Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Wednesday’s session took crude oil under two long-term supports, which deprived the bulls of solid allies. Are there any technical factors that can save them from further losses in the very near future?

Let’s take a look at the charts below (charts courtesy of http://stockcharts.com).

On Wednesday, we wrote the following:

(…) oil bulls managed to take the commodity higher before the session closure, which resulted in an invalidation of the earlier breakdown below the last week’s low.

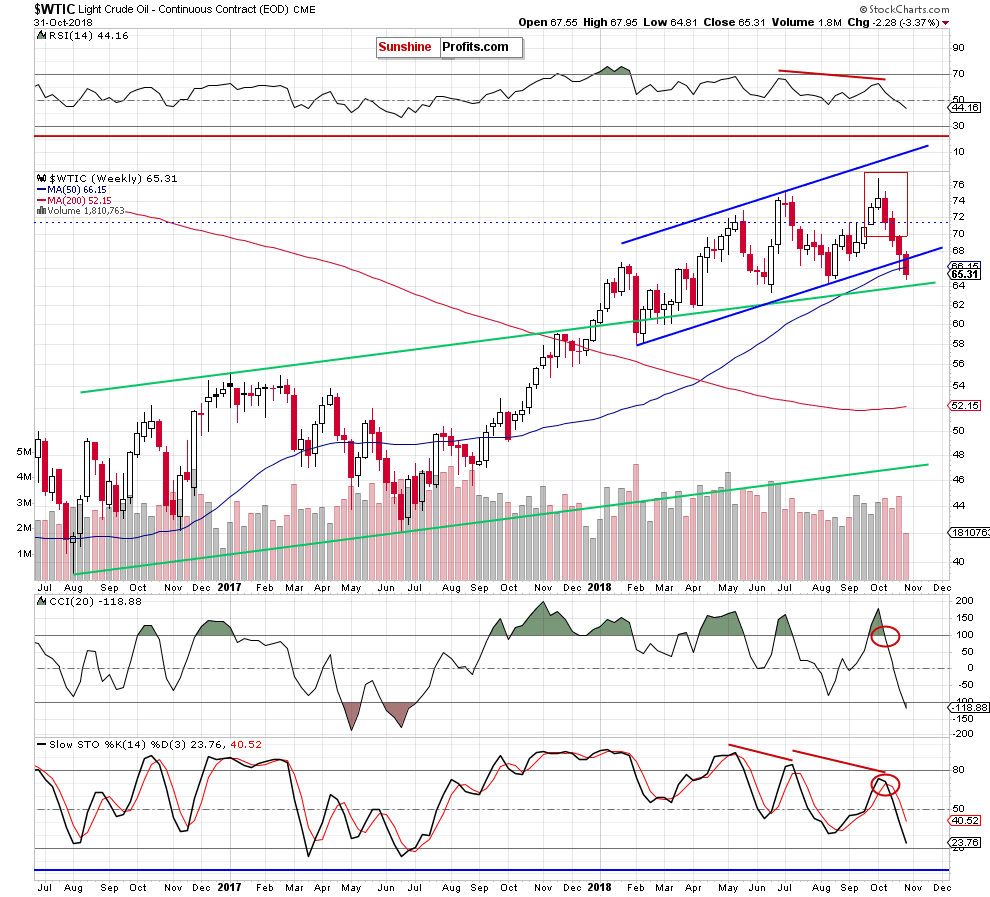

Although this is a positive development (…), we should keep in mind that crude oil is still trading under the medium-term blue trend channel and the major support/resistance line seen on the long-term chart below.

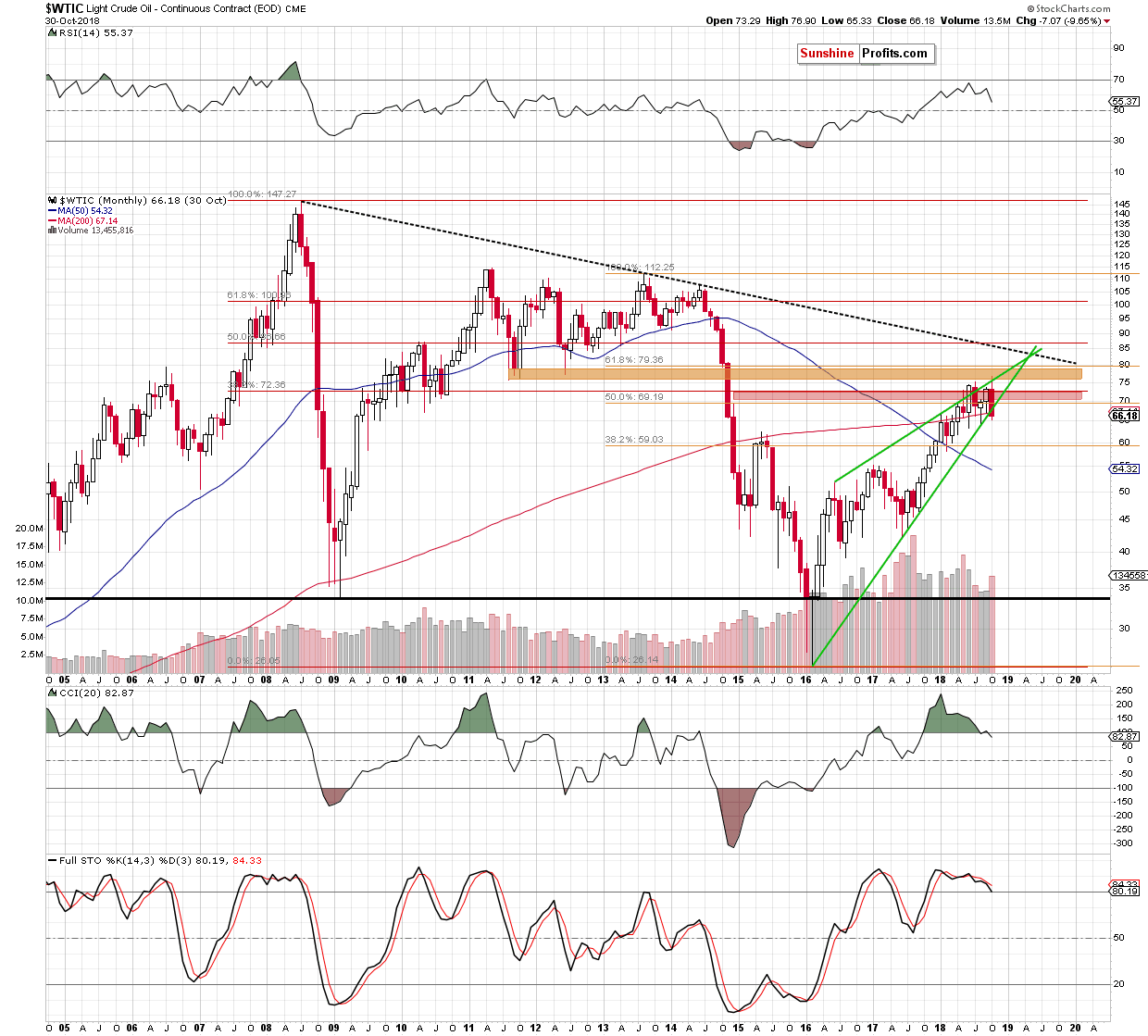

(…) the price of black gold slipped not only below the 200-month moving average, but also under the lower border of the green rising wedge which doesn’t bode well for oil bulls.

(…) if crude oil closes today’s session (what will also mean a closure of the whole month) under the green line, the way to the lower prices can be opened.

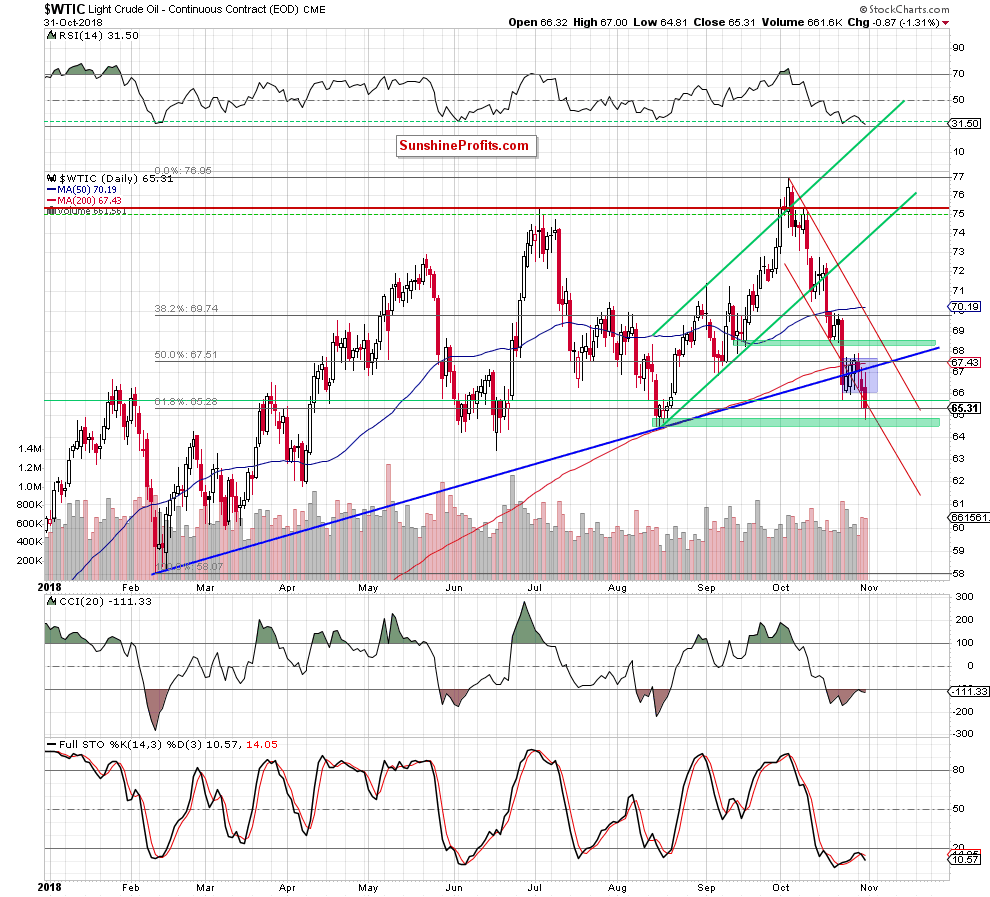

From today’s point of view, we see that crude oil extended losses and closed yesterday’s session and all of October not only under the lower border of the very short-term red declining trend channel seen on the daily chart but also below two major supports: the 200-month moving average and the lower border of the green rising wedge.

Are there any technical factors that can support bulls in this difficult moment and encourage them to fight for rebound?

Only short-term supports. As you see on the daily chart, yesterday’s decline took crude oil to the green support zone created by the mid-August lows. In this area we can also notice the 61.8% Fibonacci retracement (based on the entire February-October upward move), which together are the last barrier protecting the price of black gold before a decline to the next supports: the previously-broken upper line of the green rising trend channel seen on the weekly chart (around $64) or even the April lows (around $ 62).

Therefore, if the commodity drops under the above-mentioned important supports, we’ll consider re-opening short positions. We will keep you informed should we see a confirmation/invalidation of the above.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. As always, we’ll keep you - our subscribers - informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts