Trading position (short-term; our opinion): Short positions (with the stop-loss order at $68.15 and the initial downside target at $56.57) are justified from the risk/reward perspective.

Out of the frying pan into the fire – this is how we can summarize the beginning of today’s session (at least from the bears’ point of view). Thanks to the earlier increase oil bulls broke above two resistances and they are heading north. Are there any technical factors that can save the bears’ skin?

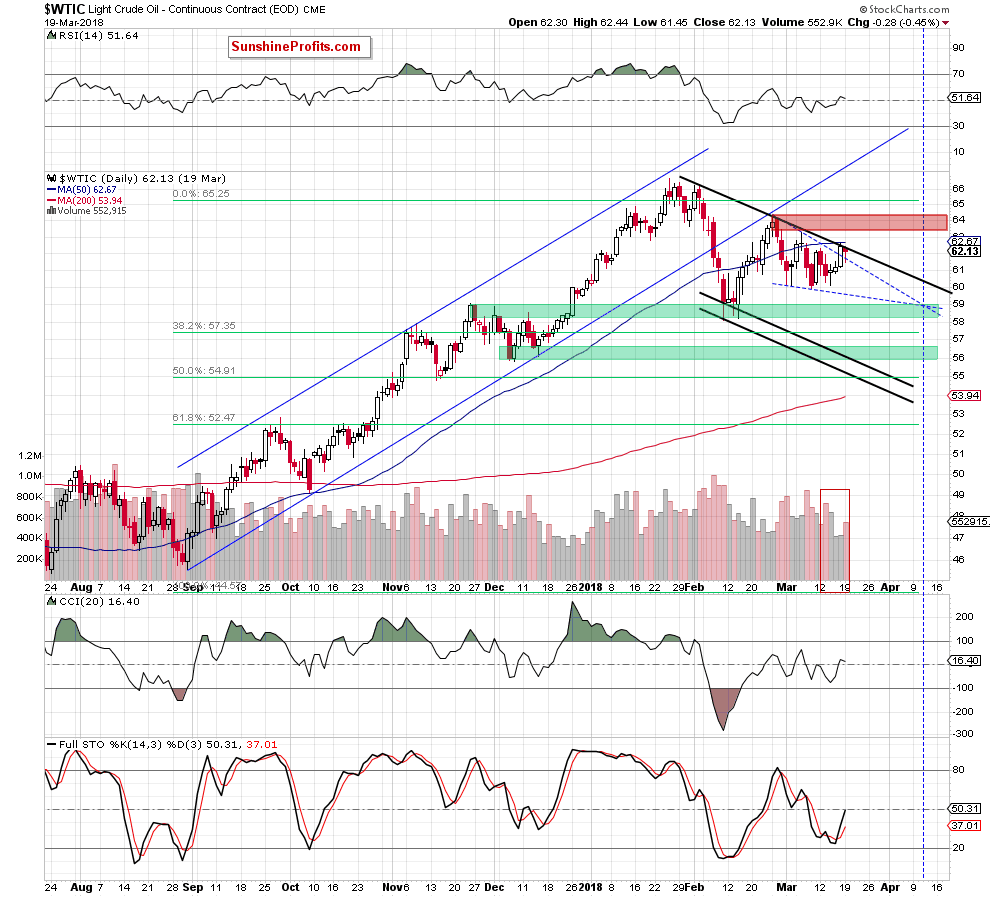

Let's examine the daily chart to find out (charts courtesy of http://stockcharts.com).

Looking at the daily chart, we see that crude oil closed yesterday’s session under the black declining resistance line. Nevertheless, earlier today, oil bulls pushed the commodity higher, which resulted in a breakout above the nearest resistances – the black line and the 50-day moving average, which opened the way to higher levels.

Where could black gold head next?

Taking into account today’s breakout (which is not confirmed at the moment of writing these words), we think that light crude will test the red resistance zone created by the late February and earlier March peaks.

If this barricade falls and the pro-bearish candlesticks formations are invalidated, we’ll consider closing short positions. As always, we’ll keep you - our subscribers - informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts