Trading position (short-term; our opinion): No position is justified from the risk/reward perspective.

After yesterday's beating, the bulls are attempting a comeback today. How far will their buying power take them? We have quite a few clues as to that. Let's share them with you so that you're ready for the action we want to take.

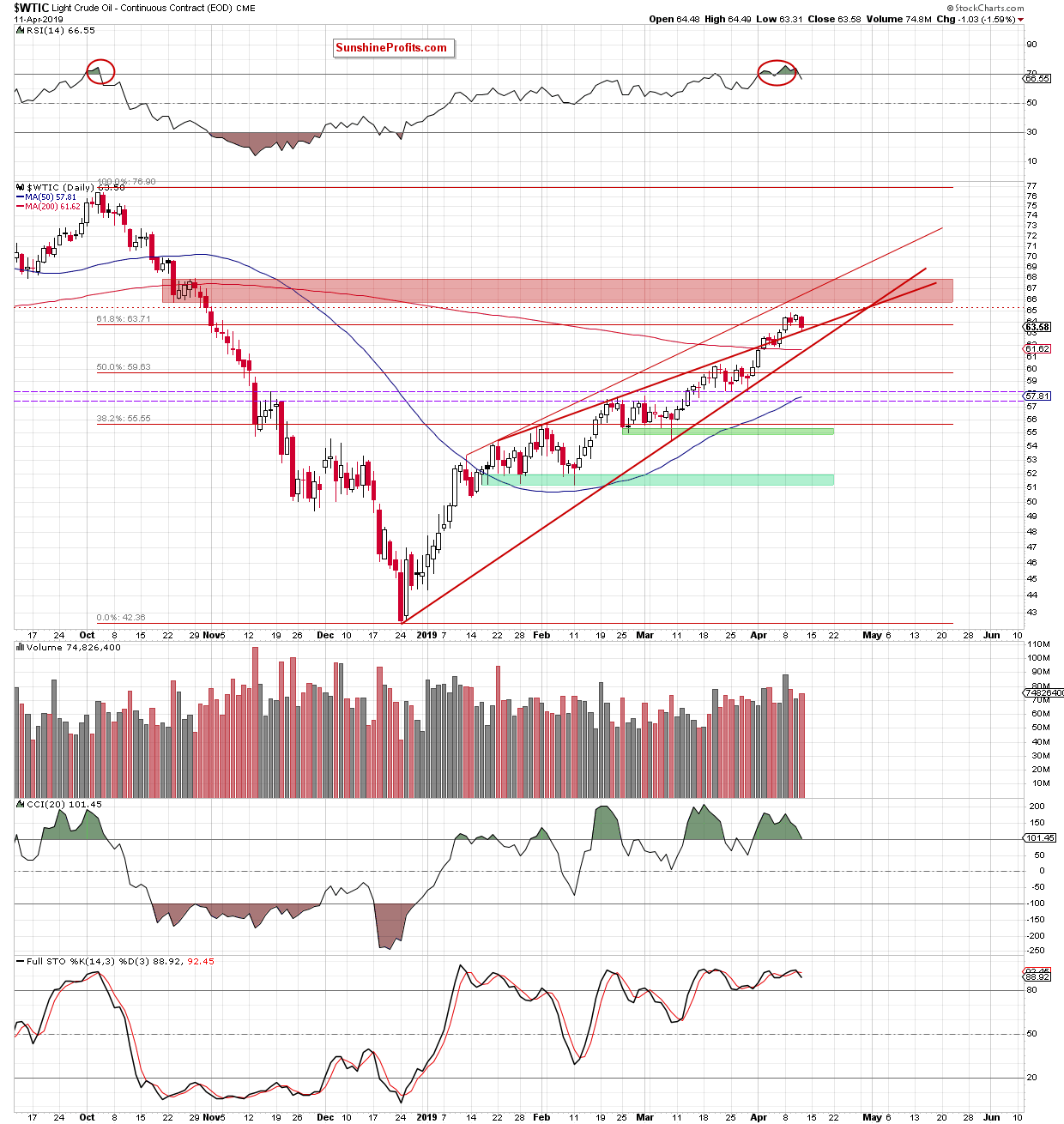

Let's take a closer look at the chart below (chart courtesy of http://stockcharts.com).

Thursday was not a good day for the bulls. Amid no fresh peaks on Wednesday, the declining volume (i.e. eagerness to push prices higher), encouraged the sellers to act yesterday.

Black gold has dropped back below the previously-broken 61.8% Fibonacci retracement. This invalidated the Monday's breakout above it. This is a negative development for the bulls.

The commodity slipped to the upper border of the red rising wedge and rebounded slightly before the session was over. Please note the increased volume of yesterday's session: it shows willingness of the bears to attempt to push the price lower.

The RSI and the Stochastic Oscillator generated their sell signals. These also suggests that further deterioration may be just around the corner. Should we see a drop below the upper border of the red rising wedge coupled with invalidation of the earlier breakout, we'll consider opening short positions.

Summing up, the signs pointing to the bulls' weakness keep mounting. Before taking action, we would like to see price action returning to the red rising wedge first, however. Before that, it's prudent to stay on the sidelines and wait for more signs of bulls' weakness.

Trading position (short-term; our opinion): No position is justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist