Trading position (short-term; our opinion): Short positions (with a stop-loss order at $54 and the initial downside target at $45.80) are justified from the risk/reward perspective.

On Thursday, crude oil extended gains and tested the September high. Will we see a double top and declines in the coming week?

Crude Oil’s Technical Picture

Let’s examine the technical picture of the commodity (charts courtesy of http://stockcharts.com).

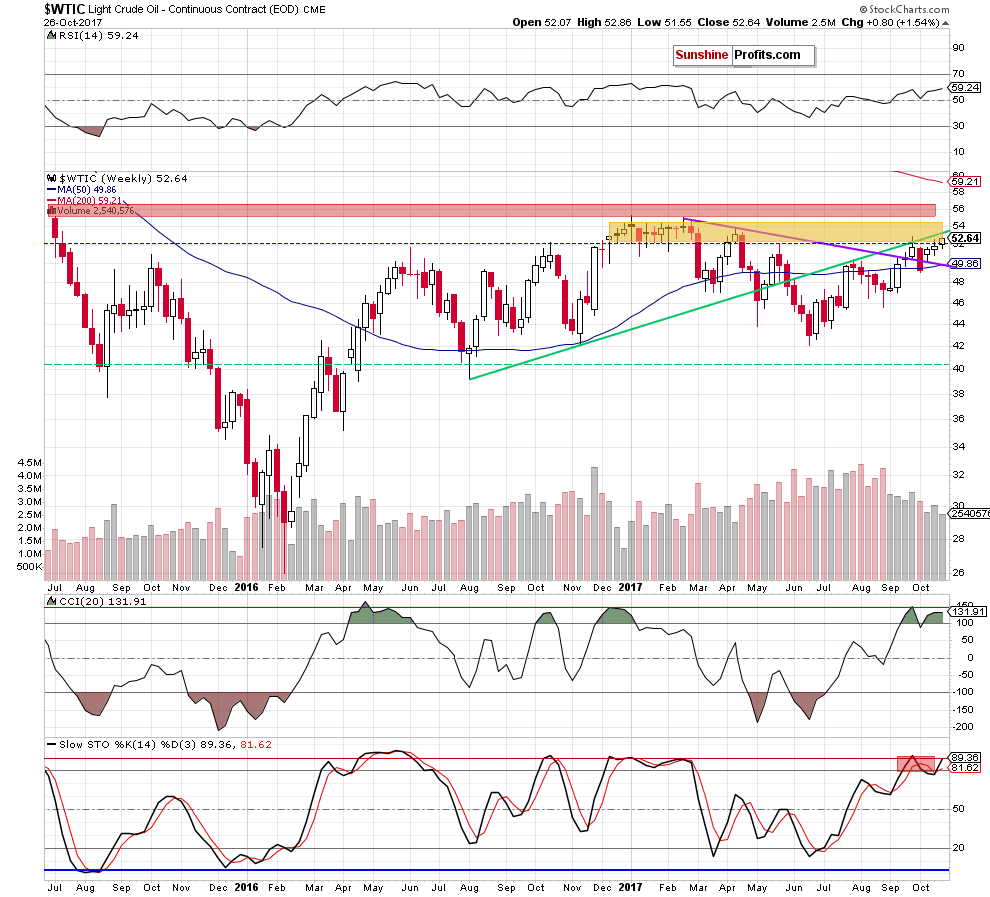

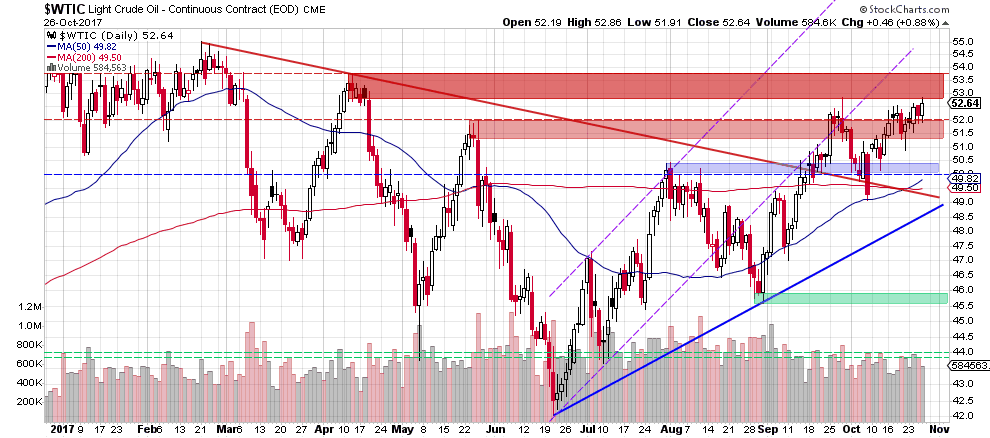

Looking at the above charts, we see that although crude oil moved higher once again, the overall situation in the short term hasn’t changed much as the commodity remains under the major resistance - the yellow resistance zone.

As we wrote in our previous alerts, this is the key resistance zone since the beginning of the year, which successfully stopped oil bulls in February, April, May and also in September. This fact suggests that as long as there is no breakout above it, the way to the higher prices will be closed and another reversal is just a matter of time.

Additionally, yesterday move materialized on visibly smaller volume than earlier decline, which increases the probability that we’ll see a post double top decline and a test of the blue support zone in the coming week.

Summing up, short positions continue to be justified from the risk/reward perspective as crude oil is still trading under the major resistance area, which successfully stopped increases many times earlier this year.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (with a stop-loss order at $54 and the initial downside target at $45.80) are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts