Trading position (short-term; our opinion; levels for crude oil’s continuous futures contract): No positions are justified from the risk to reward point of view.

The pullback in the price of crude today is surely connected with next week’s OPEC+ meeting, which may see Saudi Arabia announcing an increase in output. Oil recently rallied, but is that rally backed up by momentum or is the black gold simply overextended and awaiting a correction? Our analysis and trading positions currently remain unchanged. The chart has been updated as of February 19th.

Earlier this month, the overall outlook for the price of crude oil became less bearish and the black gold rallied. Afterwards, announcements of renewed lockdowns and more coronavirus variants as well as the strong indicator that it will take time for demand to increase caused oil prices to slip, only to rally again shortly thereafter.

This means that it’s still best to hold off with the decision to re-enter a short position in the black gold. This might be discouraging or boring, but if you participated in the 2020 profits during the big slide, you know that these small price moves won’t mean much, when things get really serious on the way down…

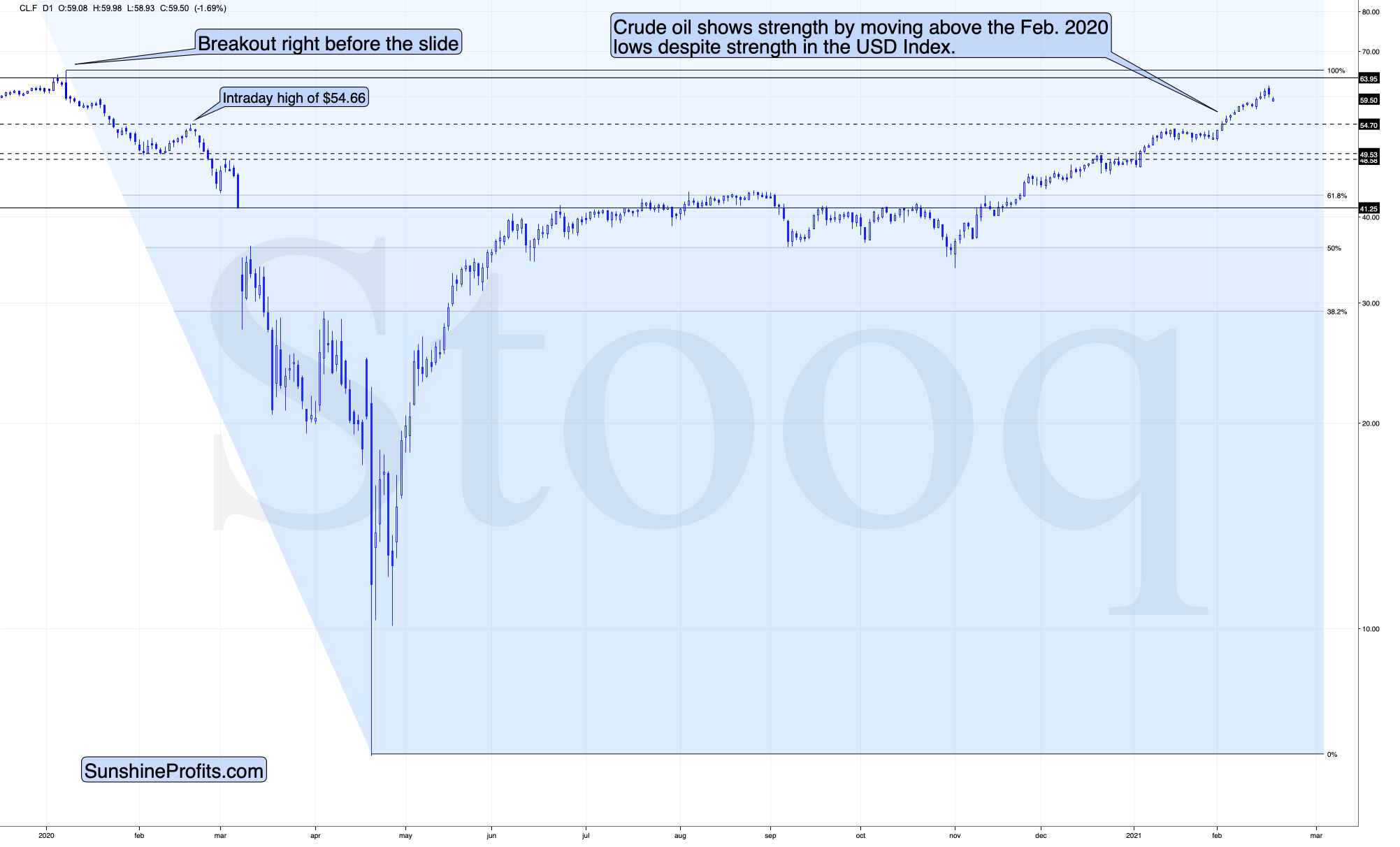

So, what’s next? Crude oil might theoretically move even higher here, and the next strong resistance is at the 2020 high, above the $60 level. However, even though this rally is possible given the current breakout, I wouldn’t call it as particularly likely.

The USD Index is breaking higher while the stock market seems to be topping here.

In fact, it could be the case that the link between stocks and crude oil is the most important one. Unlike stocks, crude oil is not above its 2020 highs, even though both are closely connected. After all, the black gold is the most versatile commodity on the planet, and all companies use it in one way or another (i.e., transport).

Now, if they are so tightly connected and one is obviously underperforming, it’s clear that this market has been relatively weak. And the thing about weak markets is that they tend to perform surprisingly well at the end of a given move. So, the strong performance of crude oil in recent days (it just moved to new highs even though the S&P 500 didn’t) might actually suggest that both: stocks and crude oil are forming medium-term tops.

Still, on a short-term basis it seems that we should wait for a better risk to reward ratio to re-enter the short positions than the one that we have right now. For instance, if crude oil invalidates the breakout above the Feb. 2020 high, we might re-enter this position.

Crude oil’s move back to its 2020 high followed by a reversal would also serve as a good indication that the medium-term trend is reversing.

To summarize, it’s likely that crude oil will decline in a major way, but its very short-term outlook is unclear at this time.

As always, we’ll keep you, our subscribers well informed.

Trading position (short-term; our opinion; levels for crude oil’s continuous futures contract): No positions.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief