Trading position (short-term; our opinion; levels for crude oil’s continuous futures contract): No positions in crude oil are justified from the risk to reward point.

Oil prices rose on Thursday to nearly $50 a barrel, still buoyed by news that upcoming vaccinations in various countries will lead to a faster demand recovery. This is yet another example of the recent back and forth between positive vaccine news and a surging number of coronavirus cases and grim economic perspective. Consequently, the outlook and our analysis for the time being remains unchanged from Friday (Dec 4). Please note that the chart and trading positions remain unchanged as well. At this time, we think that maintaining a neutral stance and waiting for a better risk to reward ratio before re-opening a speculative trading position continues to be a good idea.

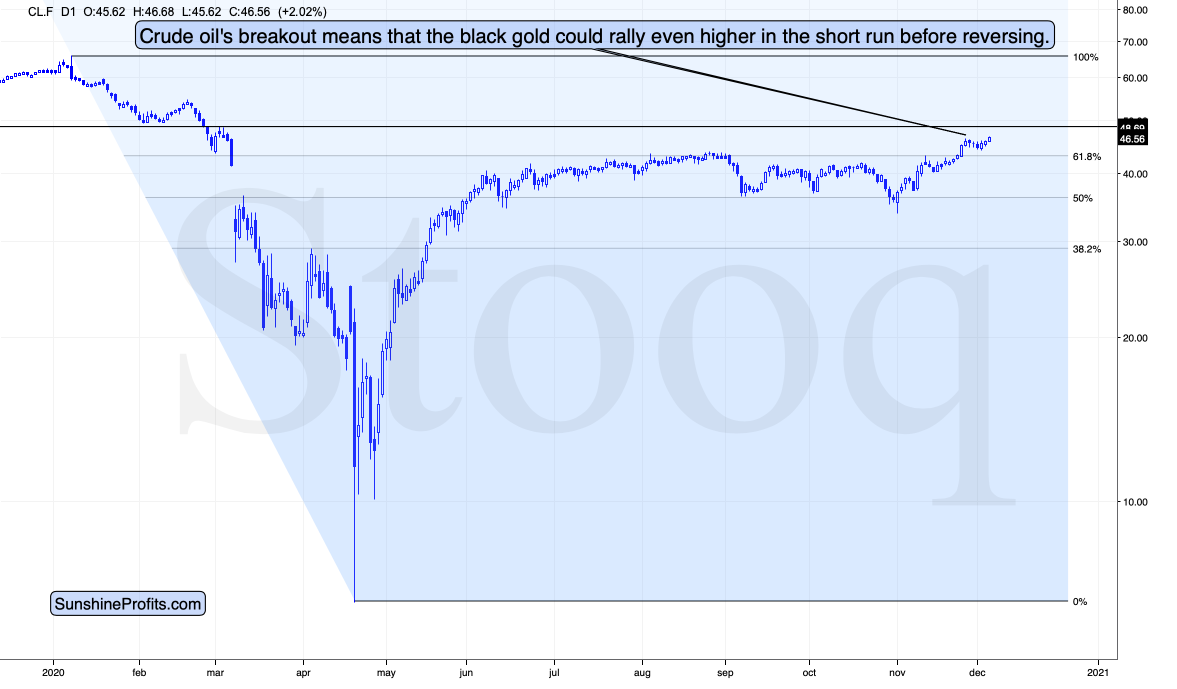

Crude oil moved higher recently, which is exactly what our protective stop-loss was protecting us from. The price of black gold verified the breakout above its August highs, which meant that an additional rally was a good possibility. And that’s what we saw.

The above 4-hour chart shows that crude oil verified the breakout in one of the most bullish ways – by entering a flag pattern. This is a typical consolidation pattern, which is quite often followed by a move that’s similar to the one that preceded it. Since crude oil just broke above this pattern, another upswing just became more likely. The move above the November high further increases the bullish potential.

How high can crude oil move from here?

The next resistance is at about $48.7 – the early-March high. And the next target – if crude oil manages to rally above it – would be the February high of about $54.7.

Since the moves to these price levels became even more probable – while simultaneously it looks like crude oil will get a bearish push from the USD Index any day now – it seems that staying on the sidelines is currently justified from the risk to reward point of view.

To summarize, for the upcoming weeks, the outlook for crude oil remains bearish, but given crude oil’s short-term breakout above the previous highs and the 61.8% Fibonacci retracement level based on the 2020 decline, it’s not bearish enough for us to keep featuring a short position in crude oil. We’re expecting to re-open this position when the risk associated with holding it becomes smaller.

As always, we’ll keep you, our subscribers well informed.

Trading position (short-term; our opinion; levels for crude oil’s continuous futures contract): No positions in crude oil are justified from the risk to reward point of view

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief