an imminent breakthrough in critical negotiations over restoring the Iranian nuclear deal.

After the fall, oil temporarily rebounded, as a senior Russian diplomat said that the negotiators need more time and effort to finalize an agreement on the restoration of the deal. In the absence of strong indicators, oil is swaying rather wildly on news stories and technical factors. These shifts are temporary and a good opportunity to enter the market.

The thing to note is that Iran has already been heavily engaged in oil export since Dec. 2020 despite US sanctions. After Biden was elected, there were hopes of sanction-lift and Iran started selling its oil on international markets, especially China.

I am reiterating my long position for oil based on consistent oil demand rise along with a weakening dollar. Keeping the long position intact, this dip is a great opportunity to increase stakes in black gold.

To summarize, the fall was driven by concerns about the oversupply of oil in the market as Iranian sanctions are expected to be lifted. We will closely watch the inflation data and Asian markets for demand signals and its impact on the oil behavior.

As always, we’ll keep you, our subscribers, well-informed.

Trading position (short-term; my opinion; levels for crude oil’s continuous futures contract): Long positions with entry at $63-63.5, with $59.7 as a stop-loss and $68.20 as the initial price target.

Thank you.

Nishant Jain, MBA, CPSM

Oil Trading Strategist