Trading position (short-term; our opinion): Small (half of the regular size) short positions (with a stop-loss order at $61.13 and the initial downside target at $52) are justified from the risk/reward perspective.

On Wednesday, black gold increased after the EIA showed a larger-than-expected drop in crude oil inventories. Thanks to this upswing, the commodity closed the day above $58, but the situation is not as positive as it seems at the first sight. Why?

Yesterday, the Energy Information Administration showed that crude oil inventories fell by 6.5 million barrels (more than expected), which was the fifth straight week of declines. Despite this bullish event, we should keep in mind that although gasoline stocks rose less than forecasts, it was the sixth week of increases in a row, which suggests a slowdown in demand. On top of that, yesterday’s data showed that the crude oil output has risen once again and hit 9.79 million bpd in the previous week, increasing to its highest level since the early 1970s. In this way, the American production also approached the Saudi Arabia and Russia outputs, undermining efforts led by these countries to tighten the oil market through stopping supplies later this year and in 2018.

Having said that, let’s take a closer look at the technical picture of crude oil (charts courtesy of http://stockcharts.com).

Crude Oil’s Technical Picture

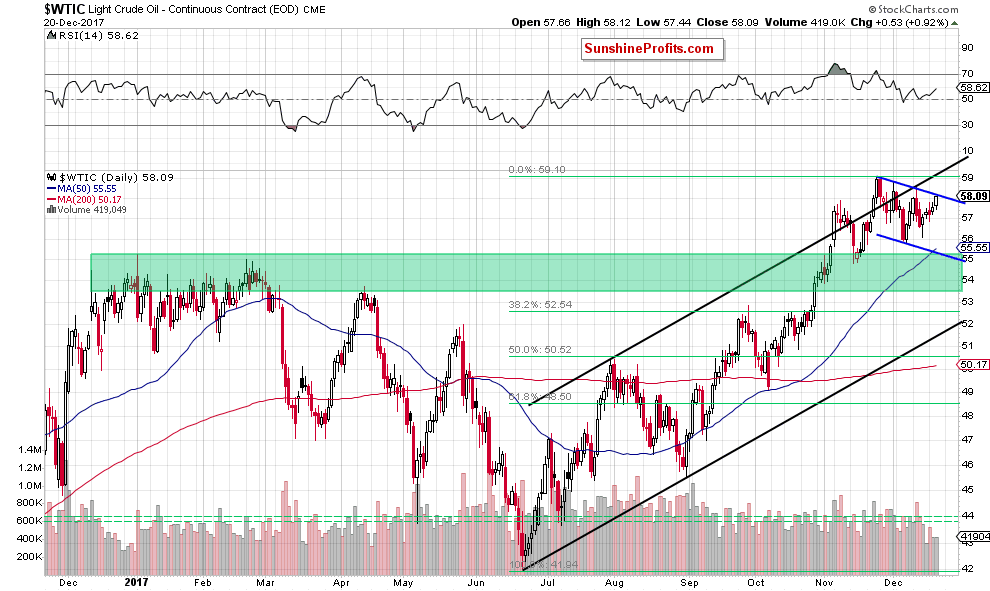

On the daily chart, we see that crude oil extended gains and climbed to the upper border of the blue declining trend channel yesterday. Will we see a breakout above this resistance line? In our opinion, it is quite doubtful. Why?

Firstly, the commodity remains inside the black rising trend channel, which means that the last week’s verification of the breakdown under the upper black line of the formation and its negative impact on the price are still in effect, supporting oil bears. Secondly, the size of volume, which accompanied yesterday’s increase was disappointing and didn’t confirmed oil bulls’ strength and the direction of the trend.

Nevertheless, even if black gold moves higher from current level, the space for gains is limited as the recent highs, the upper border of the black rising trend channel, the medium- and long-term resistances are very close.

Let’s take a closer look at the weekly chart below.

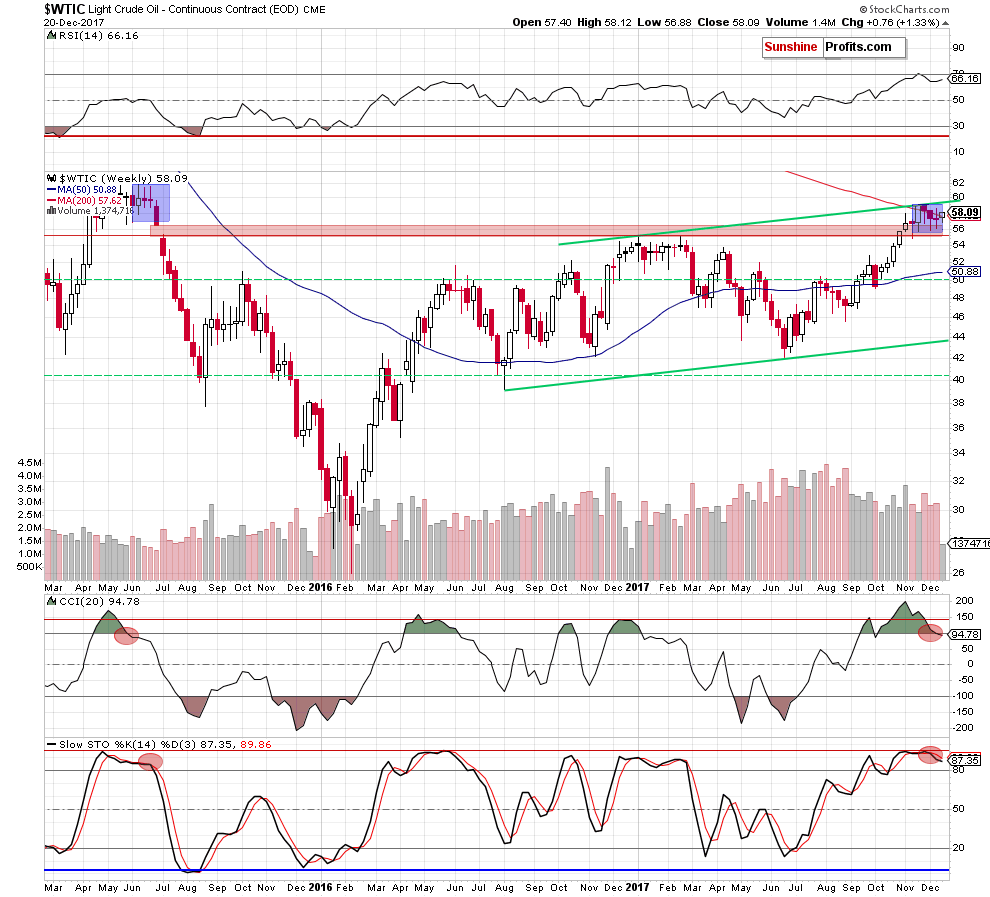

From the broader perspective, we clearly see that not much changed after yesterday’s session. Although light crude came back above the 200-week moving average, it’s not a bullish development anymore, because we saw similar price action several times in the previous weeks and none of these invalidations brought significant growth.

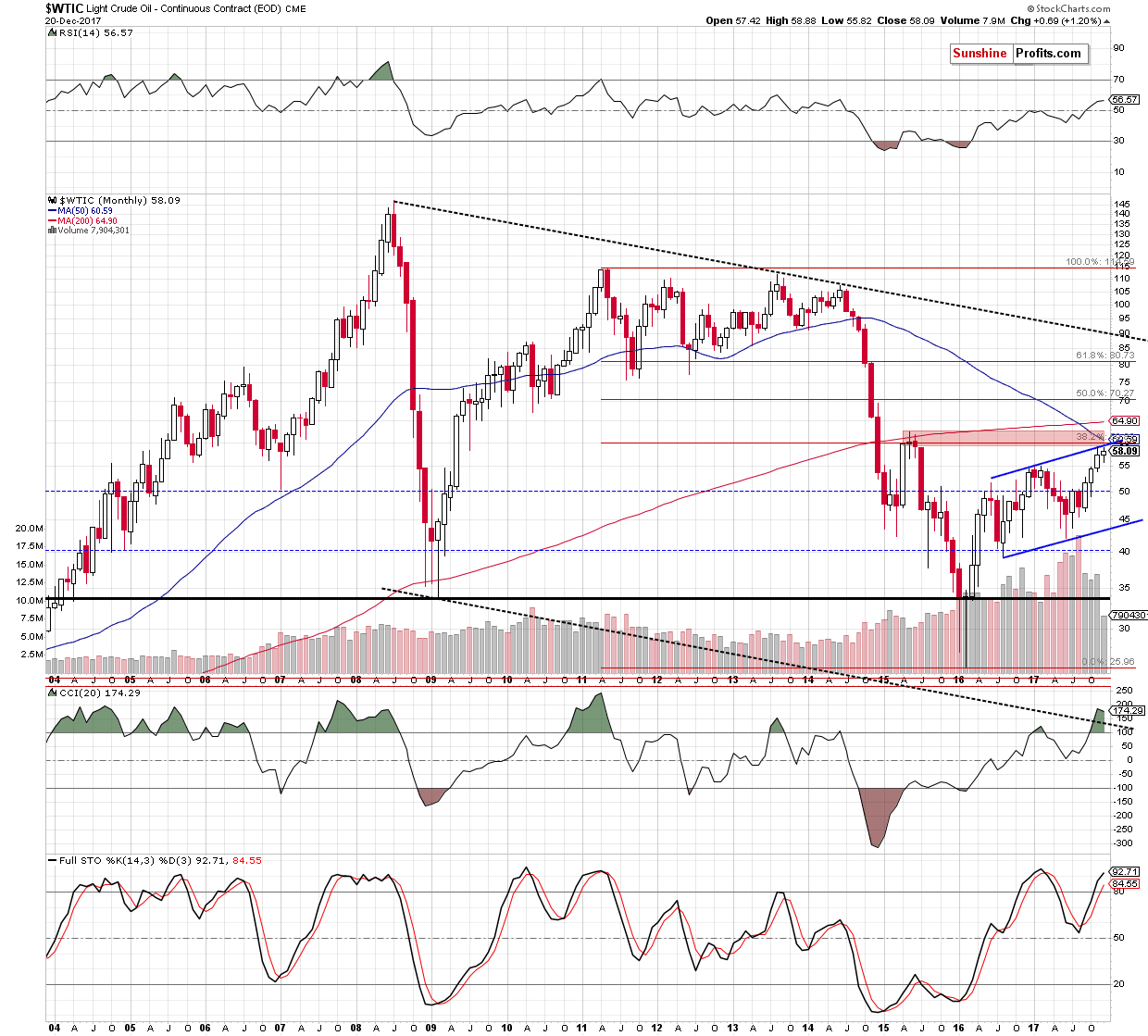

Additionally, the sell signals generated by the medium-term indicators remain in cards, suggesting lower prices of black gold in the coming weeks. On top of that, the upper border of the blue consolidation, the upper line of the rising trend channel, the 50-month moving average and the red resistance zone seen on the monthly chart below continue to block the way to higher levels.

What does all the above mean for crude oil and the bulls? In our opinion, as long as there is in breakout above this key resistance zone, the way to higher prices is closed. In other words, a reversal and bigger move to the downside is just around the corner.

Summing up, short positions continue to be justified from the risk/reward perspective as crude oil remains under the upper line of the black rising trend channel, the upper line of the blue declining trend channel (seen on the daily chart) and the key resistance zone marked on the monthly chart. Additionally, the sell signals generated by the weekly indicators together with the bearish fundamental factors increase the probability of declines in the coming week(s).

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Small (half of the regular size) short positions (with a stop-loss order at $61.13 and the initial downside target at $52) are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts